While reverse mortgages make up only a small share of the home-loan market, the growing share of Generation Xers with high equity in their homes have inspired an increasing number of lenders to offer these products, lowering the age of eligibility to as young as 55 in some cases.

The most common type of home equity conversion mortgage, or HECM, which is backed by the Federal Housing Administration, limits eligibility to those 62 and older. That’s a large potential market given that housing equity for those in that age group increased to $9.57 trillion in the second quarter this year, according to the National Reverse Mortgage Lending Association/RiskSpan Reverse Mortgage Market Index.

But economic data about Generation X points to an even larger emerging marketplace for reverse mortgages. A 2018 Pew Research Center analysis found that Generation X was the only generation whose home equity recovered to its pre-housing crisis levels. With past studies showing earning potential peaking as early as age 44 for women and 55 for men, the elder ranks of Generation X — defined as those born between 1965 to 1980 — have entered the period when they may benefit from, or require, using their home value as a source of income later in life.

A reverse mortgage can be an effective retirement-planning tool that extends the life of the asset over time, according to Michael Kent, president of Liberty Reverse Mortgage and co-chair of the National Reverse Mortgage Lending Association’s board of directors.

“Waiting until you're retired, and then saying, “Oh, this is a good idea,” that's great. You can still work it into your retirement plan, but if you could have that tool prior to retirement as you plan, even better,” he said.

Reverse Mortgage Funding, which was among the first to offer a reverse product to those as young as 60, lowered the eligible age of its proprietary reverse-mortgage product from 60 to 55 in August. Available in the District of Columbia and 19 states where regulations permitted a lower-age threshold, the redesigned offering was an evolution of the previous product to serve a broader audience.

“We've always wondered why anyone would want to take their liquid savings — or what’s now potentially lower cash flow — only to build it into illiquid savings in their home,” said Peskin, president of Reverse Mortgage Funding.

The idea behind the redesign grew out of the observation of an increasing number of 55-plus retirement communities.

“We’ve been getting a lot of requests from builders and homeowners that are in these communities, whether they’re already in them or thinking of buying in them, about accessing the product,” said Peskin. “And that’s really what led us to say we really need to be working on a product that caters to this bigger market.”

Some countries, such as the United Kingdom and Canada, already offer reverse mortgages to those as young as 55 and view them as a type of retirement supplement, according to Kent.

“It takes some pressure off the government. It provides tax-free income,” he said. “It also is a great way to do intergenerational wealth transfer instead of waiting until somebody passes away.”

