For the first time in 15 months, purchases made up the majority of monthly home loan production, a new report released early Wednesday shows.

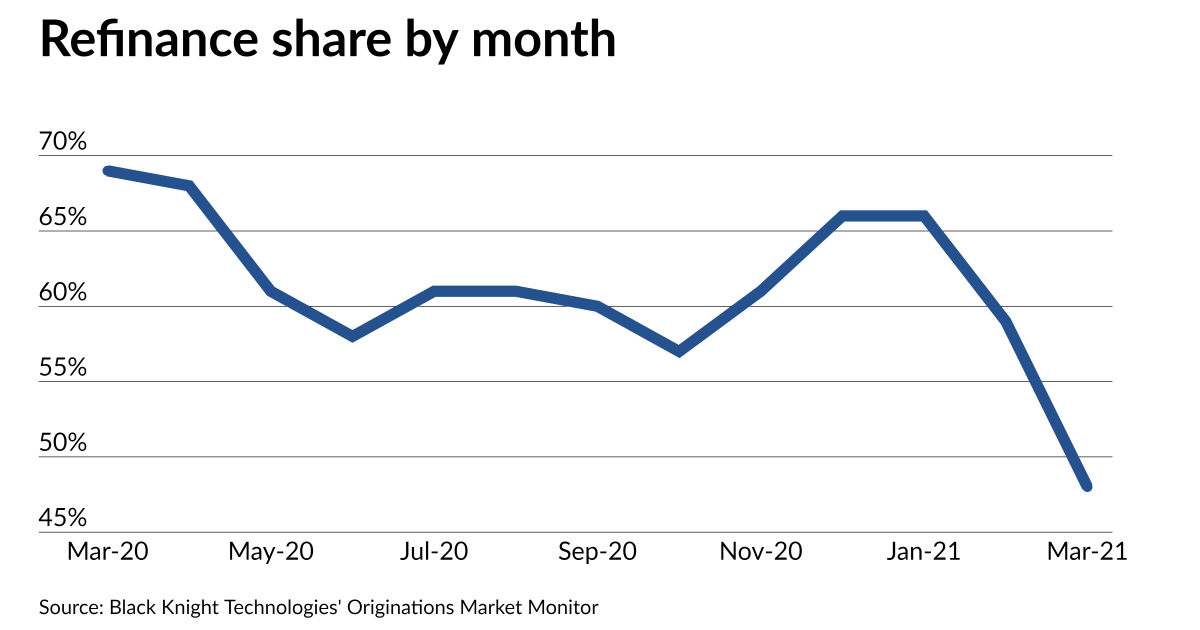

The refinance share of originations in March dropped sharply to 48% from 59% in February and from 69% in March of 2020, according to Black Knight. That made homebuyer loans the most dominant form of lending in the market in March, at 52%.

“This marks the first time — but almost certainly not the last — that purchase loans have made up a majority share of monthly mortgage lending since December 2019,” said Scott Happ, secondary marketing technologies president at Black Knight, in a press release.

The refi share of applications tracked by the Mortgage Bankers Association also dropped last week to the lowest level in over a year, but it was higher than the monthly origination share tracked by Black Knight at 59.2%, down from 60.3% the previous week, and 76.2% a year ago.

The declines in refinance share are likely signals that the refi boom that followed a pandemic-related rate drop last year may be coming to an end.

“Refinance activity has now decreased for nine of the past 10 weeks, as rates have gone from 2.92% to 3.27% over the same period,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting, in the trade group’s press release.

The housing finance industry tends to look to purchase and adjustable-rate mortgages to make up volume lost when refinancing wanes, but both of those types of applications were down slightly week-to-week. Purchase apps were down 1% on the MBA’s index and ARMs share fell to 3.6% from 3.7%.

Mixed signals last week from Treasury yields, which are indicative of the outlook for the most common fixed mortgage rates, contributing to these declines. On a net basis, rates for home loans fell slightly last week.

Persistently tight inventory conditions also contributed to the decline in purchase activity, but there could be some relief in this area as vaccinations become more widespread. That could cause some homeowners who have been waiting for the pandemic’s end to finally list their homes.