Newrez is leaning into technology investments to shore up borrower recapture and future originations after fair-value losses in its mortgage-servicing rights pushed the lender to a fourth-quarter loss, underscoring how quickly market volatility can upend mortgage earnings.

Fair-value

Total profits retreated from the $225.4 million positive gain Newrez

In its latest earnings call, Rithm leaders addressed some of the effect falling interest rates at the end of 2025 appeared to have not only on fair values, but borrower prepayment activity as customers sought to refinance.

With borrower retention top of mind for lenders, an

"Our equity got hit, as did some of the other mortgage companies over the course of the past few days," said Rithm Capital CEO Michael Nierenberg during the call. Nierenberg stressed, though, that the company was not in an originations race and had strategies to respond to interest rate developments.

"If folks are out there pricing originations through the market, it's not going to be us. Origination volumes will vary. Similarly, when you think about the MSR business, we're fully hedged against our MSR," he added.

"We're going to invest both resources, capital to make sure that our recapture numbers continue to go up, but the market's going to give you what the market's going to give you."

Newly announced technology investment deals with software providers Homevision and Valon stand to reap benefits for Newrez when it comes to overall future trajectory, company leaders sought to emphasize.

"The first phase of our Homevision rollout has already doubled our underwriting capacity, with further functionality to be delivered throughout 2026," said Newrez President Baron Silverstein.

Rithm's

Now with a minority equity stake in Valon, Newrez plans to begin moving its 4 million servicing customers onto the platform in 2027.

Originations and servicing by the numbers

With elevated refinance activity leading to servicing runoff throughout the mortgage industry, unpaid balance in Newrez's books finished at $851.7 billion in the fourth quarter, stepping back 2.9% from $877.5 billion three months earlier. The latest number still represented a 0.9% increase from fourth quarter 2024.

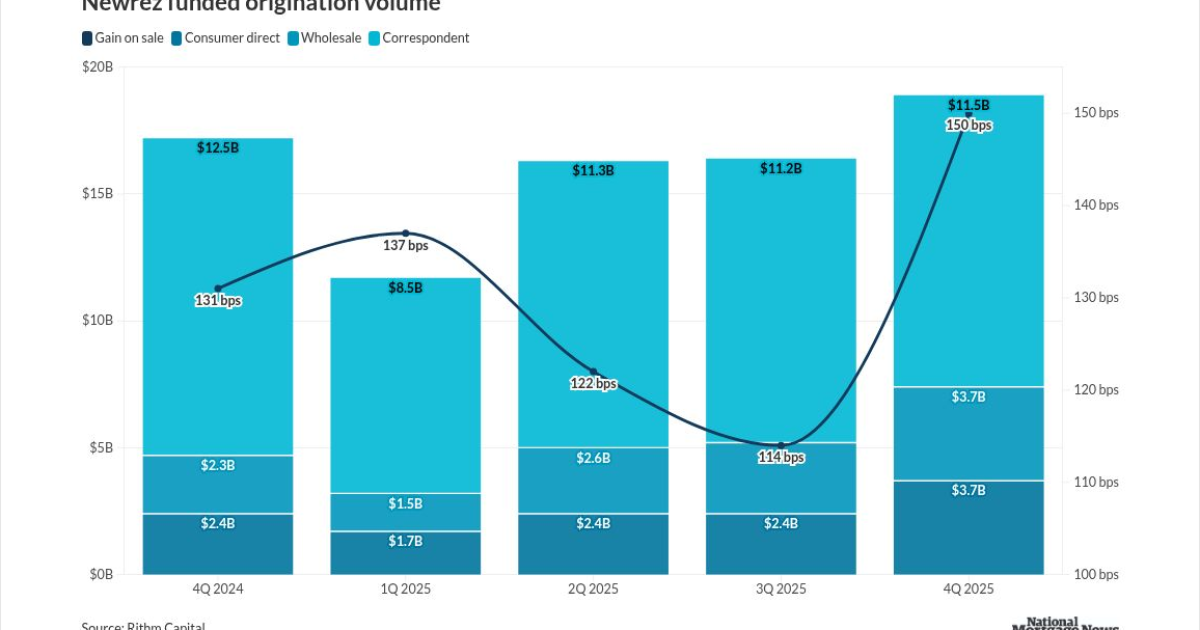

Although market trends pushed profits downward, origination production volume still grew in 2025's final three months to total $18.8 billion, up 14.6% from the third quarter's $16.4 billion. Year over year, production also rose 8.7% from $17.3 billion 12 months earlier.

Originations received a boost from gain-on-sale margins, which improved to 150 basis points compared to 114 in the third quarter and also accelerated from 131 a year earlier.

Excluding fair value changes, pretax income within servicing came out to $167.3 million, with originations contributing $126.8 million.

Rithm Capital earnings results

Across all of its business lines, which also includes asset management, commercial real estate and residential transition lending, Newrez's parent reported fourth-quarter profits of $53.1 million, falling 72.6% from $193.7 million in the previous earnings period and 79.8% from one year earlier.

Full-year net income at Rithm Capital equaled $567.2 million, a 32% decrease from $835 million in 2024.

The final three months saw Rithm close on its acquisitions

While developments at Pennymac led many mortgage stocks, including Rithm Capital's to plunge late last week, investors appeared to react more favorably to news coming out Tuesday's earnings from the New York-based company.

After opening at $11.80 per share on Jan. 30, Rithm's stock price ended trading on Monday at $10.80. The stock recovered to open at $11.23 per share on Tuesday morning following the earnings announcement.