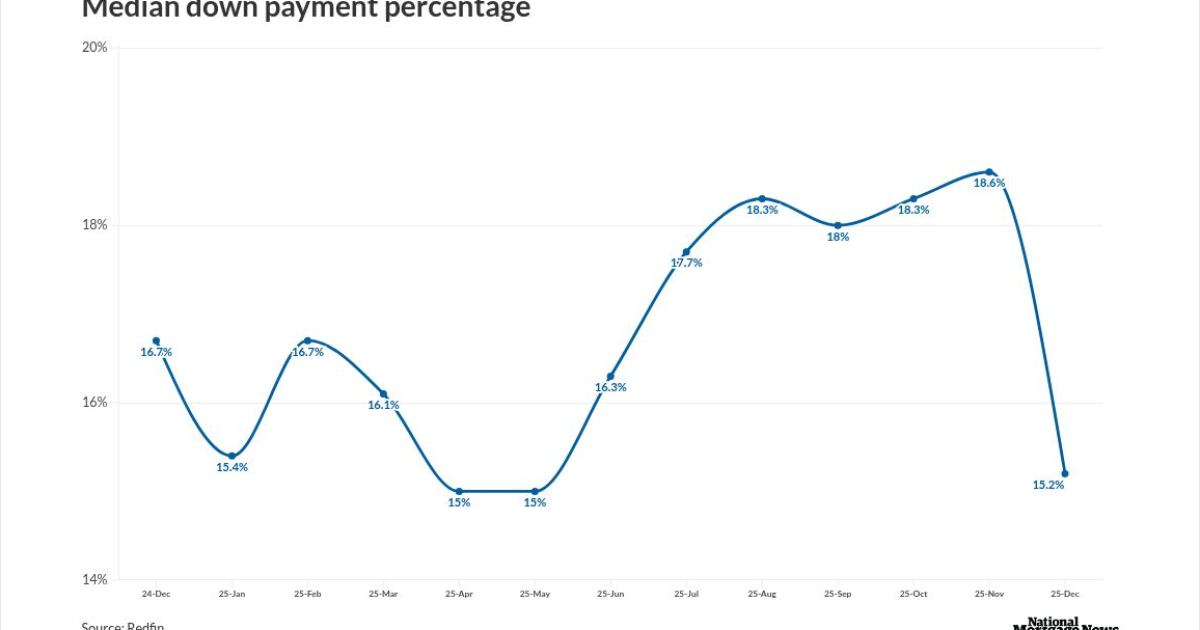

As home-price growth has flattened, the average down payment has decreased, according to a new industry report.

The typical homebuyer's down payment in the United States decreased 1.5% year over year to $64,000 in December, the first drop in five months, Redfin found. That's 15.2% of the average purchase price, compared with 16.7% a year prior.

"Down payments may be falling in part because Americans are seeking out more affordable homes due to high prices, elevated mortgage rates and economic uncertainty," Redfin Principal Economist Sheharyar Bokhari said in a press release Monday. "Sellers typically prefer buyers who make large down payments because it signals financial stability, but sellers don't have much say in today's market. Buyers hold the negotiating power because there are

While still high,

The 30-year fixed-rate mortgage has rested above 6% over the last month,

"Mortgage rates have dipped in recent weeks, which has boosted purchasing power for house hunters, but a lot of folks are still waiting to buy until rates drop further," said Chen Zhao, Redfin's head of economics research, in Tuesday's press release. "The good news is that in the meantime, price growth is limited and buyers have room to negotiate concessions from sellers."

Where down payments were the highest

California was home to the three metros with the highest median down payment, being San Francisco at $400,310, San Jose at $360,000 and Anaheim at $270,800. All three metros also posted the highest down payment percentage, each more than 21%.

The median down payment was lowest in Virginia Beach, Virginia, Cleveland and Cincinnati at $8,700, $25,025 and $25,143, respectively. Virginia Beach also had the lowest down payment percentage (3%) and highest share of homebuyers taking out Department of Veterans Affairs loans, which require little to no payment, the release said.

The largest decline in median down payment among metros Redfin analyzed was Orlando, Florida, at 23.9%, followed by Cincinnati (-22.6%) and Atlanta (-18.9%). The largest increases were in Cleveland (31.7%), Providence, Rhode Island (20.4%), and Baltimore (20%).