A pickup in originations, home price shifts, delinquencies and an intensifying focus on recapture are among the dynamics reshaping the mortgage servicing rights market, speakers at an industry event said Thursday.

Current production forecasts project growth that extends through next year with

Originations are on track to rise to $2.2 trillion next year from $2 trillion this year, but they could level out after that and remain purchase focused, Fratantoni said.

"What's changed over the past couple of months is we've become a little less optimistic," he said. "We brought our '27 and '28 forecasts more in line with '26 so not looking for much growth beyond that $2.2 trillion."

Need-based sales of MSRs have slowed as a result as origination has slowly picked up in the last couple of years compared to 2022 and 2023, said Nick Letica, chief investment officer at Two.

"There was definitely a fair amount of selling that was related to originators and servicers that needed to just raise funds to support their business operations," he said. "These couple of years have been a lot thinner."

Letica estimated deal flow has been around 35% of what was seen in peak years, fueled by sales that are more strategic than needs-based, with bulk packages trading less often but larger in size in some cases.

Retention is up, market seeks a standard for recapture

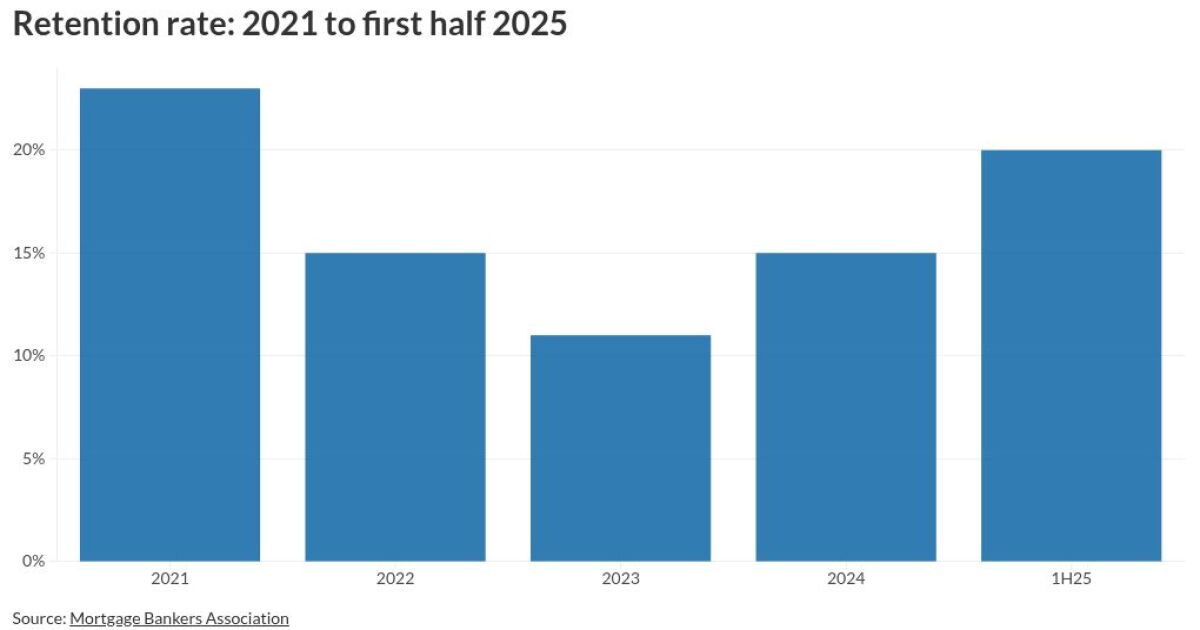

Customer value is increasingly driving trades and the average retention rate was the highest it's been since 2021 in the first half of this year, according to Fratantoni. The average retention rate was 20% between January and June, as compared with 15% last year.

Also, growth in

Pennymac asked the Financial Accounting Standards Board to make a determination related to this, Jake Katz, head of analytics research at LSEG Data and Analytics, noted. NMN confirmed that Pennymac did provide a letter to FASB requesting this over the summer.

"Consistency would make it easier," Katz said, noting that auditors have not been aligned on this point.

What current delinquency rates look like

From a loan performance perspective, Fratantoni said that he anticipates delinquencies could increase around a half of a percentage point over the next six months or so, and the current home price environment means some could proceed further down the path.

Delinquencies remain low in the government-sponsored enterprise market but those for Federal Housing Administration-insured loans have risen significantly, he said.

"I'm still amazed at how tight the underwriting standards are for GSE loans. It really is sort of a tale of two cities," said Letica.

Preliminary data suggests that the FHA delinquency rate in the third quarter approached 11% compared to the 10.5% recorded for

The upward creep in delinquency rates could boost loan costs with nonperforming loans costing $1,700 per unit to service on average compared to $180 for a mortgage that's paying on schedule, the MBA economist said.