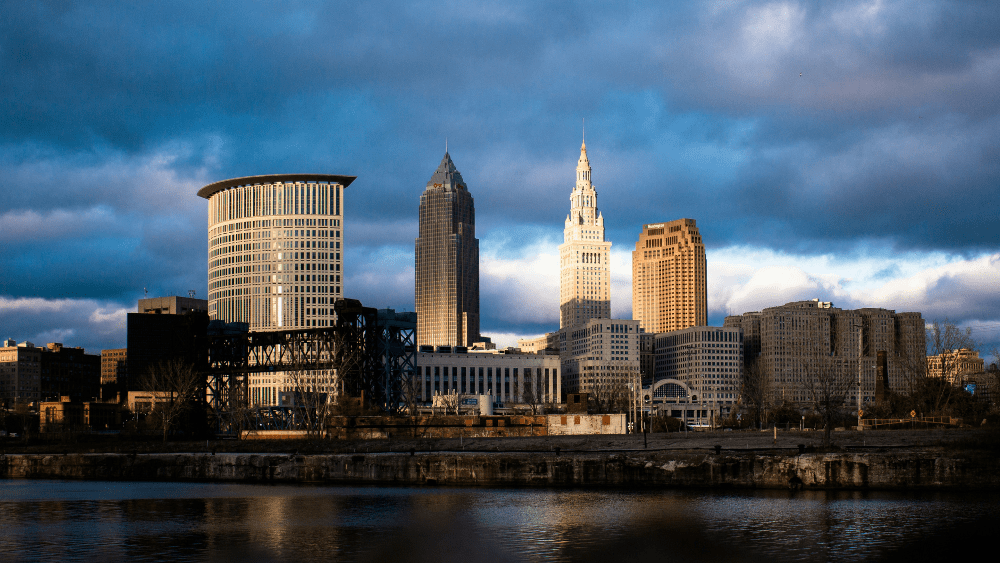

Are you seeking funding for your next real estate investment project in Ohio? You might want to consider a hard money loan. Whether you’re looking to flip a fixer-upper in Cincinnati’s Over-the-Rhine or invest in a rental property in the heart of Cleveland, hard money lenders in Ohio offer the speed and flexibility that traditional loans might not provide. Hard money loans serve as an alternative financing option and are particularly valuable for those with tight project timelines, limited initial capital, or credit challenges. If you’re not an investor but need to bridge the gap between buying and selling your home, we’ll explore some viable alternatives to help you leverage your home’s equity. This guide will walk you through the essentials of hard money lending in Ohio, helping you determine if this financial tool fits your real estate investment or home-buying needs. A hard money lender is a private individual or company that provides short-term loans secured by real estate. Unlike traditional lenders, who focus heavily on the borrower’s creditworthiness, hard money lenders emphasize the value of the property used as collateral. They often work with real estate investors, including house flippers and those purchasing rental properties, who need quick access to funds and flexible terms. Hard money lenders use after-repair value (ARV) — the estimated value of a property after renovations — to determine the loan amount. Typically, they lend a percentage of the ARV to ensure the investment’s security and profitability. Interest rates on hard money loans are higher, often ranging from 8% to 15%, with additional costs like origination fees and points. If a borrower fails to repay, the lender can seize the property to recover their investment. If you’re a real estate investor in Ohio searching for a flexible financing option, connecting with hard money lenders could be a smart move. Here’s a brief overview of how hard money loans work:What is a hard money lender?

How does a hard money loan work?