Active forbearances grew slightly mid August, as the industry anxiously waits to see what September offers, when large numbers of borrowers reach their limit of COVID-related relief.

The August mid-month uptick was fueled by a higher numbers of distressed portfolio-held and privately securitized loans. Unlike loans backed by the U.S. government or GSEs, portfolio and PLS loans did not receive the same CARES Act protections.

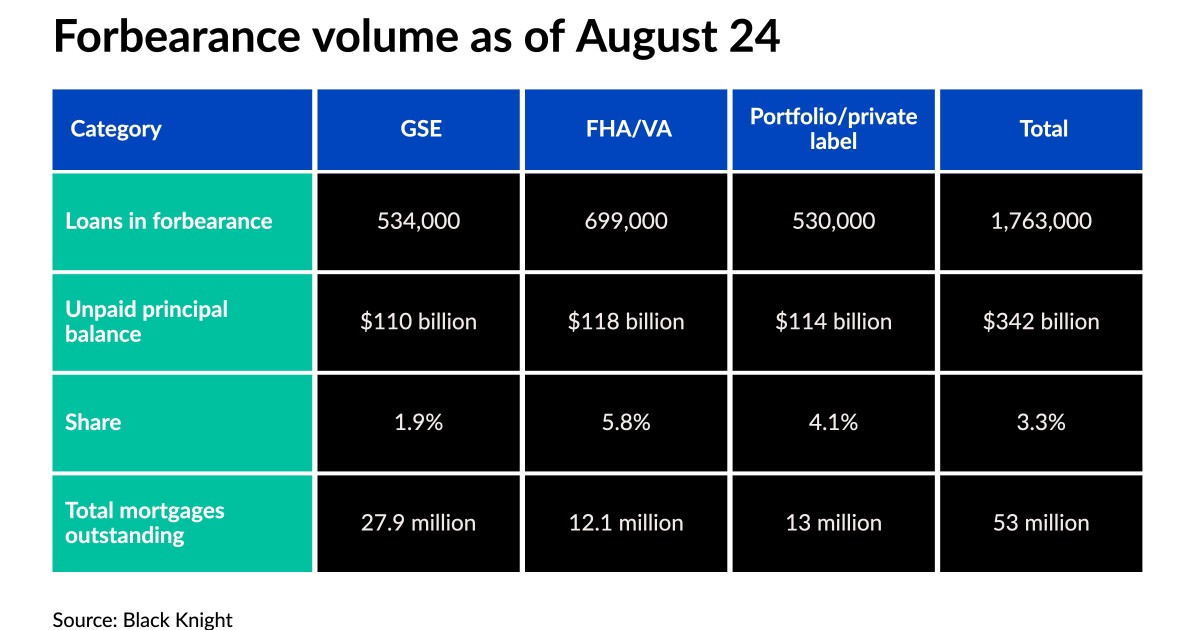

For the weekly period ending August 24, the number of active forbearances climbed by 12,000, a week after growing by 11,000. Portfolio and private-label securitized mortgages accounted for the lion’s share of the increase, adding 10,000 distressed borrowers. Mortgages backed by the Federal Housing Administration or Veterans Administration also contributed to the rise, with their numbers increasing by 3,000, while forborne loans held by Fannie Mae and Freddie Mac offset the jumps in other categories, falling by 1,000.

Mid-month increases have become common during the pandemic, as plan removals typically occur in the first half of each month and lead to higher re-start volumes in the following weeks, according to the data and analytics provider.

But even with the weekly increase, COVID-related forbearance totals were lower by 132,000 from the same week in July, a 7% month-over-month decrease. With more than 150,000 plans slated for review in the last week of August, further improvement may still be on its way this month. The number is expected to rise further next month.

“That number ramps up to nearly 670,000 for September, though, with 415,000 of those plans set to reach their final expiration next month based on current allowable forbearance term lengths,” Andy Walden, Black Knight’s vice president of market research, wrote in a statement on the report.

CARES Acts protections consisted of an initial six months of forbearance, followed by up to two extension periods. Those who entered forbearance immediately after it was offered in March 2020 are approaching the end of the second extension.

“How those exits manifest themselves will tell us a great deal about what we might expect for the remainder of 2021,” Walden noted.

With federal moratoria on foreclosures ending in late July, the extent of the challenges distressed homeowners might face will largely depend on state orders. Meanwhile, the Consumer Financial Protection Bureau is doing what it can to stave off a wave of foreclosures.

To date, 1.76 million homeowners remain in CARES Act-related forbearance plans. Of that number, 1.9% are held in government-sponsored enterprises, 5.8% are backed by either the FHA or VA and 4.1% are portfolio held or privately securitized mortgages. Forborne loans amount to 3.3% of total outstanding mortgages, the same percentage as the previous week.

The unpaid balance of loans in forbearance totaled $342 billion, up from $340 billion the prior week. GSE loans accounted for $110 billion of the amount, the same as in the previous reporting period. Forborne FHA/VA loans equaled $118 billion, increasing from $117 billion a week earlier, while portfolio/PLS mortgages rose to $114 billion from $112 billion the prior week.

Forbearance data comes from Black Knight's McDash Flash daily tracker, which tracks numbers from servicers representing nearly 70% of the U.S. mortgage market.