New securitizations of loans made outside the qualified mortgage definition set multiple records in the third quarter, according to a recent Morningstar DBRS report.

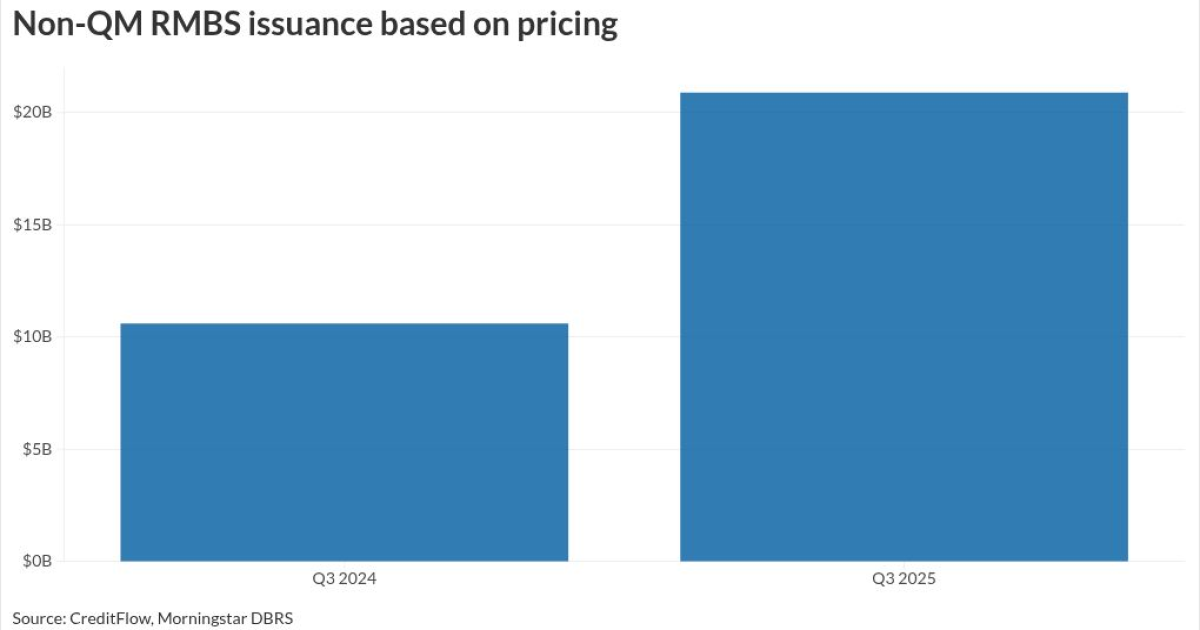

The study, which analyzes data from CreditFlow, shows issuance of non-QM residential mortgage-backed securities climbed to $20.9 billion in the third quarter from $10.6 billion during the same period a year ago based on pricing information. Non-QM RMBS issuance had clocked in at around $17 billion based on pricing data in the second quarter.

This year's volume through the end of September exceeded that of last year as a whole at $52 billion compared with $41 billion in 2024. September's $8.5 billion marked a record for a single month, according to the rating agency.

Broader trends in the mortgage industry

Growth looks likely to persist with larger lenders showing more interest in getting involved in the sector as long demand continues. Notable examples of this include

"Origination volumes in the broader conventional mortgage space were similar to volumes in the same period last year while non-QM and other nonconventional product volumes continued to accelerate," authors Mark Fontanilla, Mark Branton, Corina Gonzalez and Quincy Tang wrote.

The report also notes that non-QM has relatively higher delinquency rates than other RMBS types. So stakeholders may want to keep an eye on performance risk that's still historically low but is rising for some vintages.

What non-QM performance and underwriting have been like

The average 30-year delinquency rate for all 2019-2025 prime jumbo and non-QM vintages inclusive of bankruptcies, foreclosures and real-estate owned was 3.63%, Recursion and MBSData in the report show. For non-QM, the delinquency rate was 5.66% for the same period.

Delinquencies in older vintages up to 2022 have been decelerating while they are accelerating at a relatively faster rate in the 2023-2024 loans, likely driven by a slight rise in historically low unemployment rates and flatter home prices.

Weighted-average