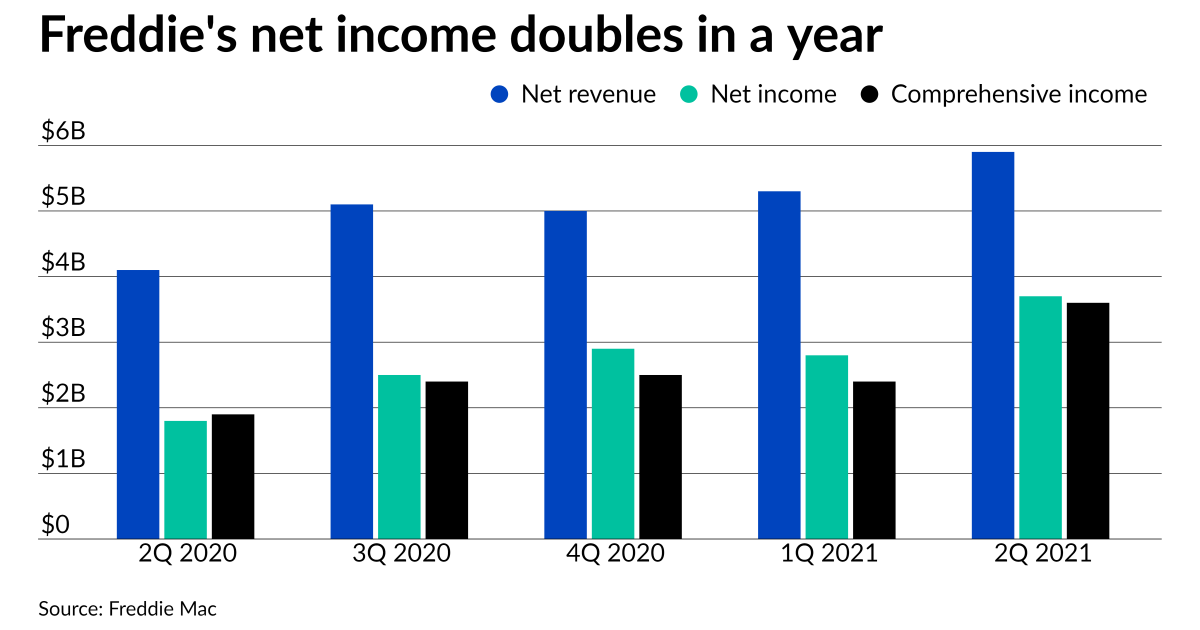

Freddie Mac enjoyed a successful second quarter as its profit more than doubled what it pulled in a year ago thanks in large part to a credit reserve release.

The government-sponsored enterprise’s net income of $3.7 billion jumped from $2.8 billion in the first quarter and $1.8 billion the year before. Comprehensive income also increased, to $3.6 billion in the second quarter, up quarterly from $2.4 billion and annually from $1.9 billion.

Overall revenue climbed to $5.9 billion from $5.3 billion in the opening quarter and $4.1 billion the year prior. The single-family segment of Freddie’s business primarily generated the profits, thanks to high net interest income and the reserve release, CFO Chris Lown said on the earnings call.

“Realized house price appreciation and improving economic conditions drove the reserve released in the quarter, resulting in a $200 million benefit on credit-related items compared to a credit-related expense of $700 million for the second quarter of 2020,” Lown said.

The single-family business produced a net income of nearly $2.9 billion, comprehensive income of almost $2.8 billion and net revenue of $4.7 billion. Those stood at $1.7 billion, $1.4 billion and $3.8 billion respectively in the first quarter and $772 million, $875 million and $2.7 billion in the second quarter of 2020. Freddie’s mortgage portfolio growth, higher average guarantee fee rates and higher deferred fee income recognition led to the single-family surges.

The multifamily sector saw declines across all three profit levels, dipping to $824 million in net income, $830 million in comprehensive income and under $1.2 billion in net revenue. Those compare to $1 billion, $968 million and $1.4 billion quarter-over-quarter and $1 billion, $1.1 billion and $1.5 billion year-over-year.

“Lower net investment gains drove the decrease, primarily due to less case certificate spread tightening and impact of lower volume,” Lown said. “Multifamily saw new business activity of $27 billion year-to-date, a $3 billion decrease versus the prior year period, driven by increased competition and reduced loan purchase cap.”

Meanwhile, Freddie’s capital position grew to $22.4 billion in the second quarter, up from $18.8 billion at the end of 1Q and nearly twice the $11.4 billion from a year ago.

New CEO Michael DeVito — whose lending experience spanned 24 years at Wells Fargo before joining Freddie Mac — laid out the GSE’s commitment to being a world-class risk manager, building capital and investing within to meet its long-term aspiration of exiting conservatorship. It also renewed its focus on reaching underserved markets through affordable housing funds.

“I'm confident Freddie Mac can be a source of positive influence in addressing long-standing issues of fundamental fairness for people in communities of color, at every income level,” DeVito said. “This mission and these opportunities are among the main reasons I joined the firm.”