As the residential mortgage industry looks forward to the New Year, I have some wish list items which could make a big difference to mortgage lenders and consumers alike. Sadly, the Trump Administration is not yet focused on these concerns as it pursues ways to address home affordability before the mid-term election.

First and foremost, the Trump Administration should commit not to increase the conforming loan limit in 2026. The Federal Housing Finance Agency just

Another big wish for independent mortgage banks and depositories alike is an end to the progressive conversation about credit scores.

Speaking of the conventional loan market, IMBs would really like to hear in the New Year that Fannie Mae and Freddie Mac are not going to impose a capital increase on issuers by disallowing capital contributions from institutional investors for calculating net worth requirements.

As we noted in November ("

An excess servicing strip transaction is the sale of a portion of mortgage servicing fees which are above the base amount considered necessary for the servicer's work and, more important, to support loss mitigation. Some of the largest issuers in the industry use ESS transactions to finance mortgage servicing rights.

Recent ESS transactions where the investor: 1) finances the entire MSR and 2) takes responsibility for cash advancing and hedging, may provide the best source of equity capital for IMBs. "ESS 2.0" essentially removes the capital cost of the servicing rights from the independent mortgage banker's balance sheet, making the risk-adjusted returns attractive for issuers and also for the GSEs in terms of counterparty risk.

The Trump White House should not allow the GSEs to impose new capital requirements on IMBs. Supporting ESS 2.0 may provide a solution to the systemic risk caused by the lack of sovereign liquidity support for government-insured loans and Ginnie Mae mortgage-backed securities.

Allowing ESS 2.0 investments by institutional investors in servicing rights can help to reduce or eliminate systemic risk concerns about IMBs. But another important piece which the Trump Administration ought to champion is getting the Federal Home Loan Banks to re-engage with the mortgage industry by supporting Ginnie Mae issuers.

The FHLBs have recently embarked upon a public relations campaign to remind us

Before Christmas, we asked several dozen colleagues in the FHLB system a question: Would the banks be able and/or willing to engage in fully secured loan repo transactions with IMBs? IMBs cannot become members of the Home Loan Bank system, but they could engage in repurchase trades with FHLBs. We received no reply to our question so far, but we'll let you know in the event.

The idea is simple: Get the FHLBs back into the game by providing repo financing for IMBs, what we call gestation finance on Wall Street. No FHLB membership is required. These short-term money market trades involve only fully secured repos using the street legal docs and operations template. Plus, the agency/government collateral has a government guarantee, so zero risk weight.

The Federal Reserve Bank of New York noted

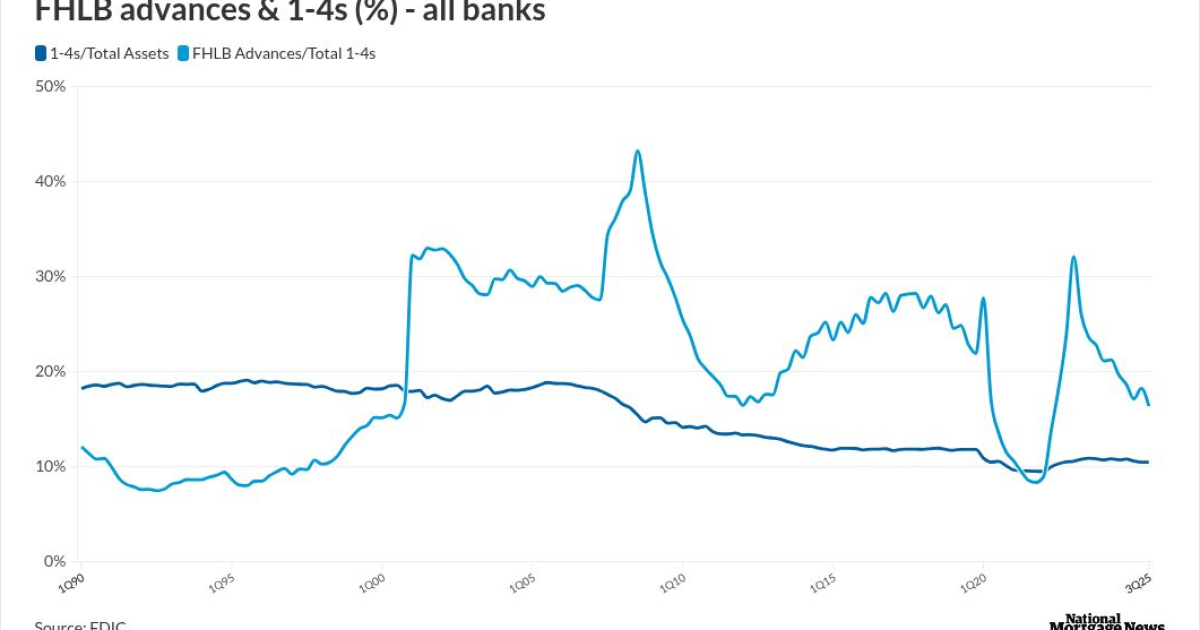

A more striking statistic is that bank use of the FHLB system is also falling, both in absolute terms and as a percentage of total bank holdings of 1-to-4s. Bank holdings of these have fallen from a quarter of total assets in 1990 to just 11% today, according to the FDIC. But bank utilization of the FHLBs to support 1-4s has fallen to the lowest levels in 50 years.

In TBA trades for new production MBS, the loans financed via repo or warehouse lines must be 1) dry and 2) eligible for pooling to be accepted. The cash provider and borrower face each other in a 30-day repo trade. The dealer qualifies the loans with the loan administrator and sells the pool forward to lock the rate. These self-liquidating trades are fully secured and zero risk weight under Basel III.

The FHLBs, however, have far wider criteria than do banks and FINRA repo dealers, and are not bound by the rule regarding eligibility for pooling. The Banks could finance not only new production loans but also defaulted government and even jumbo mortgage loans too. Plus, they can manage their repo market participation with IMBs via haircuts and rates.

In good times, the FHLBs can lean away and let the warehouse banks and repo dealers handle secured mortgage finance. In bad times, the FHLBs can do precisely what they have done over the past 100 years for mortgage lenders, namely lean into the secondary market. In 2008 and again in 2020, the FHLBs were the backstop for bank mortgage lenders, but they could and should do much more to support Ginnie Mae issuers and all market participants, whether they are banks or IMBs.

The FHLBs have growing excess cash and the capacity to support the entire mortgage market via fully secured repurchase transactions. In times of elevated delinquency, the FHLBs should finance defaulted FHA/VA/USDA loans, which have a zero risk weight due to the loan level insurance. Just by having the FHLBs focus on financing defaulted government loans, the Trump Administration could address the single largest systemic risk issue facing mortgages since 2008.

After all, Ginnie Mae is the largest single risk to the other two GSEs and currently lacks a liquidity backstop for government loans. The FHLBs have excess cash and the infrastructure to finance all residential mortgages in times of stress. If the FHLBs stepped up their game to support the entire mortgage market, they would no longer need to commission paid research papers to describe their good works. Happy New Year.