One of the lowest exit rates since the pandemic began helped drive a weekly increase in forbearances, according to Black Knight.

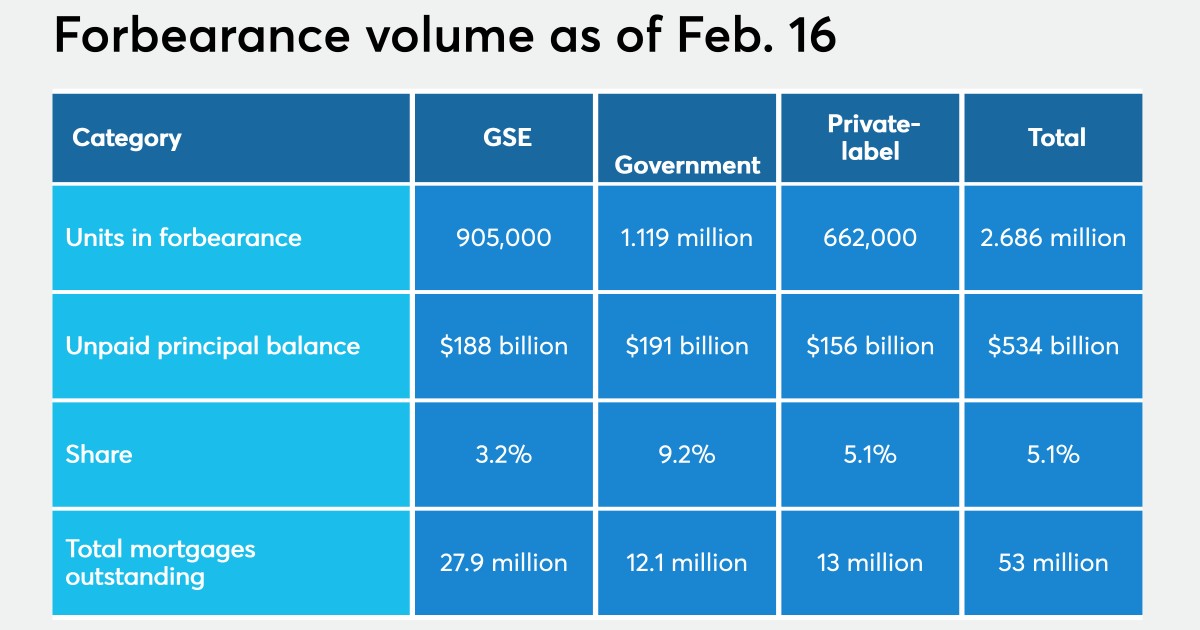

Outstanding mortgages in forbearance plans rose by 15,000 to 2.686 million as of Feb. 16 from 2.671 million one week prior. These borrowers represent 5.1% of the 53 million active mortgages in the market and combine for an unpaid principal balance of $534 billion, up from 5% and $532 billion week-over-week.

Another reason for the increase can be attributed to the recent forbearance moratorium extensions. First, the Federal Housing Finance Agency announced borrowers could request three additional months of coverage for Fannie Mae and Freddie Mac mortgages. Then, President Biden followed suit for FHA, VA and USDA loan protections.

While the movement followed the continued pattern of slowing forbearance recovery and mid-month growth, the total decreased 2% month-over-month, staying in line with changes since early December.

By loan type, only those backed by Fannie Mae and Freddie Mac decreased week-over-week, dipping by 2,000 to a total of 905,000. Government-backed mortgages — sponsored by the FHA and VA — rose by 5,000 to 1.119 million overall. Portfolio and private-label securitized loans — which do not fall under CARES Act protections — increased by 12,000 to a total of 662,000.

“Some 204,000 forbearance plans are scheduled to scheduled term expirations at the end of February, suggesting that any decline in forbearance volumes in the coming weeks is likely to be limited,” Andy Walden, Black Knight's director of market research, wrote in a blog post.

Servicers need to make monthly advances of $3.3 billion in principal and interest payments and $1.2 billion due in taxes and insurance per month, according to Black Knight’s analysis. Those breakdown to estimates of $1 billion and $400 million for government-sponsored enterprise loans, $1 billion and $400 million for FHA and VA, and $1.1 billion and $400 million for private labels.