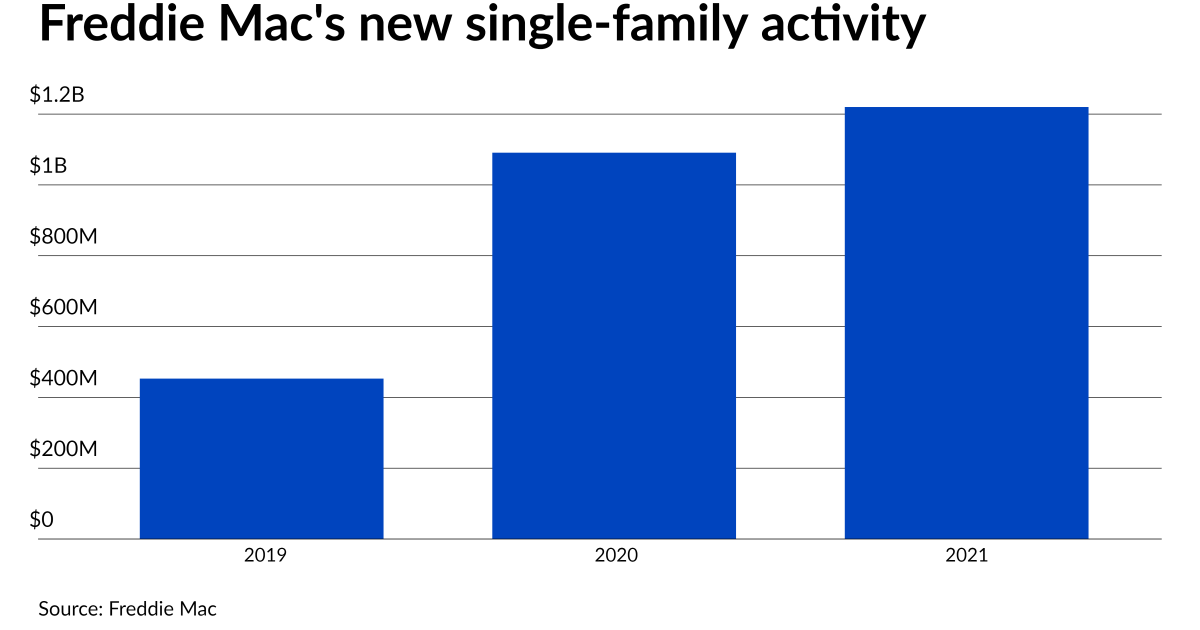

New purchases of single-family loans at Freddie Mac soared to another record high in 2021, the second of two banner years for the mortgage industry.

“Total single family, new business activity increased by 12% to a record $1.2 trillion reflecting a 32% increase in home purchase loans and a 3% increase in refinance loans,” CEO Michael DeVito said during a Feb. 10 earnings call.

However, for the final quarter of the year originations subsided. Single-family loan purchases by Freddie totaled $271 billion, which compared to $299 billion in the third quarter of last year and $383 billion during the fourth quarter of 2020. Of that amount, $111 billion were purchase loans, down from a record high of $131.2 billion in the previous quarter, and $109 billion a year earlier.

Overall, Freddie reported $2.7 billion in net income compared with $2.9 billion in both the third quarter and the fourth a year earlier. Only comprehensive income, an equity-based measure used in calculations related to Freddie’s conservatorship agreements, was higher than a year ago. In the fourth quarter of last year, Freddie’s comprehensive income was $2.5 billion. During the other quarters, the comprehensive income calculation was the same as the net.

“The decline in net income was primarily driven by a credit expense this quarter, compared with a reserve release in the fourth quarter of 2020,” Chief Financial Officer Chris Lown said during the earnings call.

While long-term delinquencies continued to abate during the quarter, those with shorter-term nonpayment did plateau or rise slightly, likely reflecting the spread of the omicron variant.

The rate at which loans in that market went seriously delinquent dropped to 1.12% from 1.46% in the third quarter of last year, and 2.64% during the last three months of 2020. In contrast, the one-month delinquency rate rose to 0.81% from 0.76% the previous fiscal period and 1.01% in the fourth quarter of 2020. Mortgages with payments late by two months had a 020% delinquency rate which matched the third quarter of 2021’s, and was down from 0.38% a year earlier.

Forbearance plans on single-family loans fell to roughly 16,000 from 21,000 the previous quarter and 52,000 in the fourth quarter of 2020. Deferrals, in which borrowers push forborne payments suspended for pandemic-related hardships to the end of their loans, also dropped, slipping to 39,000 from 45,000 in the third quarter of 2021 and 74,000 a year earlier. Other workouts, a category that includes loan terms modified to accommodate changes in income and foreclosure alternatives, remained stable at around 7,000 for the most recent quarter and comparable periods.

Despite the fact a small percentage of Freddie’s loans have been undergoing workouts due to new or lingering distress from the pandemic, its net revenues rose to $5.6 billion from $5.2 billion in the third quarter of 2021, and $5 billion a year earlier. Net interest income, which has been a key revenue driver, was $4.8 billion improving on $4.4 billion the previous quarter and $12.8 billion in the fourth quarter of 2020. Single-family activity accounted for the lion’s share or $4.7 billion of net revenues, with the balance coming from Freddie’s multifamily business.

“Overall, we saw strong performance from both our business lines that contributed substantially to our capital position,” said DeVito.

That gives Freddie “a good start” in efforts to improve its capital position under a new framework that raises the bar. More will need to be done, and plans to issue a record number of credit-transfer transactions in 2022 will be key to that end, DeVito added. .

Maintaining strong earnings will be as well, said Freddie’s CEO.

“We remain undercapitalized and our path to a stronger capital position is through consistently solid financial performance. To achieve that performance, we must demonstrate relentless focus on all aspects of our business,” DeVito said.