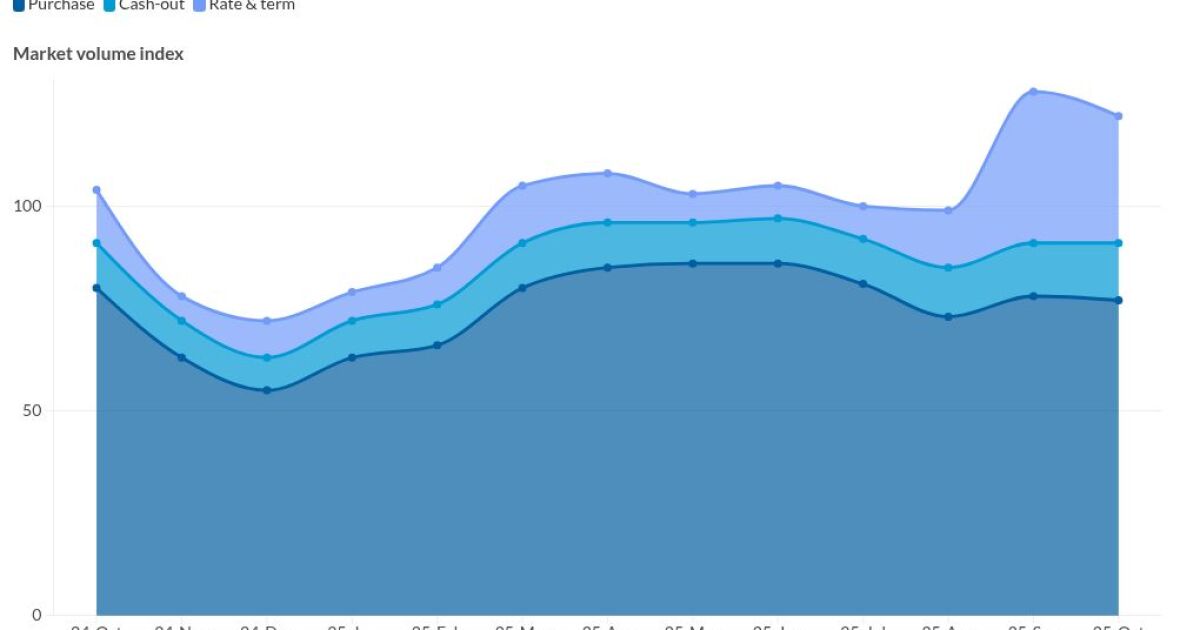

Refinancing slowed down in October after consecutive months of dramatic spikes, pushing down rate-lock activity.

Rate locks fell 4.2% to 122 from September to October, but were still up 18% on a year-over-year basis, according to Optimal Blue's latest Market Advantage mortgage data report.

Purchase locks decreased 1.5% last month, following seasonal trends, while rate-and-term refinances dropped 14% month over month, but were still up 143% from the same time last year. Cash-out refinances saw monthly and yearly increases of 6% and 29%, respectively.

"October's data speaks to the market's resilience," said Mike Vough, head of corporate strategy at Optimal Blue, in a press release Tuesday. "Purchase activity held steady and refinance demand — particularly cash-outs — remained strong. Even after

Mortgage rates hit 6.17%, its

The Optimal Blue Mortgage Market Indices 30-year conforming fixed rate fell 16 basis points to a similar 6.16%, its lowest mark since late 2023. Rates for government-backed mortgages decreased as well, with Federal Housing Administration loans down four basis to 6.04% and Department of Veteran Affairs loans down 15 basis points to 5.67% month over month.

The easing rates grew the number of highly qualified refinance candidates, homeowners with at least a 720 credit score, 20% equity and potential savings of at least 75 basis points, to 1.7 million, the

Secondary markets see more activity

Larger-lender securitization growth continued last month with increased activity in the secondary market. Sales to agency mortgage-backed securities climbed 400 basis points to 46%. As a result, sales to the agency cash window fell 200 basis points to 30%, while aggregator bulk and best-efforts channels each dipped 100 basis points.

The share of loans sold at the highest price tier rose to 81%, up 300 basis points.

"October's secondary market data reflected clear strength in execution," said Vough. "Lenders leaned further into MBS sales and maintained access to top-tier pricing, signaling disciplined hedging and growing investor confidence. With securitization share and pricing quality both on the rise, large lenders appear well positioned to sustain profitability as production remains steady."