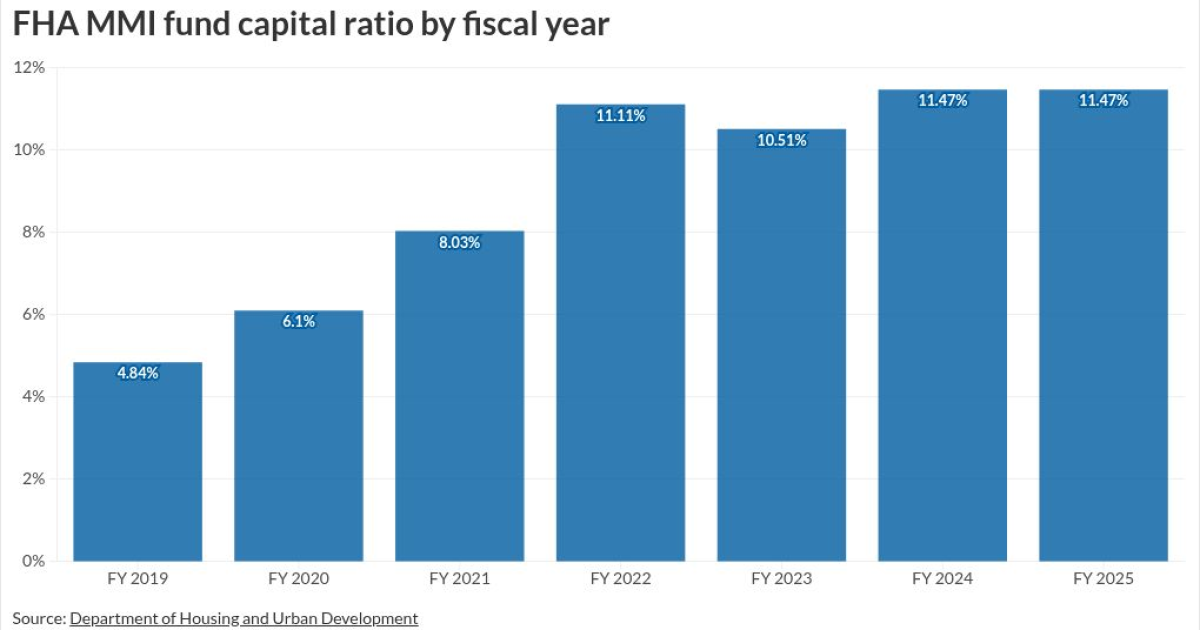

The Federal Housing Administration's mortgage insurance fund capital ratios were largely stable this past federal fiscal year, its annual report, delayed by the government shutdown, showed.

The overall ratio for the Mutual Mortgage Insurance Fund matched

The relatively high overall ratio renewed some calls for a premium cut.

"In light of today's report showing continued FHA financial strength, CHLA renews its call for an end to the FHA practice of charging

However, the Mortgage Bankers Association expressed a need to be cautious about relaxing the fund's discipline or the premiums that support it given a rise in delinquencies.

"We will review the report in greater detail to assess whether any policy changes are warranted to improve affordability and access to homeownership in 2026, including a potential reduction in FHA's annual mortgage insurance premiums," said Bob Broeksmit, president and CEO of the Mortgage Bankers Association. "Any such changes should be calibrated responsibly and informed by a careful evaluation of the program and the economic factors behind the rising serious delinquency rate."

Mortgage insurers reprise call for more parity

US Mortgage Insurers, a trade group representing private companies that offer a competing product for low down payment loans which can end up sold into the government-sponsored enterprise market, reprised an earlier call for the fund's capital standards to be more aligned with those of Fannie Mae and Freddie Mac.

Year-end 2024 estimates suggest that FHA's total capital resources for its traditional mortgage program would have a $31.7 billion shortfall if held to the same capital standards that private insurers working with the enterprises must meet, according to an actuarial firm USMI hired.

The actuarial firm examined the enterprises'

If the FHA were held to the same standards as the enterprises' capital framework holds them to, the administration would have to hold $50 billion more.

"USMI urges policymakers to continue the current disciplined approach to ensure the long-term health of the MMIF, while also considering modernized stress-based, loan-level risk-weighted standards for FHA similar to the frameworks applied to Fannie Mae and Freddie Mac," President Seth Appleton said.

Recently finalized goals for Fannie and Freddie call for less competition with the FHA for borrowers with

Fannie and Freddie's delinquency rates are lower than the FHA's, but the enterprises also are held in government conservatorship they were forced into during the Great Financial Crisis. The Trump administration is exploring ways to move toward restoring their status as quasi-public enterprises and has been generally working on building up their capital levels for this purpose.

The FHA recently rectified the long absence of an official commissioner by confirming Frank Cassidy, who had held the role on an acting basis, to officially fill the post. In a similar action, Ginnie Mae President Joe Gormley also was confirmed.

Getting both roles officially filled is important for the health of the housing finance system because Ginnie guarantees the securitizations of government mortgages the FHA insures. Both are part of the Department of Housing and Urban Development.