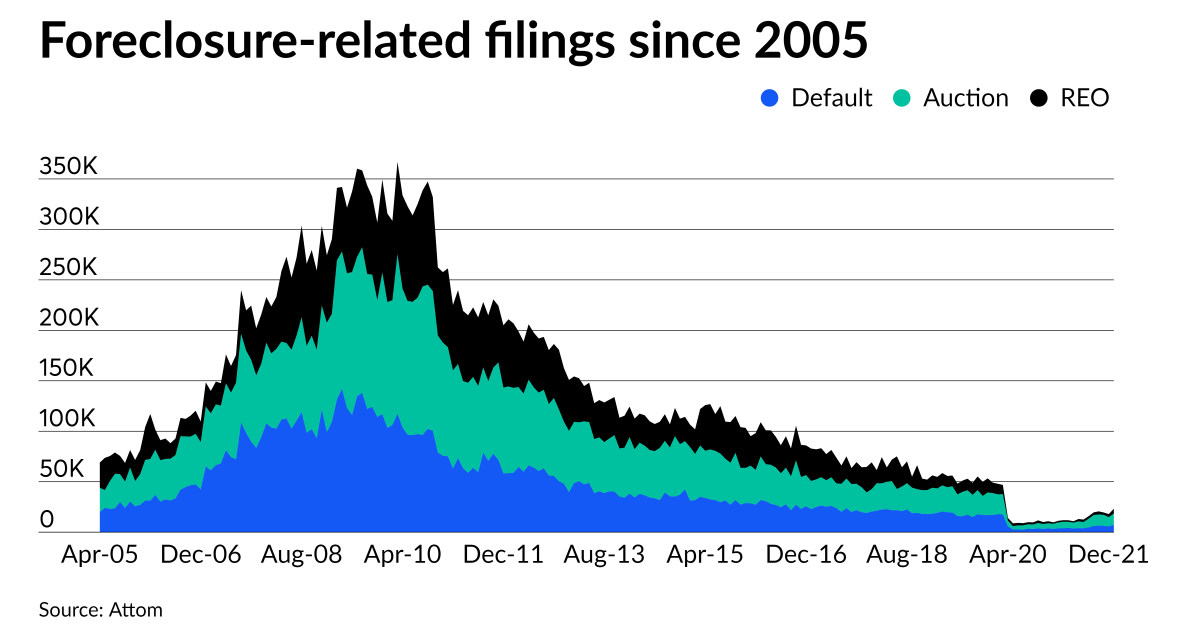

Foreclosures by one measure rose to a pandemic high during January, but they and delinquencies overall remained far below long-term averages last quarter.

Filings related to foreclosure activity jumped to 23,204 last month, up 29% from December and 139% from a year ago, according to Attom Data Solutions. However, filings were still just around half as high as when the U.S. entered the pandemic in March 2020.

The latest quarterly delinquency rate, at 4.65%, was down 23 basis points from the previous quarter and well below a long-term average of 5.32%, according to the Mortgage Bankers Association’s survey, which dates back to 1979. A year ago, the delinquency rate was 208 basis points higher at 6.73%. Just prior to the pandemic, the delinquency rate hit a historic low at 3.77%. (The MBA’s survey does not include foreclosures in its delinquency rate but does include forbearance or any instance in which the payment based on the original terms of the loan is not made.)

Collectively, these numbers suggest that while the rollback of pandemic-related consumer protections did boost some foreclosure-related activity, so far overall loan performance has remained historically strong.

“I don't think we’ll get back to normal levels of foreclosure activity until the very end of this year or even early 2023,” said Rick Sharga, executive vice president of RealtyTrac, an Attom company. A lot of the current filing activity reflects long-term foreclosures processing, he noted.

Foreclosures may be picking up but it’s a relative gain from scarcely any activity at all. The MBA’s number for the foreclosure start rate, for example, did rise in the fourth quarter, but only to 0.04% from 0.03%.

“It's artificially low right now. It's basically almost close to zero,” noted Marina Walsh, MBA’s vice president of industry analysis.

These and other statistics around loan performance also indicate that if the highly contagious but less severe omicron variant did temporarily boost infection rates, it has had very little lasting impact on mortgages.

The latest report from Black Knight shows a slight uptick in forbearance that was partially reversed last week, was completely erased by the latest seven-day period. New forbearance starts had boosted the number of plans to 835,000 from 780,000 during a two-week period in mid-January, but at last count the total number was 761,000.

The latest workout data suggests servicers have been successful in moving some borrowers who are still distressed after forbearance into the expanded modification options available rather than foreclosure or other alternative distressed home sales. Completed modifications in the government-sponsored enterprise market rose to 5,266 in November from 5,166 in October, according to the latest data reported by the Federal Housing Finance Agency. During the same time period, home forfeiture actions dropped to 93 from 124.

Workouts may be more difficult for Federal Housing Administration loans, which have higher delinquency and forbearance rates, but even in this market loan performance has been promising. Serious delinquency rates for these loans fell markedly in the fourth quarter by 171 basis points compared to the third, compared to double-digit drops in those for conventional mortgages and those guaranteed by the Department of Veterans Affairs, according to the MBA.

“If you think about the forbearance rate for Fannie and Freddie, it spiked…and then it just continued to decline and decline and decline, whereas the Ginnie Mae forbearance rate, which includes FHA loans, was still elevated. I think [the FHA serious delinquency rate fell more], because it's starting from a higher place,” Walsh said. “If you look at [FHA] foreclosure starts, they picked up a little and went from 0.04% to 0.11%. So ultimately they just increased a little bit.”

One downside to the continuation of relatively strong loan performance is a continued low level of foreclosure inventory available to a housing market with affordability constraints that are likely to grow given the rate-indicative 10-year Treasury’s rise above 2% for the first time since 2019. The foreclosure inventory rate was at historic lows in the fourth quarter at 0.42% compared to 0.46% in the third and 0.52% a year ago, according to the MBA.

While the gain in this number is likely to be gradual, it will incrementally add to housing supply in a way that could have an upside, Sharga noted.

“As these properties enter foreclosure, it will actually contribute to the inventory available for sale, which will be a good thing on balance for the housing market,” he said.