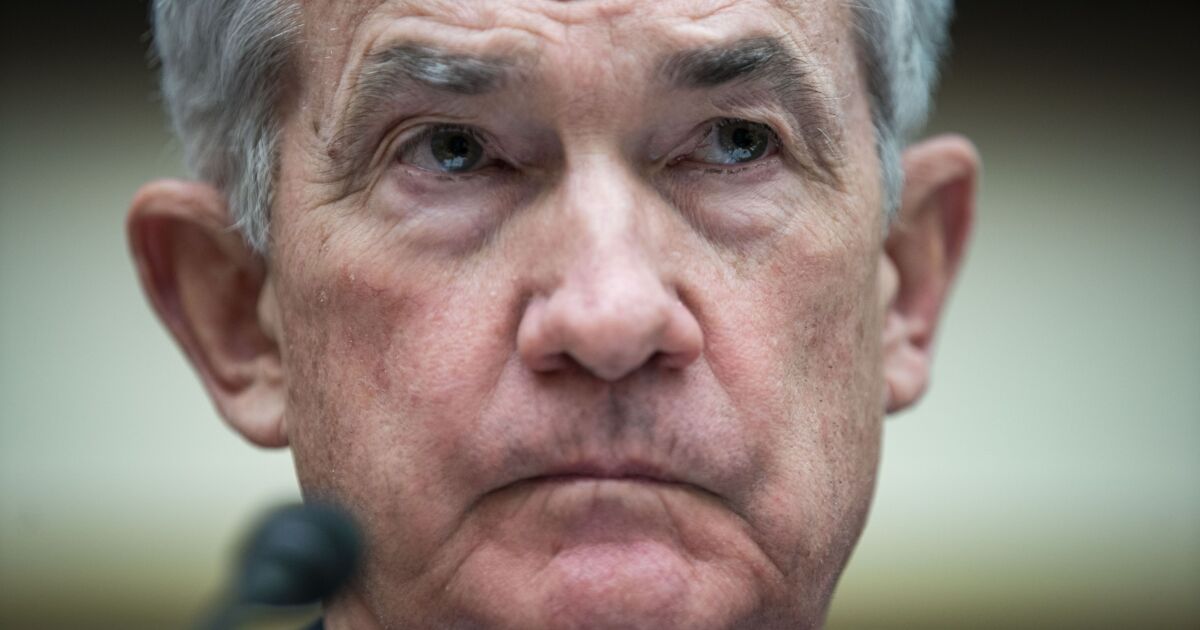

Federal Reserve Chair Jerome Powell said the central bank will take the “necessary steps” to get inflation down even if that means increasing interest rates more rapidly than currently anticipated and eventually to levels that slow the broader economy.

Policymakers raised the benchmark lending rate by a quarter point at their meeting last week, the first increase since December 2018, and signaled six more hikes of that magnitude this year, based on the median projection. The rate is anticipated to reach 2.8% in 2023, beyond the so-called neutral rate of about 2.4% that neither speeds up nor slows down economic activity.

“If we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so,” Powell said Monday in prepared remarks to the National Association for Business Economics. “And if we determine that we need to tighten beyond common measures of neutral and into a more restrictive stance, we will do that as well.”

Powell — who reiterated and elaborated on many of his key comments from last week’s press conference — said Russia’s invasion of Ukraine is aggravating inflation pressures by boosting prices on food, energy, and other commodities “at a time of already too high inflation.”

He said central banks typically look through event-driven commodity price shocks. But this time won’t necessarily be typical.

“The risk is rising that an extended period of high inflation could push longer-term expectations uncomfortably higher, which underscores the need for the committee to move expeditiously as I have described,” he said, adding that this “underscores the need for the committee to move expeditiously.”

Inflation risk

The comments suggest that Powell sees even higher inflation as a greater risk to the economy than any near-term slowdown resulting from consumption due to fuel costs and rising uncertainty.

Powell described the economy as “very strong” and well positioned to handle higher interest rates. Fed officials last week forecast economic growth of 2.8% this year, but Russia’s invasion of Ukraine has thrown new risk into their outlook.

Discussions on when and how quickly to start winding down their $8.9 trillion balance sheet are still ongoing, policymakers say, but a decision is expected soon. On that topic, Powell reiterated a comment from last week’s press conference, saying that action to reduce the balance sheet “could come as soon as our next meeting in May, though that is not a decision that we have made.”

The Fed chair said policymakers are now no longer assuming significant relief on supply chain issues and will be looking for “actual progress” on inflation to guide interest rate decisions.

Despite the aggressive tone of Powell’s remarks, he said he remained optimistic about soft-landing the economy to some sustainable growth rate.

'Common' occurrence

“Soft, or at least softish, landings have been relatively common in U.S. monetary history,” he said. “I hasten to add that no one expects that bringing about a soft landing will be straightforward in the current context—very little is straightforward in the current context.”

Policymakers expect little change in the jobless rate as they tighten benchmark lending rate into restrictive territory next year. The unemployment rate stood at 3.8% in February, and Fed officials forecast it will return to the prepandemic low of 3.5% by the end of the year.

“By many measures, the labor market is extremely tight, significantly tighter than the very strong job market just before the pandemic,” Powell said, noting that total demand for labor exceeds the size of the workforce. He said there is the possibility that the economy makes gains in labor supply over time.“

With prime-aged participation still well below its prepandemic level, there is room for further progress,” he said. “A more complete rebound is, however, likely to take some time.”