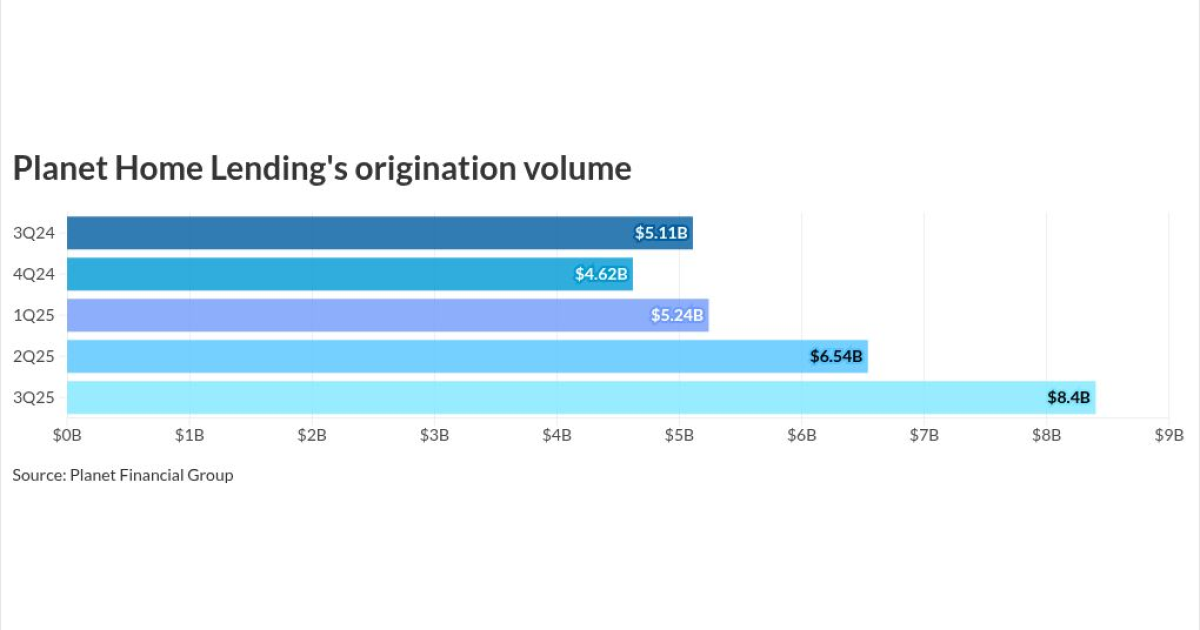

Planet Financial Group grew its production volume by 64% and its mortgage servicing portfolio by 28% year-over-year in the third quarter, as its portfolio retention unit reported record lock volumes in September, a strong month for refinances in the industry.

The privately held company did not disclose any profit or loss data. As a group, independent mortgage bankers

Including all business lines, 85% of the participating IMBs in the report were profitable on a pretax basis in the third quarter.

Planet's mortgage production statistics

Planet's annual increase in volume by far tops the 7% industry-wide gain to $488 billion from $456 billion, according to

The company originated $8.4 billion in the third quarter, up from $6.5 billion in the second quarter and $5.1 billion one year prior.

Its

"We ended the quarter with a surge in demand

The third quarter production also included $377 million from its distributed retail channel, the segment's best quarterly performance for the company since the pandemic, Planet said.

"A strong servicing book, combined with our distributed retail and retention efficiency, gives Planet a real advantage when rates move," said Bosley. "We're seeing that play out in record locks, high recapture and a robust Q4 pipeline."

The bulk of Planet's volume came through the correspondent aggregator channel, where it produced $7.5 billion; the company said it had a "notable increase in engagement" from depositories like credit unions and community banks, along with non-delegated mortgage sellers.

It has added or expanded several niche product offerings, including down payment assistance options; a first lien bridge loan to support a

"Our niche products are doing exactly what they're designed to do: unlock opportunities in today's environment," Bosley said. "Our branches are helping more buyers move forward while also driving growth for builders and real estate agents."

Planet's MSR portfolio growth in 3Q25

As of Sept. 30, Planet had a $140.9 billion MSR portfolio. This includes $125.1 billion of owned MSRS, along with $14.1 billion of subservicing.

It also reported a record $300 million in

"Our servicing team continues to scale efficiently while maintaining quality," said Sandra Jarish, president, servicing. "We're managing a larger, more complex portfolio, while

Planet also offers

During the quarter it acquired $2.1 billion of MSRs through bulk purchases as well as the co-issuer program.

Its correspondent unit launched a

"Planet's Origination and Servicing businesses are tightly connected, giving us the ability to move quickly when conditions change to capture volume, protect performance and deliver value to borrowers and clients throughout the loan lifecycle," said Michael Dubeck, CEO and president of Planet Financial Group.