In the third quarter, Angel Oak Mortgage nearly tripled its earnings from the previous three months, as loan purchases gained momentum and the real estate investment trust completed its first bond deal since going public.

Net income for the period was $6.3 million, compared to $2.2 million recorded for the second quarter period. The company, which launched its IPO on June 17, is one of the nontraditional loan specialists being watched closely as margins for more plain-vanilla products have waned.

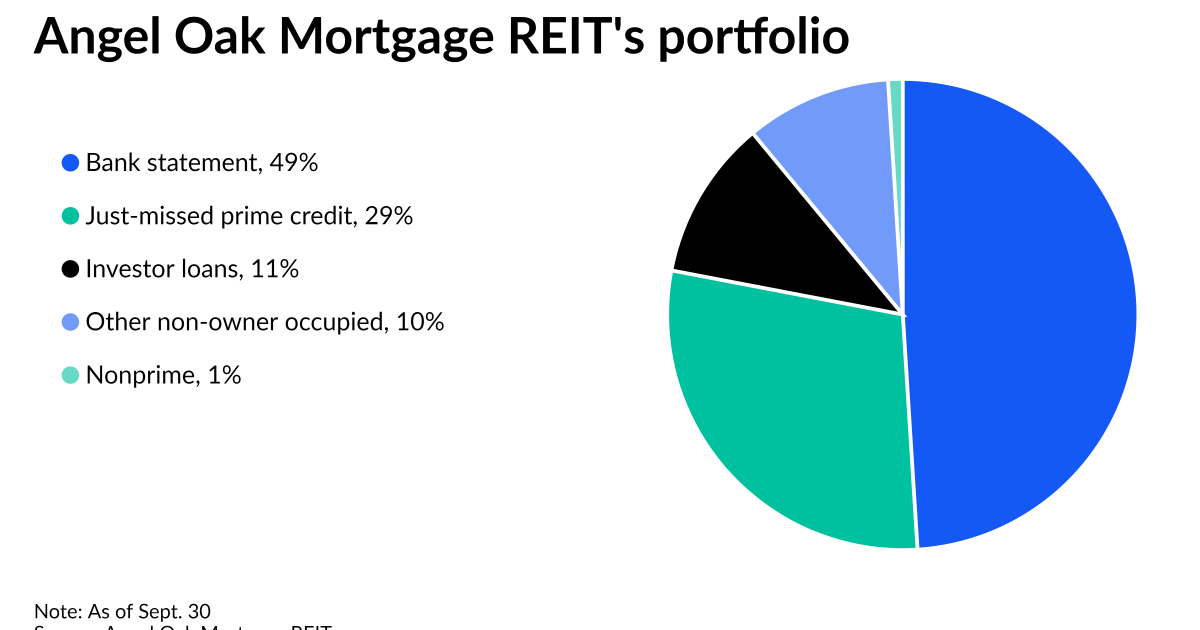

Angel Oak’s securitization during the third quarter consisted of loans made outside of the definition for qualified mortgages, which have more standard characteristics indicative of an ability to repay. Underwriters reviewed income verified through bank statements for nearly half of the loans in the company’s portfolio.

“The increase quarter-over-quarter is due to loan purchases made post IPO as we’re ramping into a fully-invested portfolio and an optimal financial and structurally leveraged profile,” Chief Financial Officer Brandon Filson said during the company’s earnings call.

The company’s $0.25 earnings per share was lower than Zacks Investment Research’s $0.35 estimate, and its net interest income of nearly $13 million fell below Seeking Alpha’s by a little over $1.4 million, but based on its current pace of loan purchases at deadline, Filson was optimistic its results could be stronger in the fourth quarter.

The company purchased $543 million in non-agency mortgages during the third quarter and as of Nov. 9, it had bought an additional $338 million.

“This purchase volume is ahead of our expectations and should give additional tailwinds to future quarters,” Filson said.