Mortgage rates rose by 2 basis points this week, but did not impact home purchase activity during the period, Freddie Mac said.

"Rates for the 30-year and the 15-year fixed-rate mortgage essentially remained flat this week, but we did see purchase activity increase, which is encouraging," said Sam Khater, Freddie Mac's chief economist.

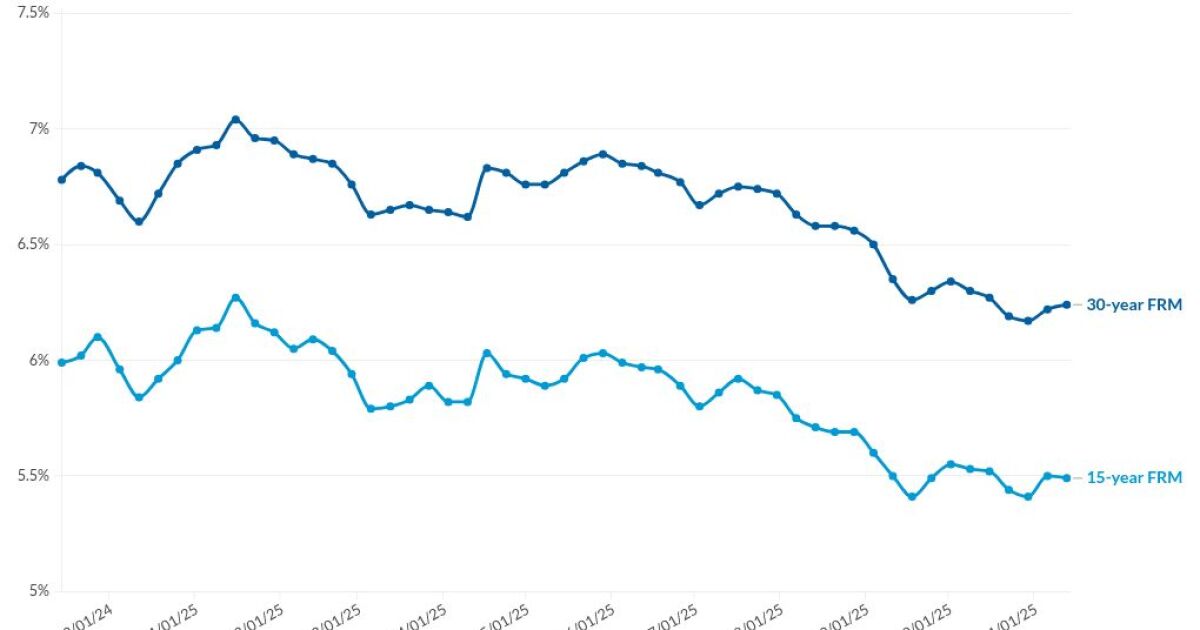

Right now, rates for both products as tracked by the Freddie Mac Primary Mortgage Market Survey are about 0.5 percentage points lower than

The 30-year FRM averaged 6.24% on Nov. 13,

Meanwhile, the 15-year FRM ended the period lower, at 5.49%, down from the week of Nov. 6, when it was 5.5%. It was also lower than the same week last year, when the 15-year averaged 5.99%.

"While these movements are modest, they reflect a broader pattern we've seen recently with rates hovering in a relatively tight range after months of more dramatic swings," said One Real Mortgage CEO Samir Dedhia in a statement. "Mortgage rates have settled near their lowest levels since October 2024, creating more stability for both homebuyers and homeowners."

Mortgage application activity this past week

Khater's comments were similar to a Thursday morning statement from the Mortgage Bankers Association's President and CEO Bob Broeksmit regarding the previous day's release of its Weekly Application Survey.

"Mortgage applications rebounded last week, despite mortgage rates increasing," Broeksmit said. "Homebuyers are taking advantage of increased housing inventory and slower home-price growth, leading to a 6% jump in purchase applications and the strongest start to November since 2022, on an unadjusted basis."

Its purchase index rose 6% seasonally adjusted, 5% unadjusted, countering a 3% week-to-week drop off in refinance volume.

The conforming mortgage rate as tracked by the MBA for the week ended Nov. 7 was 6.34%, a gain of 3 basis points from the previous period.

How did the 10-year Treasury move these past seven days

This week's PMMS report followed a roller coaster seven-day stretch for

On Nov. 5, the 10-year closed at 4.16% but fell to 4.09% the following day. On Nov. 10, after the Senate came to a deal on the budget extender, the yield ended the day at 4.11%, rising by 1 basis point the following day before dropping back down to 4.07% before the House vote on Wednesday.

But by Thursday morning at 11 a.m. eastern, it was back up to 4.11%.

Mortgage rates as tracked by the Optimal Blue product and pricing engine are lower as of Nov. 12 versus seven days prior. The 30-year FRM is at 6.18% versus 6.25% on Nov. 5, while the 15-year dropped to 5.51% from 5.54%.

The shutdown's effect on mortgage rates

After the initial rise in mortgage rates following the October Federal Open Markets Committee meeting and

The statement came out prior to the House vote and Pres. Trump signing the budget extender, but in anticipation of those events Ng commented "the market may need to reassess its outlook on the labor market and inflation as government data resumes, which could lead to renewed volatility in interest rates."

Consumers did see "modest" relief in mortgage rates in September and October and it encouraged buyers and sellers to "re-engage, leading to stronger than expected housing activity for the season," Ng said. But affordability concerns, as seen by the latest ideas thrown out by the Trump Administration like

"We've seen this rhythm before: rates fall in anticipation of a Fed cut, rise slightly following the announcement due to cautious messaging, and then stabilize or trend down again as economic data unfolds," One Real's Dedhia said. "With only one Fed meeting left in 2025 and no guarantee of another cut in December, markets are watching inflation and labor data closely, and that uncertainty continues to influence bond yields and mortgage pricing."

Investment banker Louis Navellier commented on this morning's rise in the Treasury market.

"Bets on a quarter-point Fed cut in December have fallen below 48," Naveilier wrote. "This is happening while Trump is hailing

The market isn't buying that a QE program will occur right now but it may come to pass when Powell is likely replaced as Fed chair next spring, Navellier said.