- Key insight: Treasury said it will abolish the CDFI Fund in reduction in force notices handed out to employees on Friday.

- Forward look: The CDFI funding that's already been appropriated could be subject to what's called a "pocket recession," a move likely to be legally challenged.

- What's at stake: Millions of dollars for banks and other financial firms that lend to customers across the political spectrum could never reach those customers if the program and its staff are gutted.

WASHINGTON — The Trump administration is gutting the Community Development Financial Institutions Fund staff as it pursues significant reductions in force on Friday.

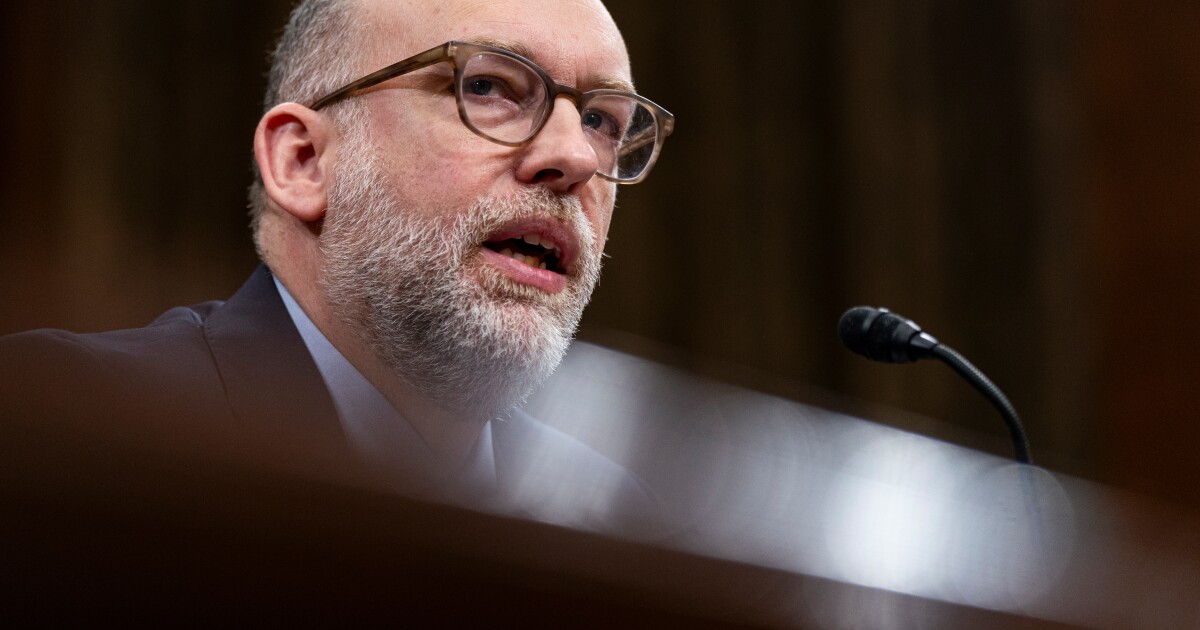

Russell Vought, head of the Office of Management and Budget, said on social media that the layoffs — which the Trump administration has been threatening since the beginning of the government shutdown Oct. 1 — have begun. That shutdown shows little sign of ending soon as Democrats refuse to pass a continuing resolution to keep the government funded without extending health care subsidies that, if expired, they say would raise health insurance costs for many Americans.

The CDFI Fund is wrapped up in the mass layoffs, according to documents viewed by American Banker.

"The [Reduction in Force] is necessary to implement the abolishment of the Community Development Financial Institutions (CDFI) which is based upon the Department of Treasury determination that its programs, projects, and activities do not align with the President's priorities," the RIF notices say.

The layoffs will be effective in mid-December, they say.

The Trump administration earlier this year targeted the CDFI Fund in an

In a note to OMB,

Nonetheless, OMB has

Vought has argued in favor of using "pocket recessions" for funds appropriated by Congress for programs that the executive branch decides it doesn't want. Under current law, a president can propose cuts to a program that has already been funded by making a request to Congress, which in turn has 45 legislative days to respond. A

CDFIs thought they received

CDFIs would not get approved for funds on the basis of those items being on their CDFI application, and it would not count positively toward firms' eligibility.

Those supplemental applications are due Oct. 27, but that could be pushed back due to the government shutdown. OMB at the time did not commit to a timeline for awarding the appropriated funds.