Fannie Mae revised its 2026 mortgage expectations marginally upward, with borrower interest in refinances, in particular, more likely to provide opportunities following the more muted activity of the past few years.

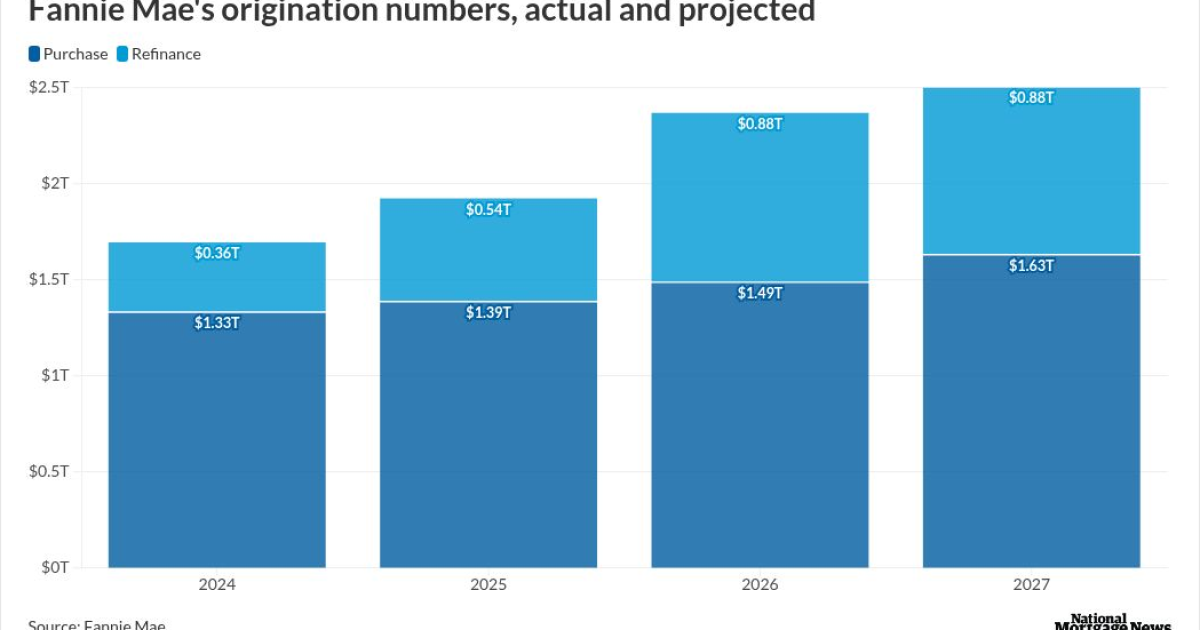

In its December housing outlook, the government-sponsored enterprise increased its forecasted volume for total originations next year to $2.37 trillion

For full-year 2025, Fannie Mae also revised expectations upward to $1.93 trillion, compared to $1.88 trillion last month. If the number holds, originations in 2025 will end up 13.6% higher from 2024's volume of $1.7 trillion.

While totals should increase by Fannie Mae's estimates, the growth will come on momentum to be provided by elevated refinance activity, as purchase expectations remain flat.

Purchase originations should finish 2025 with $1.37 trillion worth of volume and $1.49 trillion next year. The numbers were both a fraction under Fannie Mae's November estimates.

Refinances appear poised to increase

Refinances, however, look to climb up to $538 billion by year's end and surge further to $882 billion for all of 2026. These totals would represent a significant uptick in activity of 47.8% and 142% compared to last year's $364 billion, respectively.

Last month, Fannie Mae laid out refinance-volume predictions of $490 billion and $847 billion for this and next year. By the end of 2026, refinances should account for a 37% share of total originations, surging from an anticipated 28% for 2025. Refi transactions accounted for 21% of mortgage activity last year, with a majority of borrowers still holding on to more favorable interest rates.

The updated estimates come after Fannie Mae predicted mortgage rates to

A soft purchase market?

Elsewhere in its December numbers, the GSE said housing sales will finish 2025 at an annual seasonally adjusted pace of 4.74 million units and 2026 at 5.1 million. This year's number was revised upward from November's forecast of 4.73 million but remained flat for 2026.

While Fannie Mae's rate outlook veers more favorably to the benefit of lenders, slowing of purchase volumes align with forecasts provided by economic analysts recently,

Housing prices, meanwhile, are set to grow 2.5% this year before moderating to 1.3% at the close of 2026, Fannie Mae said.

MBA's expectations for 2026

The sluggishness of sales looks set to persist into next year,

The MBA's latest Mortgage Finance Forecast pinned total volume by loan count at 5.46 million loans for 2025, a 0.2% decrease from November's outlook. Next year's projections fell 0.4% to 5.8 million from 5.82 million. The current and following years' volumes still exceed 2024's 4.57 million.

Expected purchase and refinance totals shrank for both years. The purchase outlook shrank by 12,000 loans and refinance originations decreased by 7,000 for 2025 compared to November's forecast. Much of the same is in store for next year with month-over-month downward revisions of 14,000 and 8,000 in originations, MBA said.

Despite fewer units, MBA maintained its production outlook on a dollar basis, a sign values will remain elevated. Anticipated originations should finish at $2.05 billion and $2.2 billion for 2025 and 2026, respectively.

Diverging from Fannie Mae, the trade group sees the 30-year fixed mortgage rate constant into 2027, hovering in a range between 6.3% and 6.4% over the next two years.