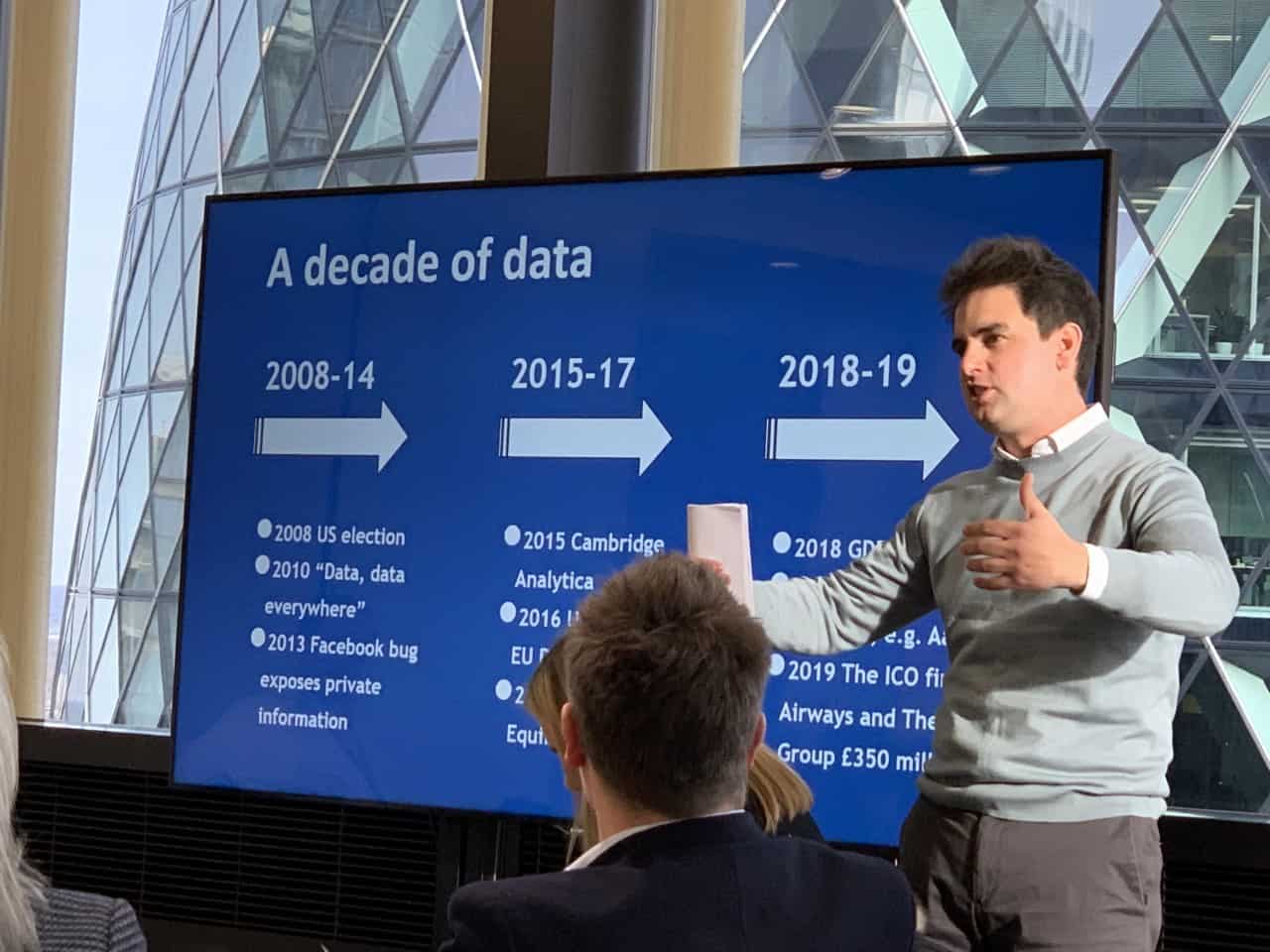

Alain Desmier (pictured) from Contact State discusses how scams are impacting the lead generation industry and how to stay vigilant as new FCA regulation comes into force.

Finding the best rates on the market can be as simple as a Google search. Type in a simple key word such as ‘bad credit remortgage’ or ‘remortgage for unemployed’ and you can find a series of websites quoting the best deals for a particular product. This can be helpful, particularly if you are looking for a rate in a hurry. However, not everything can be as it seems.

Unfortunately, some landing pages can be misleading or, even worse, can be impersonating a household name in order to attract interest. This fraudulent activity becomes more problematic as lead generation is not understood by many – even regulators have remained silent on the issue until a recent consultation by the FCA unveiled that there is soon to be a new regulatory framework on financial promotions, which has been described as a “gamechanger” by experts in the field.

One such expert is Alain Desmier, founder of award-winning Contact State. Contact State was founded in 2019 by Desmier and his business partner Mike Laming and sets out to help companies “buy compliantly, profitably and confidently” from Europe’s best and most trusted lead generation firms.

Desmier and Laming saw a gap in the market, with many lead generation firms using fraudulent tactics such as misleading advertising and reselling of consumer data. Much of this behaviour was not mandated, meaning large intermediaries and insurer partners became more at risk of being investigated by regulatory bodies such as the Information Commissioner’s Office (ICO) through claims being made by lead generators.

