The government-sponsored enterprises' move toward buying mortgage-backed securities to lower rates in the near term has raised questions about whether it diverts attention from broader reform efforts.

The answer appears to be that MBS buying could add to capital challenges at the margins, but ultimately it doesn't do much to change the big picture for the enterprises, said Eric Chan, a vice president at Morningstar Inc.

"It's part of their risk weighted assets and in terms of the capital ratios, risk weighted assets would be the denominator," noted Chan, one of the nonbank financial institutions analysts who helps rate the GSEs, commenting on a recent report on reform he helped co-author.

The amount of bonds the GSEs have been buying to date have been small in the context of the overall size of their multitrillion-dollar retained portfolios, he said. But news of plans for the purchases did initially

A projected 25-50 basis points in rate reduction

The bond buying has one near-term goal and that's to lower rates, according to other researchers and Trump administration statements.

Barclays has projected MBS purchases may lower financing costs by as much as 50 basis points or more in combination with other affordability measures, less if done alone.

Some other analysts have released similar estimates, with Quincy Tang, a managing director and head of US residential MBS for Morningstar DBRS, projecting at

Where capital stands

Capital levels and the size of the retained portfolios are likely to be a key focus for investors if the GSEs move forward with Trump administration

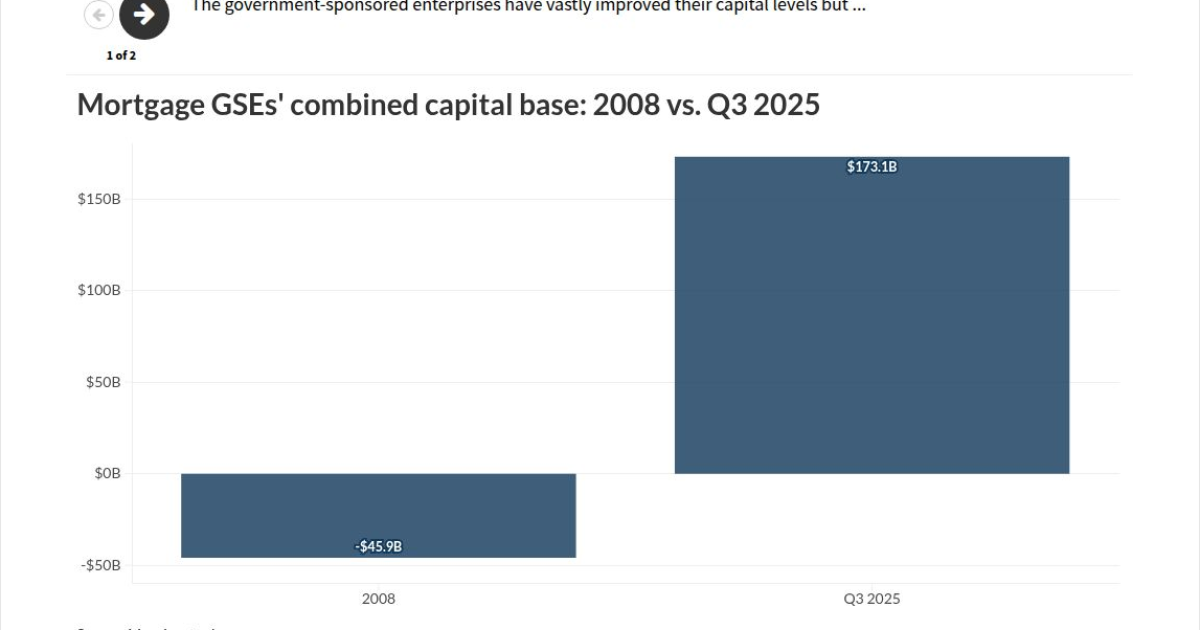

The enterprises have far more value now than they did when they went into conservatorship in 2008, going from -$45.9 billion in combined net worth to $173.1 billion, based on Morningstar's analysis of equity capital based on generally accepted accounting principles.

However, under the enterprises' regulatory capital framework the total adjusted amount is -$35 billion, leaving them with $378 billion short in total of ERCF ideals that include protective buffers against risk, according to Morningstar

"Given the deregulatory agenda of the current administration, it's not impossible for them to potentially decrease requirements," Chan said, but he noted that there would be questions about whether a reduced mandate would satisfy risk management aims and investors.

Under current requirements, and based on the average for recent normalized earnings per year, Morningstar estimates it would take over a decade to meet current ERCF requirements.

Other challenges that remain in reform

The GSEs' ability to retain their top AAA ratings hinges on preserving the implicit government guarantee backing their mortgage-backed securities, a commitment the Trump administration has said it will uphold and one that remains critical for international investors, Chan said.

Regardless of whether they're retaining more MBS in their portfolios or not, the implicit guarantee points to the tension between the private and public sectors that the enterprises would need to find a way to balance in order to profitably sell shares.

Some legacy private investors in the GSEs, such as billionaire Bill Ackman, have favored a scenario where the liquidation preference on their senior preferred stock is forgiven, and the report does note there is an argument to be made that the government has been paid back.

In comparing the US Treasury's $191.4 billion investment in the mortgage GSEs to $301.1 billion received through net worth sweeps and dividends, Morningstar estimates there could be said to be a 57% return.

But there still remain questions about whether the public sector would view this as justification for giving up contractual rights.

Private investors may also be wary of investing in a company that remains in conservatorship, particularly given the potential for policy changes across administrations and the lack of independence that could complicate a common-share offering.

An offering of senior preferred shares could face additional scrutiny based on the treatment of legacy investors during conservatorship.

The Trump administration has pledged not to act unless it can get a favorable offer for Fannie and Freddie's shares and some investors may want more of a sense of the GSEs' long-term game plan to make one, Chan said.

"They need to resolve what type of government support would still apply if they are going to do this in conservatorship and are they going to retain it or change it? There are a lot of moving parts, and I think that's part of the reason why talk about all this has gone on for years," he said.