Onity Group posted its best quarter for funded loan volume and shed a troublesome subservicing portfolio, in another steady quarterly performance.

The lender and servicer Thursday posted net income attributable to common shareholders of $18.7 million, down from

The company recorded $11.9 billion of funded volume, $7.1 billion of which came from its correspondent and consumer-direct operations. An 85% recapture rate on consumer-direct originations, on par with retail competitors, drove that surge with the

Onity also reported $25 million in adjusted origination pre-tax income, more than doubling quarter- and year-ago marks, on the strength of greater closed-end second volume and higher margins on lower volumes of reverse originations. While reverse volume fell 13% quarterly to $143 million in the third quarter, revenue margin shot up to 446 basis points from 367 basis points the quarter before.

The company posted $31 million in adjusted pretax income, flat compared to the second quarter and down $18 million from the same time last year. The company's total revenue climbed to $280 million, rising 13% quarterly and 5% annually. On an adjusted basis, revenue was $265 million, an amount including the portion of the looming subservicing subtraction.

Onity, Rithm Capital end subservicing relationship

Company chair, president and CEO Glenn Messina explained

That low-margin subservicing portfolio is composed of low-balance, pre-2008 subprime loans, and accounts for over half of Onity's delinquencies, Messina said. Shedding the portfolio was an eventuality, he noted.

"The portfolio probably had maybe another year of marginal profit contribution associated with it," said Messina.

The portfolio accounted for 4.9% of Onity's third quarter adjusted revenue, but the CEO said the company doesn't expect the move to have a material financial impact for 2026.

Onity's servicing growth

Onity expects $32 billion of unpaid principal balance additions in the second half this year, from nine new clients and six more under negotiation.

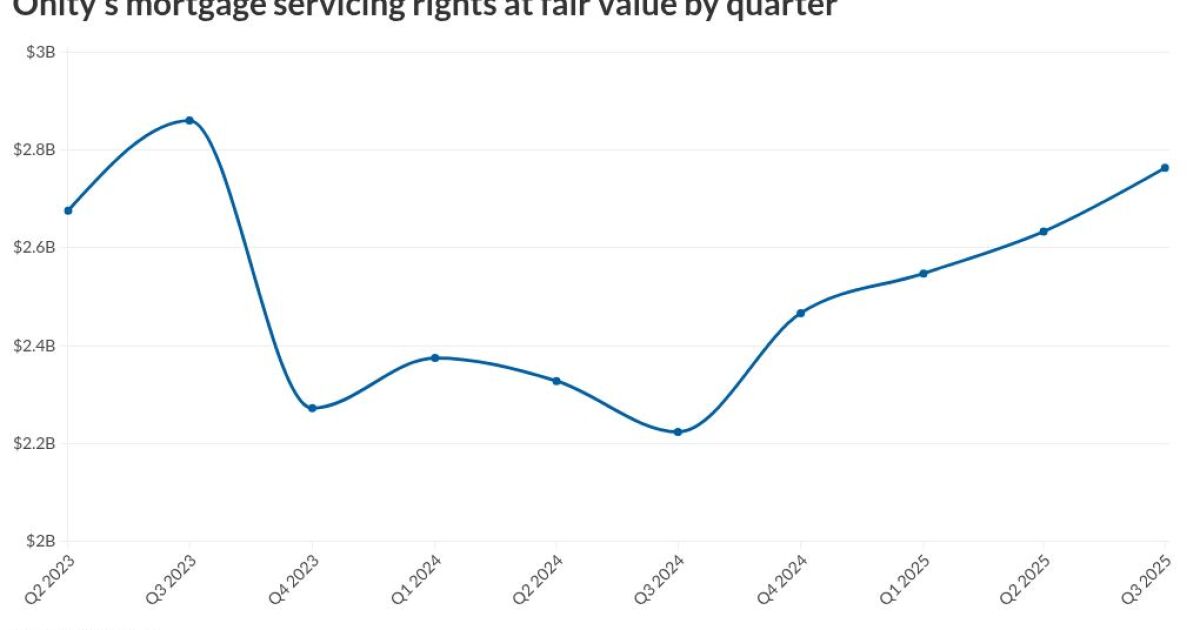

The firm's servicing average unpaid principal balance ticked up to $312 billion ending Sept. 30, and the fair value of its mortgage servicing rights has risen quarterly and annually to $2.76 billion.

The company also reported improvements in late payments, with a 4.2% portfolio-wide rate showing improvements in each of conforming, government-sponsored and

Shareholders reacted positively to the third quarter figures, and Onity's stock was up 7% and trading around $42.40 per share as of midmorning.