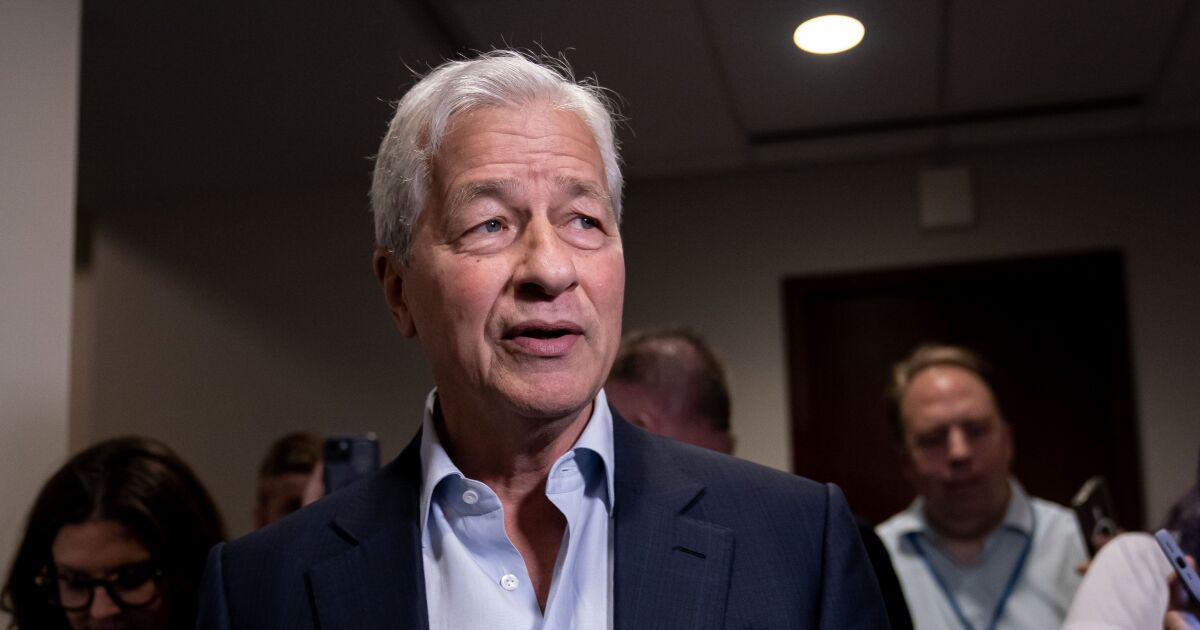

NEW YORK — Jamie Dimon pushed back forcefully against what he described as an "onslaught" of regulation during a fireside chat Monday at the American Bankers Association's Annual Convention.

Dimon spent more than two-thirds of his 30-minute appearance discussing how the banking industry is regulated — not only during the Biden administration, but also dating back to the Obama era. The specific topics included the Basel III endgame capital rules, interchange fee rules established by the so-called Durbin Amendment, the Consumer Financial Protection Bureau's new open banking rule, FDIC insurance reforms and banks' role in advocacy.

"Dodd-Frank did a lot of things that were needed," Dimon said, but argued that the 2010 law also did a lot of things that were not needed. "I put a spaghetti chart up once, and looked at all the new agencies and all their overlocking rules. And we can't get mortgages fixed. We can't get Durbin fixed. We can't get millions of things fixed, [and things] need to be fixed. It is an onslaught, and it is unfortunate."

"Banks are under such pressure, and a lot of banks — the truth is — are unwilling to fight with regulators because they'll come after you," Dimon said. "It's gross. Time to fight back."

"We don't want to get involved in litigation just to make a point, but I think if you're in a knife fight, you better damn well bring a knife, and that's where we are."

On the Basel III proposal, which is being revised in the wake of fierce industry pushback, Dimon said: "The devil's in the details, and there's a lot of details." He also said that a lot of the effort to toughen capital standards "isn't justifiable."

As banks await finalized Basel III endgame regulations, one key question that has emerged is whether regulators will revise their initial proposal or issue a re-proposal.

CFPB Director Rohit Chopra, who sits on the Federal Deposit Insurance Corp.'s board, said last week that he favors revisions rather than a re-proposal in order to push forward "

Dimon said Monday that he, too, prefers a new notice of proposed rulemaking. "I've been told that the FDIC is not going to vote for it. The OCC and the Fed can [issue the notice of proposed rulemaking without the FDIC also signing on]. I would prefer that so at least we get to see and start to comment on it."

Dimon said the failure of Silicon Valley Bank last year demonstrated the shortcomings of several key provisions of the Dodd-Frank Act, including resolution planning and stress testing. Neither of those measures prevented SVB's demise or the ensuing crisis, he said.

In response to the spring 2023 banking crisis, the best thing regulators can do is focus on reforming liquidity requirements, Dimon said. He also argued that altering the deposit insurance regime could be beneficial, but warned that the process of doing so could be politically messy.

"If we open up FDIC insurance, which is possible, the problem with that is … the legislators put more and more stuff in there. It just becomes a Christmas tree of crap," Dimon said. "So, I'm not against it. I'm just worried about that particular thing."

"The whole thing was flawed to start," Dimon said. "And while it was put into Dodd Frank, we don't think the Fed did the numbers right. Now we're going to

Dimon also argued that the debate between banks and retailers over interchange fees is tainted by what he called "the big lie." He was referring to the costs that retailers absorb when they process cash.

Dimon said that processing cash costs small retailers 5%-7%, and can cost big-box stores 1% or 2%, due to costs such as insurance, defalcation, logistics and fraud, and counterfeiting prevention that retailers must incur to actually move cash to a bank.

"If [merchants] don't like debit or credit, let them take cash," Dimon said. "But to tell us it doesn't cost any money, and they want it for free. … When have you ever had the government [dictating] pricing between two big industries?"

Dimon was also critical of the CFPB's

"Rohit [Chopra] is a very smart guy who has one major flaw — which I told him personally — is that you use your brains to justify what you already think," he said.

"No one is against open banking," Dimon said. But he argued that the CFPB rule creates risk for both bank customers and the payment systems.

"Instead, there should be a clear liability shift included with the sharing of data," Dimon said. "If someone takes all that data and then somehow the money is stolen because of what [the third party] did, they're responsible, not [the bank]. We're going to fight, and we're going to win this one too."

Dimon's appearance came two weeks after

Other uncertainties remain for the banking industry, which is staring down a

Dimon said that while the American economy has "been kind of booming" with strong home and stock prices, a solid job market and increased wage growth, he remains concerned about the potential for stubborn inflation.

"My concern is inflation, in my view, may not go away so quickly," Dimon said. Huge fiscal spending, the remilitarization of the world, the green economy and the restructuring trade are all inflationary expenses that could cause elevated prices for goods and services to linger.

"It's only a really big deal if we have stagflation, i.e.: a recession with inflation," he said. "And I would not rule it out. I'm not talking about next year. I'm not making a forecast, but in terms of managing our exposures for all of us, I'd be thinking about that a little bit too."

Dimon made little mention Monday of next week's presidential election, though he was asked about it. Dimon, who has not endorsed a candidate, has publicly commended some of former President Donald Trump's policies, though he has

Kyle Campbell contributed to this report.