Using their expertise, Contact State has set out to break the rule of silence and introduce transparency into what is a convoluted sector of the market. Alain Desmier spoke to Mortgage Introducer about how his business is helping many and is bringing these dangerous practices into the spotlight.

The origins of Contact State

Desmier’s career began at a Californian lead gen firm, with a lot of his experience being in America. After four years at the firm, Desmier began a company with a business partner in 2011 which he describes as being a “classic lead gen” company but was directly authorised. This venture was successful, but after 15 years in lead generation, Desmier was looking for a change. “I realised that everywhere in the world, there was this struggle between genuine lead generators and fraudulent ones, similarly there were genuine buyers and fraudulent buyers,” he says. “It was almost impossible to determine which was which.”

It was this observation that laid the foundations for Contact State. The business is integrated with both the sellers and buyers of leads, making it easier to work with legitimate buyers and sellers; giving everyone the tools to do their own due diligence on either side. “One of my driving ambitions when I started this business, was to be a helpful tool. I saw a wave of regulation coming,” he says. “We are seeing how privacy laws are changing even now, with consumers having much more control about what they share.”

Contact State aims to bring light to the huge amount of fraud going on in the lead generation space and raise the standard of lead generation as a whole to a point where the regulatory requirements are as strong as they are for brokers, intermediaries and banks. This in time, Desmier states, will “lift” the quality of financial advertising and the consumer will easily be able to decipher the difference between a fraudulent lead and a legitimate one.

The FCA’s approach

Thousands of mortgage businesses are currently buying leads with no idea of where they are coming from. In an attempt to combat this, the FCA last year revealed that it is changing the way that regulated firms approve financial promotions, making the buyer liable for the leads they obtain.

This, Desmier claims, is a “gamechanger” and means that regulation begins at the first click of a lead rather than further into the process. This is different to the way regulation works in this field in America, which puts the onus on the source of the lead, and even allows for legal action if the consumer did not provide consent. Europe is set to follow suit and enforce similar regulations. “It is only a matter of time until a big mortgage business gets pulled up by the ICO for buying fraudulent leads and being fined for doing so,” Desmier predicts.

Putting the onus on the lead buyer may appear as a strange concept, however Desmier explains that this area has been misunderstood by the regulator to date and this latest consultation is an attempt for the industry to regulate itself. “This isn’t a bad idea,” Desmier explains. “But what is most important here is for there to be a level playing field. If you are going to expect one sector to adhere to the rules, the mortgage brokers for example, you should expect the lead generators to also be directly authorised.”

This regulation is a step forward but may not be completely necessary. “You don’t need to take significant pieces of regulation to try and fix the current problems,” Desmier says. “What you need to do is change the way that data is exchanged. When someone buys a lead from a lead generation website, they should understand that it complies with the GDPR.”

Veil of secrecy

As a former lead generator who ran a directly authorised lead generation firm for eight years, Desmier understands the need for change in lead generation and financial promotion more than most. “A lot of thinking behind Contact State comes from the fact that I was a lead generator that tried to do things properly,” Desmier says. “We were the first directly authorised lead generation business who worked with up to 2,000 mortgage brokers at one stage. From working internationally and across Europe, I found that there was almost an unwritten rule that fraud existed but no-one wanted to talk about it.” To solve this, Desmier set out to create a level playing field and take down what he calls the “veil of secrecy”.

Unfortunately it is so simple for fraudulent activity to occur in lead generation. Desmier explains that one can simply buy a URL, build a website with the various providers available to do so at low cost, put a Google advert up for the ‘cheapest remortgage rates’ and just like that you can be selling leads to a variety of regulated businesses. This can all be done with no checks or a required license. “It is insane when we are talking about what is at stake,” Desmier argues. “What Contact State does is due diligence checks on lead generators that are interested in working with one of our clients.”

One of the most common scams of fraudulent leads in the mortgage sector is tricking consumers into thinking they are buying into a well-known bank such as Santander or Barclays. These landing pages will be formatted to look exactly like the bank’s main website and can be dangerous for those looking to save time without taking the necessary due diligence. There is an argument to say that the big banks have a duty to monitor these websites fraudulently publicising leads and taking action, but Desmier explains it is not that easy.

“Big banks should be more proactive in taking down and challenging websites that impersonate them,” he says. “It is more complicated in the sense that lead generators that do this often sit off-shore. They make it extremely difficult to shut these websites down because they sit outside the UK’s jurisdiction. There is a vacuum that has appeared where even the big banks are unable to take action.”

It is this lack of transparency and inability to take action that will cause unsuspecting mortgage brokers in the future to fall for these scams and receive calls from the regulator questioning why they are buying fraudulent leads. This, Desmier explains, is why staying alert and conducting the appropriate due diligence is becoming increasingly important.

The future in uncertain times

The plans for Contact State in 2021 is to work with the lending sector. They have been making a big impact in the insurance space, but Desmier believes that in this time of economic crisis, the lending market needs to be their next step. “We will begin to see an increasing amount of short-term lending and distressed lending as an inevitable recession bites from COVID-19,” he says. “It is an obvious place for us to work with.”

With plans to hire and expand their growing client base in 2021, it is set to be an interesting future for Contact State, particularly as the new regulation from the FCA is set to be enforced in the next 12 months. Desmier hopes that soon, hiring a lead generator will become as “meticulous a process as it is to hire a new member of staff”.