Both forbearance starts and exits had reduced activity last week, leading to a relatively muted improvement as expiration dates for a large swath of such loans approach in the coming weeks, according to Black Knight.

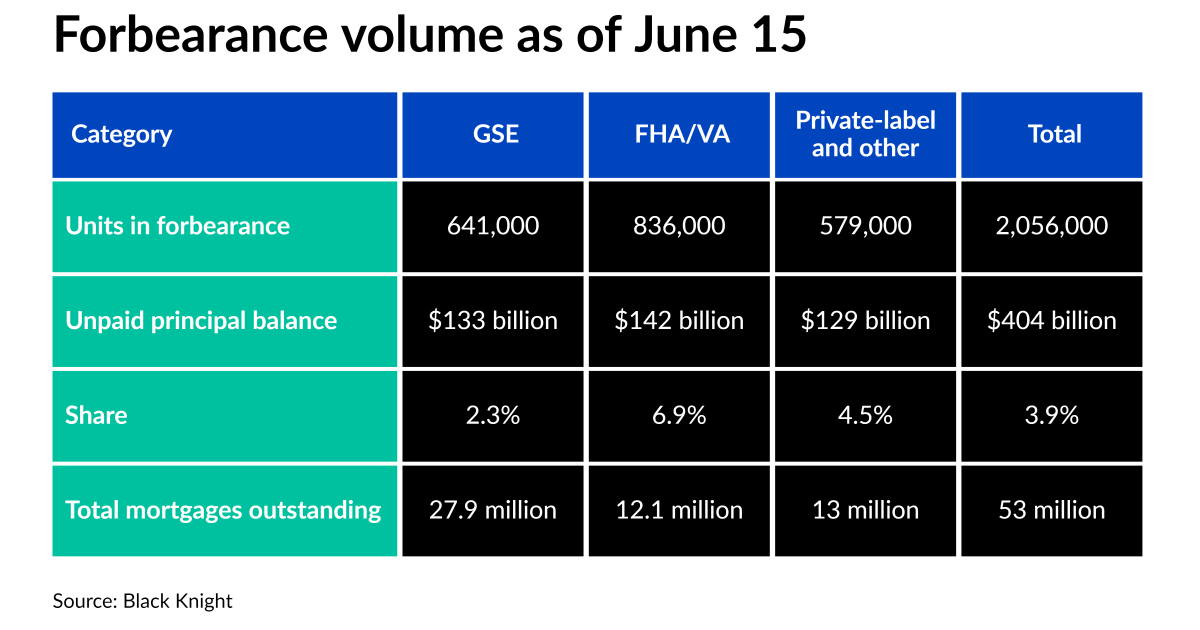

Outstanding loans in forbearance decreased for the third straight week, falling by 7,000 to 2.056 million as of June 15 from 2.063 million a week earlier. These delinquent borrowers account for 3.9% of the 53 million active mortgages in the market, amassing an unpaid principal balance of $404 billion, down from $406 billion week-over-week.

However, about 400,000 borrowers will face quarterly reviews for their forbearance plans at the end of June. For many of whom it will be the last within their 18 months of coverage.

“If a big chunk of those move out of forbearance, it will paint a picture of accelerating improvement throughout the end of the year,” Andy Walden, Black Knight economist and VP of market research, told NMN. “Whereas if the bulk choose or need to extend their forbearance another 90 days to what may be their final expiration date, it’ll suggest a larger group with perhaps more deeply set financial difficulties.”

Broken down by loan type, Fannie Mae and Freddie Mac-sponsored mortgages led the modest weekly decline, dipping by 6,000 week-over-week and bringing its total to 641,000. Those backed by the FHA and VA edged down by 4,000 to 836,000 overall. Portfolio and private-label securitized loans — which do not fall under CARES Act protections — actually rose by 3,000 to a total of 579,000.

The marginal increase toward the middle of each month has been somewhat common across all investor classes because that’s when reviews and outflow tend to cyclically slow down, Walden explained.

Servicers need to pay estimated monthly advances of $2.5 billion in principal and interest payments and $900 million in taxes and insurance per month, according to the analysis. Those are broken down by approximately $700 million and $300 million for government-sponsored enterprise loans, $800 million and $300 million for government-backed loans, and $1 billion and $300 million for private labels.