In 2021, bank CEO pay climbed by more than 20% as stock prices soared following early-pandemic shutdowns. Last year's full tally is not yet available, but early data suggests that pay raises in the industry's top ranks were more modest.

In fact, at three of the largest U.S. banks, the chief executives took pay cuts last year. Across the banking industry, the stock price gains of 2021 were largely wiped out last year, as the KBW Nasdaq Bank Index fell by about 25%.

Last year's pay reductions were 2% for Truist Financial CEO William Rogers Jr., 6% for Bank of America CEO Brian Moynihan and 15% for PNC Financial Services Group CEO William Demchak.

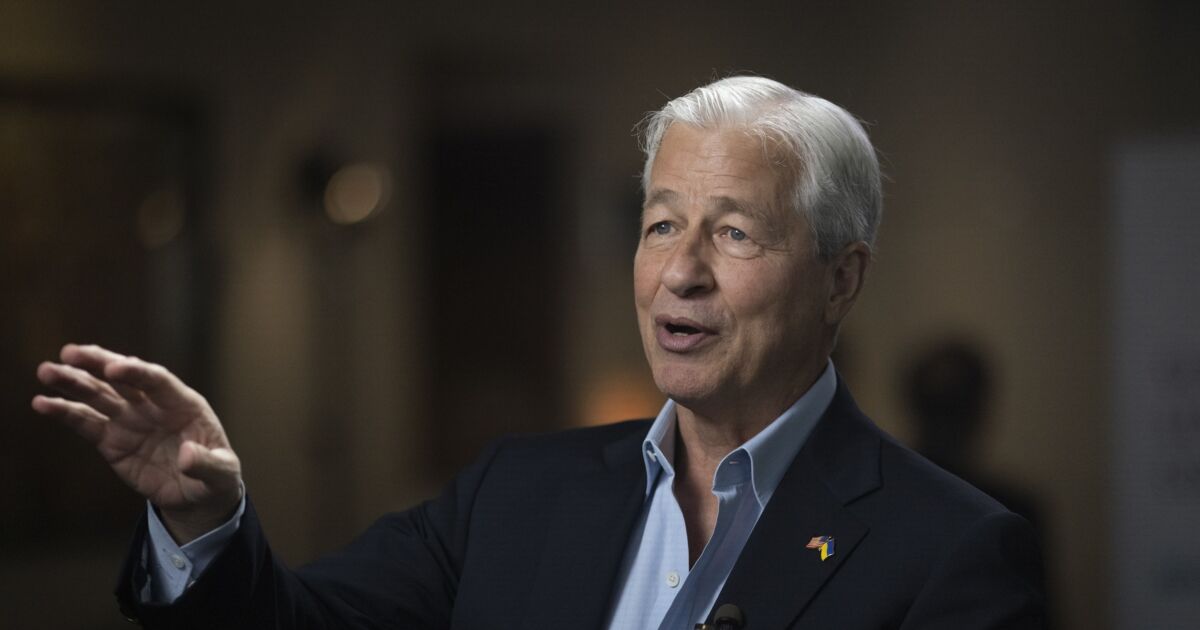

JPMorgan Chase CEO Jamie Dimon and Wells Fargo CEO Charles Scharf both received the same amount in total direct compensation last year that they did in 2021.

Citigroup Chief Executive Jane Fraser and U.S. Bancorp CEO Andrew Cecere both fared better. Fraser received a 9% boost in total direct compensation, and Cecere got a 5% increase.

What follows is a more detailed look at the 2022 pay packages for CEOs of seven of the nation's largest banks, based on the banks' most recent proxy statements and a data analysis by the consulting firm Compensation Advisory Partners.

The CEOs are listed in the descending order, based on how much they received last year in total direct compensation.