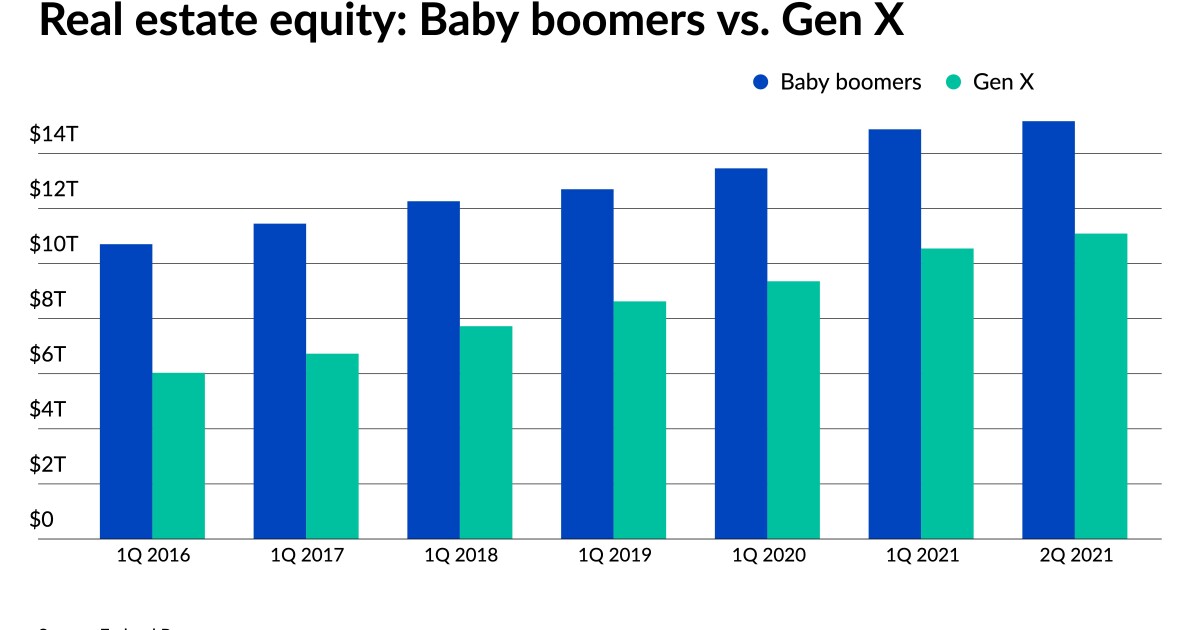

The Federal Reserve determined that since the beginning of 2020, real estate equity among the American Generation X population grew as much in dollar value — $1.7 trillion — as it did for baby boomers, despite Gen Xers being a smaller cohort. Currently, members of Generation X hold $11.1 trillion in real estate equity compared to $15.2 trillion for baby boomers. In that same time frame, Generation X’s share of total home equity wealth increased from 30.5% to 31.8%, while the baby-boomer share decreased from 43.9% to 43.5%.

Reverse Mortgage Funding’s recent product announcement came after Finance of America unveiled its own hybrid loan earlier this year for borrowers as young as 60, a new offering to supplement its more traditional proprietary reverse mortgage targeting the same age group, launched in 2014. The hybrid product combined elements of both traditional and reverse mortgages.

Surveys have consistently found that people over the age of 55 prefer to age in place. Reverse mortgages serve as a possible means to achieve that outcome, or even provide capital for a second residence. As homeowners can draw on a reverse mortgage to be utilized in any way they wish, the income also could serve as rainy-day funds for unexpected periods of income shortfalls, such as those many experienced during the COVID-19 pandemic.

But the products come with risks as well, including high closing costs that reduce the amount of equity available to the homeowner and higher interest rates. And once taxes, insurance and maintenance are factored in, the proceeds may not be sufficient enough to meet homeowner needs.

“The thing about a reverse mortgage loan is it's not always used correctly,” said Michael Branson Jr, vice president of All Reverse Mortgage, a company offering reverse products exclusively. Among its portfolio of loans are a small number of proprietary mortgages with a qualifying age of 60. Some borrowers turn to a reverse mortgage for short-term payment relief that buys them time to get a house to market.

“That’s not what it was designed for. That's not how it's best served, but some borrowers still make that choice,” he said.

And what initially seems like a high-value proposition could also turn into a longer-term headache with poor planning.

“It's hard to plan for what that equity position looks like over time at, say, 55 years old,” Branson said. “If you go for a maximum loan to value, at age 55, at a higher-rate loan — your life expectancy — you could be in that property for 30 years, maybe more. And so that's a long time for that loan to be in place.”

Decreasing profit margins in other channels prompted some larger lenders like Finance of America and Ocwen to maintain or further develop their presence in the reverse-mortgage space this year. Despite the litany of rules surrounding these types of loans that led others to leave the reverse-mortgage space, they see financial opportunities through diversified offerings.

Although no other company apart from Reverse Mortgage Funding has thus far come forward with products for older Gen Xers, several lenders have proprietary products for those as young as 60, including American Advisors Group and Liberty Reverse Mortgage, a division of wholly-owned Ocwen subsidiary PHH Mortgage.

Liberty Reverse Mortgage began offering its proprietary reverse-mortgage product in 2019. According to Kent, the decision to open up reverse mortgages to a slightly younger demographic that didn’t qualify for a traditional HECM made business sense when measuring both inquiries and the bottom line.

“We actually see interest in these types of products for people as young as in their mid 50s,” he said. “And then, as the market grew and matured, we were able to model the kind of financial performance of what it would look like if we had younger borrowers in these pools, and it worked out well.”

For some borrowers, these proprietary products create the opportunity for more couples to be fully included on a loan, according to Branson. Prior instances where only one half of a couple qualified for a HECM loan resulted in prolonged legal hassles.

“The one thing that's really nice about the age-60 is when you have one spouse older than the other. So let's say the husband or the wife is 64, 65, but the other one is 61. Well, that's what the 60 is really nice because they're, they don't have to worry about being a non-borrowing spouse — they can actually be a borrower,” he said. “So we absolutely love that innovation.”

While the number of Gen Xers is currently not as large as the population of baby boomers or millennials, they still account for 34.6 million households in the U.S. and are expected to eventually outnumber boomers by 2028. Approaching retirement age, many find themselves sitting on far more home-equity wealth than they had before the COVID-19 pandemic, thanks to record price growth in the last 18 months. With the quick infusion of additional equity, Gen Xers quickly turned into a more lucrative market that mortgage businesses may seek to attract, compared to just a few years ago.

“We are estimating in the states that we rolled it out to — roughly 2.7 million homes can now be eligible for a product like this,” Peskin said about Reverse Mortgage Funding’s updated offering.