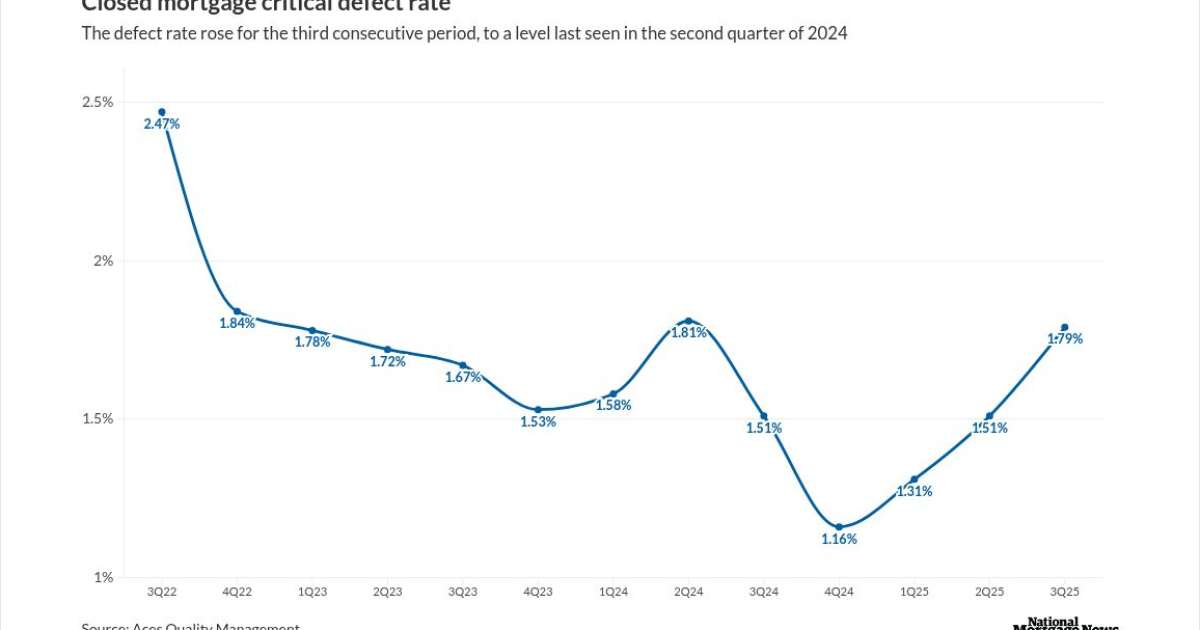

Plummeting mortgage rates during the third quarter last year started a shift in originators' business mix towards refinance, and this, more than a lessening emphasis on loan manufacture quality, resulted in a huge jump in defect rates, Aces Quality Management said.

For the last week of June,

The overall critical defect rate for the third quarter was 1.79%, up from

"The increase was driven primarily by concentrated deterioration in income- and compliance-related findings, reinforcing the importance of documentation integrity and disciplined validation as refinance activity expands and lenders continue to operate lean," said Nick Volpe, executive vice president, in a press release.

Aces noted the defect rate was low by historical standards and that the current trend is really a normalization following what it termed as near-record improvements in quality in late 2024.

The defect rate was last this high in the second quarter of 2024 and before that, the first quarter of 2023.

While a manufacturing defect is not necessarily proof of mortgage fraud, it is a red flag for a problematic file, which might later be subject to repurchase.

A shift away from purchase towards refinance activity

During the third quarter, the share of purchase mortgage files reviewed fell to 80.95% from 82.67% in the second quarter, but the findings of defects fell to 62.65% from 62.65%.

At the same time, refinance defect findings increased to 37.35% from 26.04%, even though the share of reviews only increased by about 1.8 percentage points.

In the post-Covid environment, many lenders adopted a do-more-with-less approach for their back offices and this shift influenced where defects are being found, the Aces report said.

"When refinance share expands, file profiles often shift, bringing different documentation timing sensitivities and a higher likelihood of documentation refresh requirements late in the process," the report noted.

"In a lean operating environment, those added touchpoints can increase the chance of documentation gaps, missed updates, or inconsistent application of requirements, particularly in underwriting areas that are already documentation-intensive."

Categories with the most growth in defects

Aces uses

Income and employment issues in loan files remain the most common finding, and was up 47.6% between the second and third quarters, to 27.24% from 18.45%.

But Aces found a shift in the source of these defects, towards those which are documentation-driven and away from calculation-related findings.

Another category with a significant increase was legal/regulatory/compliance, where the defect rate moved 16.8% higher to 18.97% from 16.24%.

On the other hand, borrower eligibility found its defect rate significantly improved to 6.9% for the third quarter from 15.87% three months prior.

Among a pair of what Aces called "categories to watch," appraisal-related defects fell 41.5% to 3.1% quarter-to-quarter, while insurance ended the period 6.6% lower at 2.41%.

"While neither category drove the quarter's defect-rate increase, both remain important indicators because they can move quickly with market conditions, cost pressures and collateral related volatility," the Aces report commentary said.

By investor type, conventional loans made up 62.34% of all file reviews, but 57.16% of the findings. Federal Housing Administration-insured mortgages had 23.91% of files examined but 31.1% of critical defects.

The impact of industry consolidation

The report's economic discussion section mentioned the mortgage consolidation activity during the first three quarters, but only one deal by name —

"From a QC perspective, the relevance of this backdrop is what typically follows deal announcements: integration planning and execution (policies, procedures, systems, vendors, training, and leadership structures)," Aces said.

Multiple transactions were announced during the first nine months of the year, which ended with