The Cabinet Office has written to government departments asking them to “justify every quango” under their wings “otherwise they’ll be closed, merged, or have powers brought back into the department”.

The government says the move is part of its plan “to re-wire Whitehall and produce a more productive and agile state”.

Last month, the health department announced that NHS England would be brought back under its administration “to put an end to duplication”.

The government has also pledged to cut business red tape costs by a quarter over this parliament, and has replaced watchdog heads and merged other regulators in recent months.

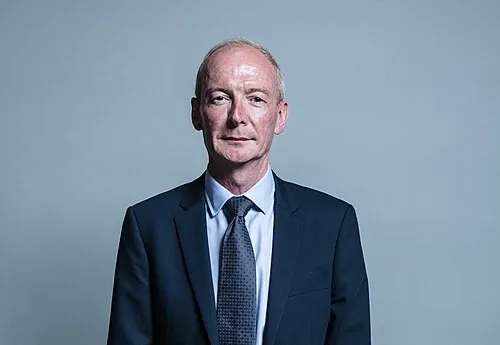

The wider review was commissioned by the Cabinet Office at the request of the Chancellor of the Duchy of Lancaster Pat McFadden (pictured).

McFadden said: “The review will aim to drive out waste and inefficiency across Whitehall, reducing duplication and bureaucracy – saving the taxpayer money and cutting the cost of ‘doing government’.”

The Cabinet Office adds: “It is expected that quangos with large policy functions could be brought back into departments, bringing ministerial, elected, scrutiny back to major decisions that affect the public.

“This would also retain the expertise and experience of staff working in these areas.”

McFadden has asked departments to consider four key principles:

- Ministerial policy oversight — if a policy is of national importance then Ministers should have appropriate oversight and control of its development

- Duplication and Efficiency — government should drive out duplication and inefficiency wherever possible

- Stakeholder Management — the fact that government needs to engage stakeholders should not be a reason for an arms-length body to exist

- Independent Advice — where there is a clear justification for independent advice, then this should be conducted at arm’s length

In the City, the Payment Systems Regulator will be abolished and rolled into the Financial Conduct Authority, the Prime Minister announced last month.

Keir Starmer said payment firms had to deal with three different regulators in this area, “costing them time, money and resource”.

Four watchdog heads have quit over the last six months amid the government’s drive to cut business regulation.

In February, the Financial Ombudsman Service announced that its chief executive Abby Thomas resigned with immediate effect. She was later replaced by her deputy James Dipple-Johnstone.

The previous month, former Amazon UK head Doug Gurr was installed as interim chair of the Competition and Markets Authority after Marcus Bokkerink left suddenly, after just over two years in the role.