Housing finance firms have been adding staff as falling mortgage rates look more likely, with stronger overall job growth raising the chances of modest business gains for the industry.

"This is likely to support some additional decline in rates, which will offer opportunities at the margin for people to buy," said

Some borrowers who locked their loans at higher rates also could refinance but Duncan noted that mixed signals in broader economic indicators could limit near-term declines in the typical long-term fixed-rate mortgage rate to level shy of 6%

Mortgage rates "have come down quite a bit, but you'd have to see more weakness for the core expectation of long rates to come down to, say, the 6% level," Duncan said.

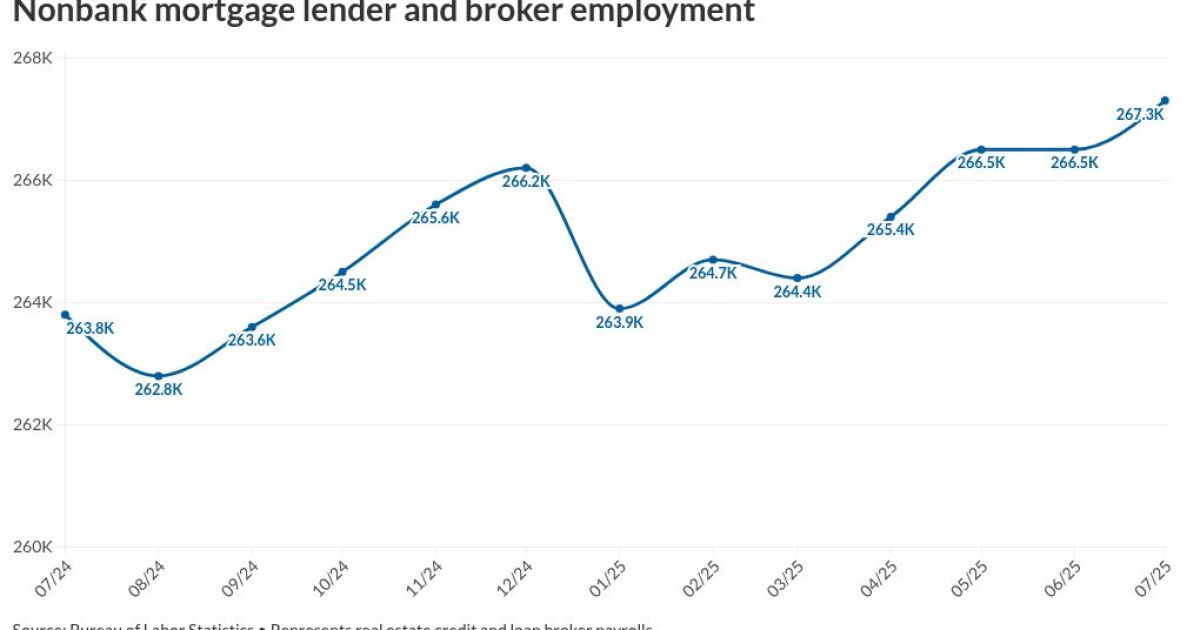

The forecast for incremental declines in the near term is in line with cautious hiring among nonbank mortgage bankers and brokers seen in the latest industry-specific BLS payroll indicators, which reflect July numbers. Industry payroll indicators inched up to 267,300 from 266,500

Mortgage bankers have shown some interest in maintaining payrolls slightly higher than what's necessary to maintain refi capacity, Duncan said.

Companies have been "working at the margins to maintain profitability while being prepared for opportunity if rates do come down, so a little bit of pick up in employment there wouldn't be surprising, because there has been some opportunity for refinance pickup," he said.

Incremental rate declines could be healthiest for the industry because more dramatic ones sometimes reflect more worrisome economic trends that could dampen homebuying.

Federal Reserve policymakers, whose view of the economy shapes

"I think that gets you pretty close to certainty on the 25 basis point cut, but it doesn't take you to 50," Duncan said of the meager U.S. jobs gain and slightly higher 4.3% unemployment rate that accompanied it.

"If the unemployment rate had gone from 4.2% to 4.5% then I think we'd be talking about a 50 basis point cut," he added.

Overall, the housing market is a little softer in some spots, with mortgage rates inching down, while incomes have grown, Duncan said.

"We've seen income growth maintain between 3% and 4% which is good. House prices in some markets have come down, not nationally. It's pretty close to zero nationally, and I do expect to see maybe a couple of percent decline nationally," he said.

Residential construction employment was down about 7,000 in the BLS numbers for August, Duncan said, noting that this is in line with excess inventory builders have been moving by offering temporary or permanent rate buydowns, Duncan said.

"A couple of other economists that I really respect also track that, and it's actually doing pretty well. It slowed a little bit in the last couple of months, but over time, you would look at the current numbers and say, it's doing okay. There will probably be some near-term continued decline, but then the question will be, what happens with inflation?" Duncan said.

An inflation rate that has remained above monetary policymakers' 2% target has been "limiting the scope for drastic rate cuts," according to a Friday morning statement from Jai Kedia, a research fellow at the Cato Institute.

Some pundits disagreed with this stance, which may be contributing to some of the downward pressure on long-term mortgage rates from Friday's job numbers given that the market had already largely priced in a 25 basis point fed funds cut.

The jobs report suggests that the 25 basis-point cut may not be sufficient and 50 could appropriately strengthen the economy, according to commentary from Nigel Green, chief executive of the deVere Group, a global financial consultancy.

"A decisive half-point reduction would provide immediate stimulus, lift market confidence, and send a strong signal that the Fed is prepared to act to prevent a deeper downturn," Green said.