A day after New York Community Bancorp's stock plunged, investors are trying to figure out whether the pain is over and how quickly the Long Island-based company can bounce back.

Several bank analysts on Thursday said they are optimistic about what comes next for the parent company of Flagstar Bank, whose assets have nearly doubled since the third quarter of 2022 following back-to-back acquisitions. Others expressed more skepticism about the company's growing pains and whether its large portfolio of apartment-building loans can stay healthy.

Jefferies and Compass Point Research & Trading both downgraded shares of the stock, while Moody's Investors Service placed the company's ratings on review for a downgrade.

What's clear is that even though New York Community's stock fell by 11.3% at days' end, the $116.3 billion-asset company's picture of health looked more certain than the prior day.

"It feels like it's starting to stabilize, and I actually think it's a great opportunity to own the stock right now," Mark Fitzgibbon, an analyst at Piper Sandler, said during an interview Thursday.

After a year where three regional banks failed —

"We expect the path to improved profitability will take years while credit risk remains an overhang," Casey Haire, an analyst at Jefferies, wrote in a note to clients.

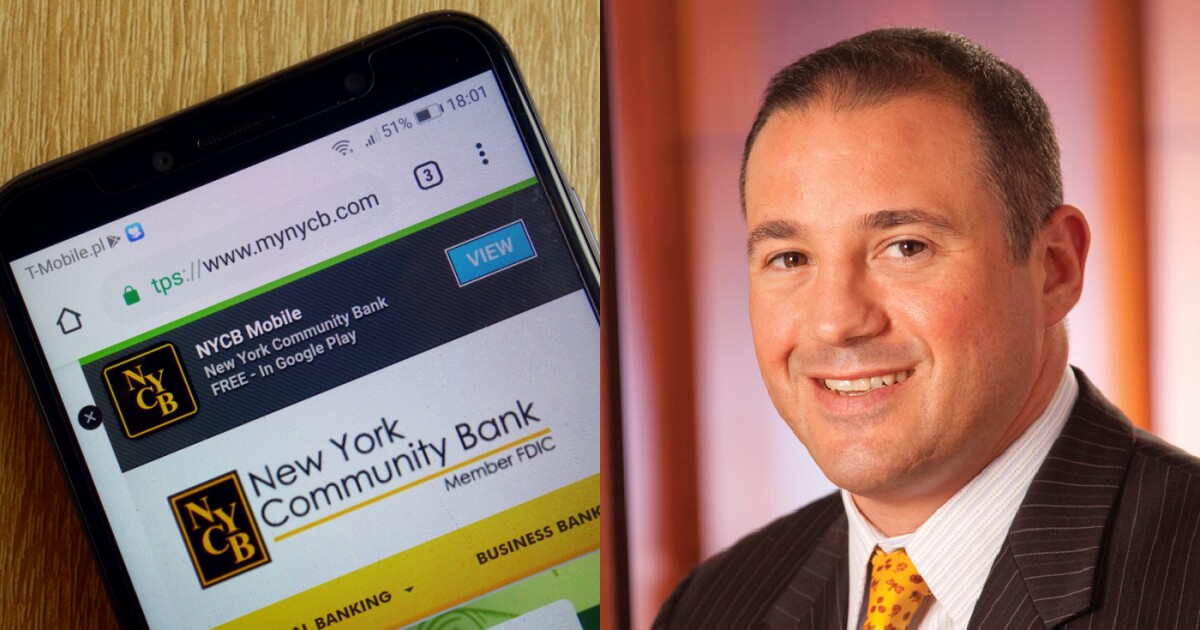

Under CEO Thomas Cangemi, New York Community has

Four months into his tenure as CEO, Cangemi

New York Community closed the Flagstar deal in December 2022. Then, in March of last year as the banking crisis unfolded, it acquired large chunks of the failed Signature Bank.

That deal pushed New York Community over the $100 billion-asset threshold, subjecting it to a whole host of tougher capital and liquidity rules from regulators. On Thursday, there was some uncertainty about whether New York Community's fourth-quarter actions to build capital, such as the dividend reduction, were driven by regulators' feedback or determined by the bank itself.

"I think what people are trying to sort out is to what extent were they hearing one thing from the regulators and [whether] that changed recently," David Smith, an analyst at Autonomous Research, said Thursday in an interview. "It's hard for any bank to talk openly about regulatory issues, so in some ways we'll all be left speculating."

"The end result is that New York Community had to take some painful actions [in the fourth] quarter and over the next year, sooner and more aggressively than maybe would have been anticipated before yesterday," he added.

The bank did not respond Thursday to a request for comment.

While there is clearly short-term pain, there are also opportunities ahead, analysts say. Flagstar's mortgage business has faltered as high mortgage rates dampen activity, but it's poised to boom once rates fall. In the meantime, the bankers it picked up from Signature can help expand its commercial and consumer lending in always-growing New York markets.

The problem is New York Community's legacy business of multifamily loans, which made up 44% of the portfolio at the end of December, could run into more trouble, some observers say. Many of the company's buildings are rent-controlled and face tougher New York state regulations, plus high interest rates are putting pressure on property owners.

Historically, its multifamily loans have performed well, with little risk that borrowers won't repay their loans.

But "this cycle may be different," according to a research note from analysts at Moody's. Higher rates will pose difficulties when loans get refinanced, adding onto the pain that property owners are feeling from higher maintenance costs, the Moody's analysts argued. Plus, rent controls mean properties have less wiggle room to raise tenant rents, they said.

New York Community executives say they foresee some "repricing risk" in the multifamily portfolio — or borrowers struggling to adjust to higher interest rates. Their more cautious tone helped explain why they set aside some $552 million during the fourth quarter to guard against loan defaults, up from just $62 million three months earlier.

But they've also expressed confidence, with Chief Financial Officer John Pinto saying Wednesday that the bank is "still very comfortable in the quality of the multifamily portfolio."

Investors don't necessarily disagree, but they'll need to see some "proof points" over the next couple of quarters that the portfolio is indeed holding up, said Ebrahim Poonawala, an analyst at Bank of America.

"That's the element of uncertainty," Poonawala said. "That's why the stock is down again today."

At least some chunk of the sales this week were tied to dividend-focused funds, analysts say. Some of those funds have rules in place dictating they can't invest in companies cutting their dividend and thus they automatically sold their positions in New York Community. Piper Sandler's Fitzgibbon said the bank had long been a "darling" of dividend investors.

On Wednesday, New York Community slashed its quarterly dividend from 17 cents per share to just five cents.

The dividend cut, which analysts see as temporary, will help the bank build a larger capital cushion and meet the tougher rules facing banks with more than $100 billion of assets.

But while the bank's moves were sudden and scared some investors, some analysts credit the bank for being proactive, even if its actions may not make the market happy.

"If they would have said, 'Here's a four-quarter or longer plan to do all of this … and make sure we're running the business to grow, I think investors would have yawned and said, 'Do it all now,'" said Christopher Marinac, an analyst at Janney Montgomery Scott. "I think they want to be at peer level on reserves and rather than fight it or slow-play it, they said, 'Let's just do it.'"