High prices, tight affordability and general uncertainty continue to hold back would-be buyers. Redfin estimates that there approximately

Zillow also reported that affordability, while improved, still strains budgets. The median earning household would have to spend nearly one-third of its income on a mortgage for a typical home bought with 20% down. It is the smallest share of income needed since August 2022, but higher than the level in which housing is considered a financial burden.

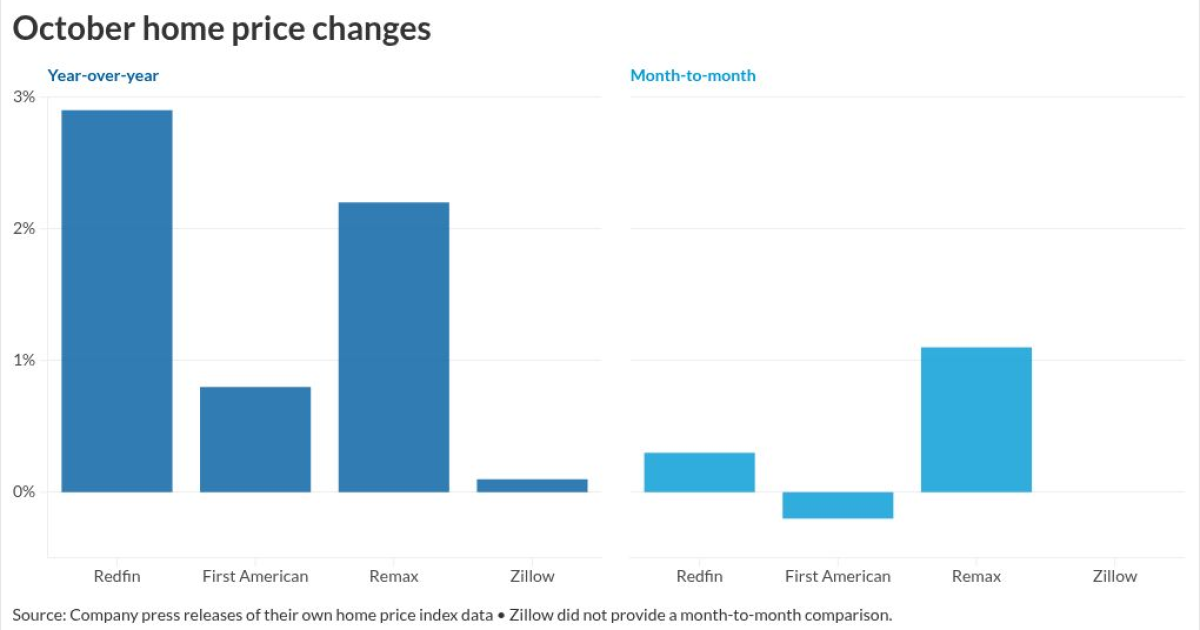

Inventory growth slows, nudging prices higher

Even with sluggish demand, prices are inching up as new supply slows. Redfin's data shows home prices rising 0.3% from September to October, a pace quicker than the 0.2% rise between September and August from the prior month. Redfin's Chen Zhao said slowing inventory growth is pushing prices higher even as demand stays "historically low." Fourteen of the 50 most populous U.S. cities had price declines in October, versus 20 in September and 30 in August, suggesting some stabilization rather than a pickup in activity.

First American echoed this. Its home price index posted a 0.8% annual gain — the first since late 2024 — but changes to prices month over month slipped 0.2%. Chief economist Mark Fleming called the trend "price stabilization," not a sign of renewed momentum.

Sales show pockets of strength despite broader stagnation

While much of the market remains stuck, some sales indicators are moving in the right direction. Remax recorded a 3.2% gain in home sales year-over-year, the fifth month in 2025 where this metric grew on an annual basis. Sales also rose 1.7% from September,

"Sales are up compared to last year, prices are steady and inventory is giving buyers more options," said Remax CEO Erik Carlson.

Zillow saw similar signs of activity. October brought the strongest combined buyer-and-seller participation in three years for what is normally a quiet month. Listings and accepted offers were both up 5% annually and held steady from September — another break from typical seasonal patterns.

Homes are taking longer to sell

One of the clearest signs of a slow-moving market is time on market. Homes tracked by Remax took an average of 50 days to sell in October, up from 48 in September and 43 a year earlier. This longer selling window may create room for negotiation, but it also reflects buyers' hesitation and the wider affordability squeeze.

Uncertainty clouds the outlook

Lower mortgage rates have unlocked some activity, but economists warn not to read too much into a single month. Zillow's Kara Ng said the softer rates gave the market "badly needed relief," but cautioned that winter

Redfin, which expects 2025 existing home sales to be flat with 2024 — the weakest year since 1995 — also sees little reason to anticipate a sharp rebound. Sluggish demand, stretched budgets and uneven inventory trends continue to define the market heading into the new year.