- Key insight: Consumers' use of home equity lines of credit is rapidly growing, as homeowners look to tap into the value of their houses, but banks are losing market share.

- Supporting data: Banks hold just under two-thirds of total HELOC debt, compared with the more than 80% they held some 15 years ago.

- Forward look: The demand for home equity debt is likely to stay elevated for some time, as borrowers avoid refinancing their mortgages at less favorable rates.

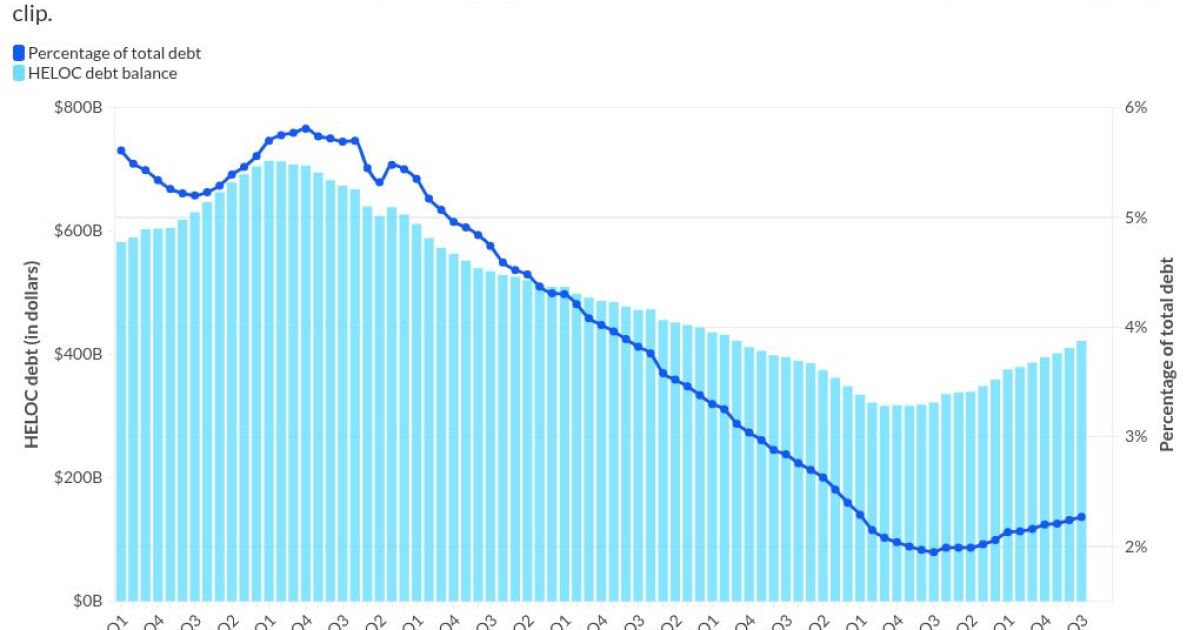

As consumers continue to take on more and more debt, banks are losing business in one of the fastest-growing household loan products.The volume of home equity lines of credit has been rising since 2022, as Americans have sought ways to access affordable debt without refinancing their mortgages at unfavorable rates. The acceleration in the usage of home equity lines follows a period of contraction that started about 15 years ago, when banks cut back on the business, or pulled out entirely.

At the peak of the Great Recession, banks held more than 80% of HELOC debt. Now, they hold just under two-thirds, as fintechs and other nonbanks have jumped into the rapidly expanding business.

Meredith Whitney, a Wall Street veteran who now runs an investment research firm, said that after banks were scarred by the mortgage crisis of the late aughts, they may be missing out on the resurgence of HELOC opportunities.

While banks do still hold the majority of HELOC volume, at roughly $276 billion, per data from the Federal Reserve Bank of St. Louis, nonbanks' market share is quickly increasing.

Several banks exited the HELOC business in 2020, due to economic uncertainty from the pandemic. Wells Fargo stopped offering the product at the time, and hasn't picked it up again. Capital One Financial, which completed its blockbuster acquisition of Discover Financial Services this spring, announced in July that it would wind down Discover's home equity loan business.

Whitney said she thinks banks have time to get in the HELOC action. At this point, though, they'll have to build digital products that are fast and easy to use, she said, in order to compete with the fintechs.

"That sounds really simple, but people want to go online and get their home equity approved and funded," Whitney said, explaining that banks will need to make investments in the HELOC business. "It's not as easy as just turning on the switch. They've been out of the market for long enough that they have to re enter the market in a competitive, modern way."

Figure Technology Solutions, which both originates HELOCs on its own and partners with other lenders to offer them, facilitated $5 billion in HELOCs in 2024. That volume accounted for about 13% of total HELOC growth last year. The company's HELOC customers have an average FICO score of 755, Figure said in a public filing.

"There is a lot of demand that the banks aren't meeting," Anthony Stratis, vice president of lending partnerships at Figure, told American Banker. "I do think there is an opportunity for depositories to rethink their home equity strategy and partner with companies, like Figure, in order to meet that demand without having the consumers go entirely outside their ecosystem."

To be sure, the largest originators of HELOCs are still banks, including Citizens Financial Group, Bank of America and PNC Financial Services Group.

And there are signs that banks are responding to the rise in HELOC demand. Earlier this year, JPMorganChase relaunched its home equity line of credit offering, after a five-year break from the product. Fifth Third Bancorp said this summer that it would expand parts of its home equity business, which has helped drive consumer growth, to make up for lost solar panel financing activity following new tax legislation.

The jump in demand is in line with an increase in consumer debt overall, according to the Federal Reserve Bank of New York's quarterly report on household debt and credit. Total household debt grew by $197 billion, or 1%, in the third quarter, to $18.59 trillion, continuing an upward march that began in 2014.

But rising indebtedness isn't necessarily a sign that there's more strain on Americans to scrape together funds, said a New York Fed researcher on a background call with reporters Wednesday. The increasing popularity of HELOCs is likely a reflection of low-risk borrowers moving away from more expensive types of debt, like credit cards or student loans, according to the researcher.

"I really see it as just a product switch where a borrower might opt for a different product than they would have a few years ago," the researcher said. "One note, I think, is that they are more available now. There were many years after the global financial crisis where the home equity product just wasn't quite as available."

U.S consumers are still showing resilience this year, with delinquency rates among Americans stabilizing in the third quarter, per Fed data.

The New York Fed researcher said that the median credit score on a newly opened HELOC is "much higher" than the median score of a newly originated 30-year mortgage, though Wednesday's report didn't include that data.

At Bank of America, fewer than 4% of its revolving home equity loans were held by borrowers with FICO scores under 660 on Sept. 30. As of the same date, the average FICO score among HELOC borrowers at PNC was 777.

Figure's Stratis said that he thinks the demand for home equity borrowing is still on the rise, due to the pressure interest rates are continuing to put on mortgage refinancing activity.

"There's going to be a need for cash on the consumer side," Stratis said. "And as far as rates go, which asks the question of what products are a good option for consumers, I think home equity still has a place."

Whitney said that consumers are still far less leveraged than they have been historically, because equity in U.S. homes has nearly tripled since 2009, to $36 trillion.

"I think we're still at the very beginning," Whitney said of HELOC growth.