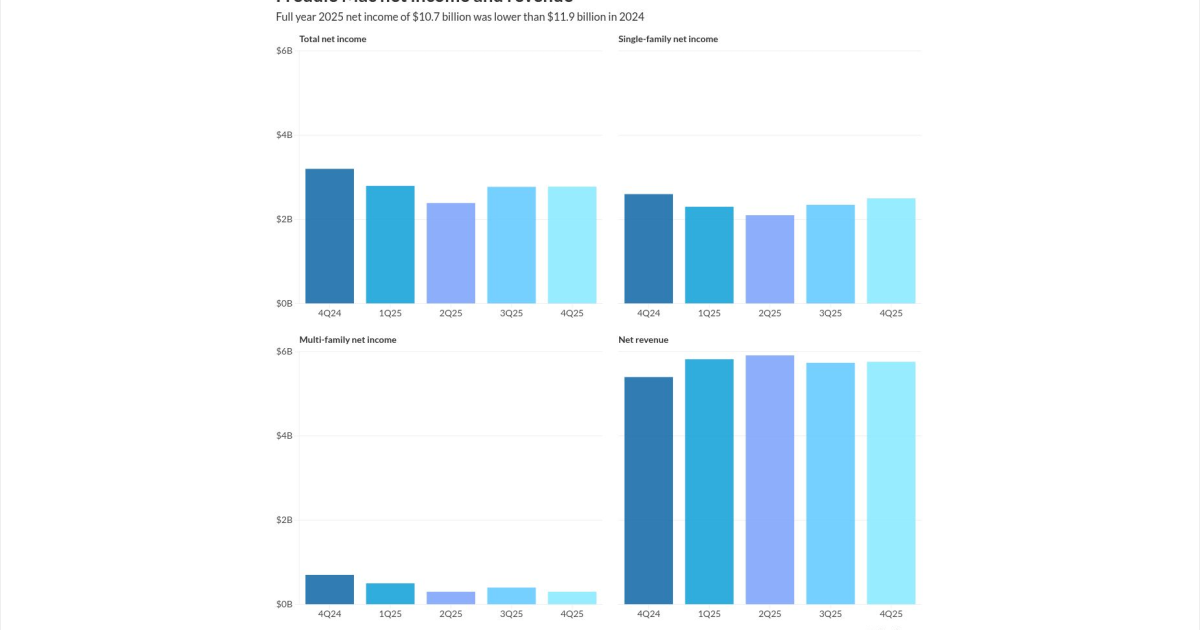

Freddie Mac posted lower fourth-quarter and full-year earnings as revenue slipped and credit costs climbed, even as lawmakers on Capitol Hill renewed debate over whether the company and Fannie Mae are anywhere close to having the capital needed to exit conservatorship.

Lower net revenues and a higher provision for credit losses drove a 10% drop in full-year net income for 2025.

Although Freddie and Fannie have been rebuilding capital since the net worth sweep ended, skepticism remains. During a House Financial Services subcommittee hearing Wednesday, Chair French Hill questioned whether the enterprises have accumulated enough capital to justify a release from government control.

Full year net income at Freddie Mac of $10.7 billion and comprehensive income of $10.8 was lower from

Fannie Mae

Freddie Mac's net revenues sunk to $23.3 billion from $23.9 billion year-over-year, but net interest income rose 8% over the same period.

"This was driven primarily by continued growth in our mortgage portfolio, which increased 2% year over year, as well as lower funding costs," Whitlinger said.

At the same time, noninterest income of $1.9 billion, down 55% year over year, "primarily driven by a shift to net investment losses for full year 2025 from net investment gains for full year 2024," he continued.

Its provision for credit losses was $1.3 billion, versus $476 million in 2024. "This was primarily driven by a credit reserve build attributable to new acquisitions across both businesses, changes in forecasted and observed house prices in single family and deteriorating credit performance on certain delinquent multi-family loans," Whitlinger said.

Freddie Mac segment results

Freddie Mac had the highest market share among the government-sponsored enterprises last year, with 54% of single family and 51% of the new multi-family business, he continued.

Freddie Mac single-family net income

- 4Q25 $2.5 billion

- 3Q25 $2.3 billion

- 4Q24 $2.6 billion

Freddie Mac multi-family net income

- 4Q25 $279 million

- 3Q25 $426 million

- 4Q24 $667 million

The future of the GSEs

Meanwhile, the future of the GSE was the topic of discussion at a House Financial Services Subcommittee on Housing and Insurance hearing titled, "Homeownership and the Role of the Secondary Mortgage Market."

Freddie Mac's net worth grew by $2.8 billion during the quarter and by $10.8 billion from Dec. 31, 2024 to approximately $70.4 billion.

During the hearing, French Hill, an Arkansas Republican who is the chair of the full committee, took the opportunity to play "Fannie and Freddie Jeopardy."

Hill noted that combined Fannie Mae and Freddie Mac are about $200 billion undercapitalized, "and yet, I read periodically on social media that someone thinks that

The Saudi Amarco IPO, which was cited during this exchange as the largest of all-time, raised over $29 billion. "It's a big number, but it is not $200 billion," Hill commented.

Plus, other items must be addressed before starting the process to end the conservatorships.

"So before anybody could consider maybe doing something and raising money from the public, aren't there some other decisions that we have to take into account?" Hill asked. "Like, wouldn't the Treasury Department have to make a concrete decision about how much money they're still owed from the financial crisis or not owed?"

A bill to end the conservatorships on the horizon

Congress would need to be involved in the process, he continued, to establish the GSEs missions, oversight, corporate governance, compensation and the rules of the road.

Later in the hearing, Rep. Scott Fitzgerald, R-Wisconsin, said plans are to introduce legislation which would end the conservatorships by codifying many of the reforms in their operations over the past few years, and especially by encouraging more use of credit risk transfers.

"I think there are a lot of reforms that have been done administratively that could use codification, legislation and encouragement of them to continue to leverage that as a form of loss protection," Michael Bright, CEO of the Structured Finance Association, and one of four panelists testifying before the subcommittee, said in response.

The legislation would also modify how the conforming loan limits are calculated. By law these are currently set by the Federal Housing Finance Agency using a price index. The proposal seeks to tie them to changes in median income instead.

Then addressing Mortgage Bankers Association President and CEO Bob Broeksmit, Fitzgerald said the bill will mandate

"We think that a model for a post-conservatorship Fannie Mae and Freddie Mac, where their returns are targeted to a range of return on equity, would make sense," Broeksmit responded. "We want it to be set enough so that there'll be interest in people buying their stock and having them be well-run companies, but with a cap, so that they don't stray away from their chartered mission and get into the primary mortgage market for instance."

Also on Wednesday, Pershing Square held its annual investor meeting, and according to social media posts, Bill Ackman reiterated his support for his three-step plan, including

"That should only be done over time after a new capital rule has been finalized," Ackman said in a response to an X comment.