While the publicly traded title underwriters across the board reported improved third quarter results on a year-over-year comparison, helped by

The biggest news from the sector came after the quarter ended, with three of the companies announcing merger and acquisition deals.

Fidelity National Financial is making a distribution of 16 million shares it owns in F&G Life & Annuities (12% of the latter's equity) to its own shareholders. The deal is structured as a taxable dividend.

It made the announcement the day after it released earnings on Nov. 6 but before the conference call.

Also on Nov. 7, a unit of Stewart Information Services agreed to buy Mortgage Contracting Services, a company which works in property perseveration.

The purchase price is $330 million and Stewart will fund it with available company resources. It should close by year-end.

Plus,

Before the quarter ended, Radian Group, which acquired a title underwriter then-called

The following is a roundup of the third quarter earnings from the four largest publicly traded companies as well as one other that is an underwriter. Other producers are owned by homebuilders or private mortgage insurers.

Refis surge in September for FNF

FNF's net earnings for the third quarter were $358 million, versus $278 million in the second quarter and

The drop in interest rates in September, which helped drive origination volume, also helped title insurer volume, including FNF.

While for the quarter, refinance orders open per day averaged 1,600, up from 1,300

"Our refinance orders open per day were up 15% over the third quarter of 2024, up 22% over the second quarter of 2025, and for the month of October, up 27% versus the prior year," Nolan said.

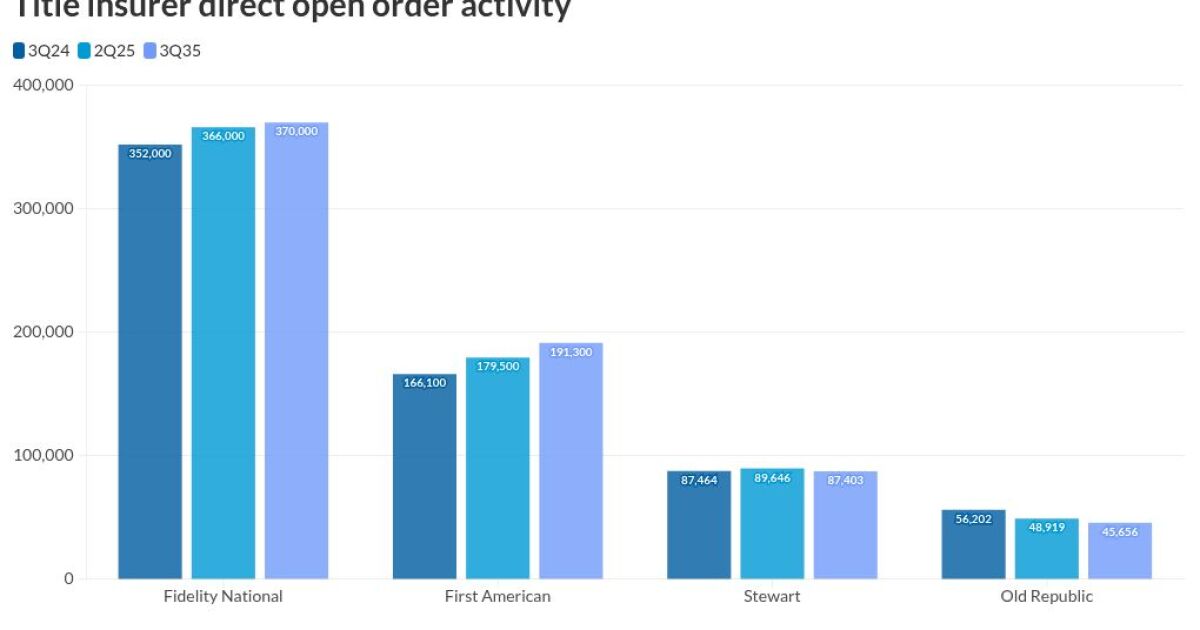

Total orders open were 370,000. This was up from 366,000 in the second quarter and 352,000 year-over-year.

As for the F&G distribution, FNF will still have a 70% equity stake. The public float in the life insurer grows to 30%, Nolan said during the call.

"This distribution reflects our confidence in F&G's long term prospects and is intended to unlock shareholder value by enhancing market liquidity and broadening investor access to F&G shares," Nolan said. "Additionally, we view this stock distribution as a tangible and meaningful return of value to FNF shareholders," along with an increase in the common stock dividend.

First American reports profit in 3Q, unlike prior year

At First American, while purchase related revenue was 2% higher from the prior year, refinance revenue grew by 28%, said Mark Seaton, CEO, during the earnings call. Still, refi volume remains at "historically low levels," Seaton said.

Even with the increase, refi revenue "accounted for just 6% of our direct revenue this quarter and highlights how challenged this market continues to be," added Matthew Wajner, chief financial officer.

First American swung to a profit of $189.6 million, compared with a year ago loss of $104 million. For the second quarter, it reported net income of $146.1 million.

The company reported 191,300 open orders for the most recent period, compared with 179,500 in the second quarter and 166,100 one year ago.

The refi share of open orders per day was 36% in the third quarter, compared with 25% three months prior and 26% year-over-year.

Another acquisition for Stewart

Stewart has been

This latest transaction, announced after it reported earnings, takes it into a new line of business.

Stewart is looking forward to offering property preservation, which supports the default servicing function, said Fred Eppinger, its CEO in a press release. "This acquisition confirms our dedication to bettering our lender services and allows us to introduce our products and services to a broader audience of customers."

Stewart's net income of $44.3 million compared with $31.9 million three months ago and $30.1 million in the prior year quarter.

On the earnings call, Eppinger was not enamored of the refi market as his competitors were.

"While there is some softening of rates in the third quarter, we did not see rates quite as low as the quick dip we experienced in September of last year, where rates hovered momentarily right around 6% and caused a flurry in purchase and refinance activity to close out 2024," he said. "I am more confident in the market's

ability to improve over the next 12 months this year than I was last year at this time."

Unlike its larger competitors, open orders were flat year-over-year for Stewart, 87,403 in 2025 and 87,464 during 2024. In the second quarter it had 89,646.

Open orders down at Old Republic

At Old Republic, its title insurance business posted pretax operating income of $45.7 million, up from $40.2 million one year prior.

"The third quarter market story is a continuation of what we reported last quarter," said Carolyn Monroe, president and CEO of Old Republic National Title Holding during the earnings call. "We still see strong activity in the commercial sector, a modest uptick in refinance activity, and a softness in the residential purchase market driven by persistent price and affordability challenges."

Revenues generated from agent business had an 80% share and made up 11% of the total.

Direct orders opened slipped to 45,656 from 48,919 in the second quarter and 56,202 for the third quarter of 2024.

More business leads to more expenses at Investors

The smallest of the publicly traded companies, Investors Title, reported net income of $12.2 million compared with $9.3 million for the prior year period. That was driven by an over 6% increase in revenue.

Its net premiums written along with escrow and title-related fees grew by $1.8 million, primarily driven by higher real estate activity levels.

But on the other hand, operating expenses also were higher, by 1.2% to $57.9 million, driven by agent commissions and other expenses from higher transaction volume.

"Our title insurance volumes continued to grow over the prior year and trailing quarter, reflecting the results of our efforts to grow market share and the benefit of improving market conditions, including a recent decline in mortgage rates that has helped to spur higher transaction activity," said J. Allen Fine, chairman, in a press release. Heading into the fourth quarter, our open order pipeline remains strong, which we believe positions us well for continued momentum."