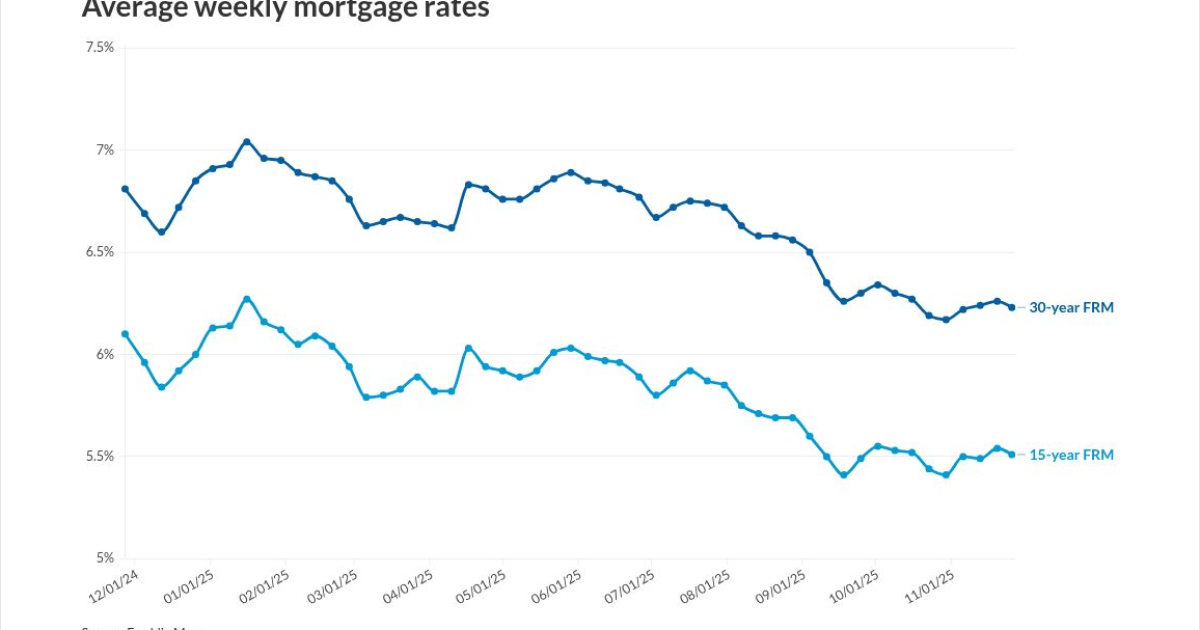

Mortgage rates inched down this week, and they are likely to remain stable throughout the rest of the year.

After three consecutive weeks of upticks, the 30-year fixed mortgage rate dropped 0.3 basis points to 6.23%

The 15-year fixed mortgage rate also fell 0.3 basis points to 5.51% from 5.54% last week. It averaged 6.10% this week a year ago.

"Heading into the Thanksgiving holiday, mortgage rates decreased," said Sam Khater,

Freddie Mac's chief economist, in a press release Wednesday. "With pending home sales at the highest level since last November, homebuyer activity continues to show resilience as we near the end of the year."

The Federal Reserve cut the federal funds rate by 25 basis at the end of October, yet the three full weeks that followed all saw

Pending home sales decreased 0.3% during the four weeks ending Nov. 9, the first drop in four months, according to a report from Redfin.

"House hunters are sensitive to rates and prices; many are waiting for one or both to drop before buying," said W.J. Eulberg, a Redfin Premier agent in Milwaukee, in a press release earlier this month.

But overall activity in the housing market saw

"Despite these slightly higher rates, purchase applications increased over the week and remained at a stronger pace than a year ago, with increases across conventional and government purchase applications," MBA Vice President and Deputy Chief Economist Joel Kan said in a press release Wednesday.

With uncertainty surrounding a rate cut next month and delayed data following the government shutdown, mortgage rates are expected to remain relatively stable until next year.