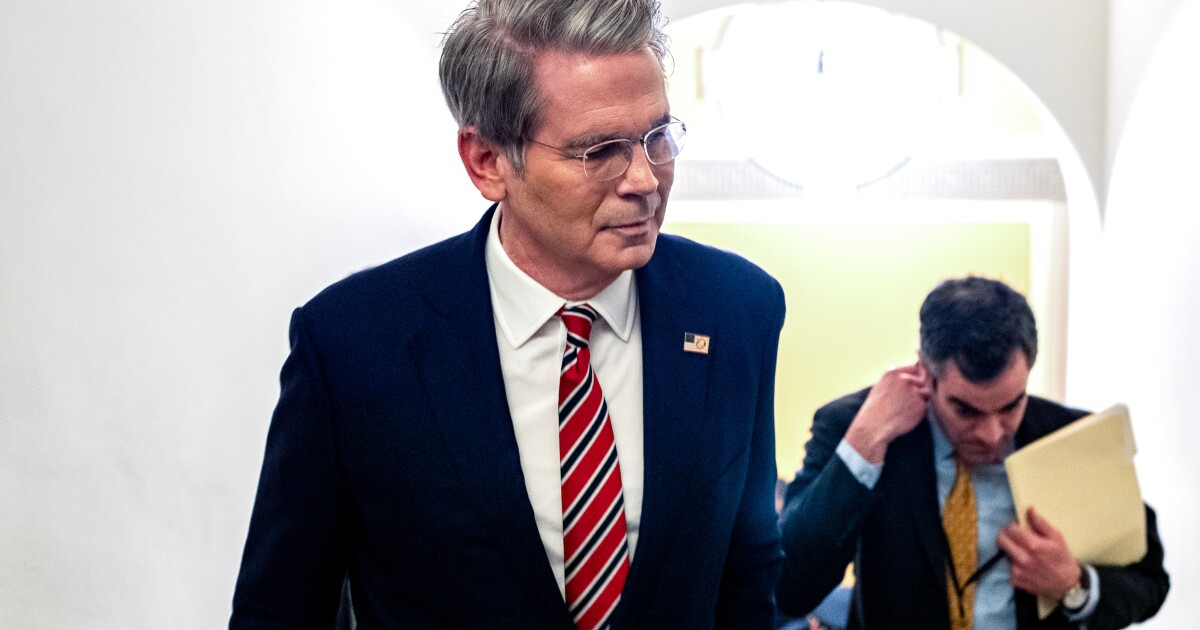

WASHINGTON — House Democrats led by House Financial Services Committee ranking member Maxine Waters, demanded clarity from the Treasury Secretary Scott Bessent regarding the future of the Community Development Financial Institutions Fund.

The lawmakers in a letter sent Monday to Bessent, Waters and other HFSC Democratic lawmakers highlighted contradictions between the Trump administration's March 14 executive order from President Donald Trump that targeted the CDFI Fund as part of a broader initiative to reduce "elements of the Federal bureaucracy that the President has determined are unnecessary," and Bessent's

"We, along with industry and community stakeholders, reject the premise that anything about the CDFI Fund and the CDFIs it supports is 'unnecessary,'" the lawmakers said in the letter.

The letter highlights what Democrats describe as a fundamental contradiction: While Secretary Bessent recently stated that "this Administration recognizes the important role that the CDFI Fund and CDFIs play in expanding access to capital and providing technical assistance to communities across the United States," the executive order explicitly lists the Fund among entities to be eliminated "to the maximum extent."

"Your words are in direct conflict with the plain language of the President's Executive Order characterizing the CDFI Fund as 'unnecessary,'" the letter said.

The Democrats' letter cites specific operational concerns that suggest more than rhetorical inconsistency, saying that "staff at the CDFI Fund has been left with the impression that they would be engaging in 'minimal operations,' while the staff was apparently relocated in January to a building outside of the main Treasury building that has no Internet connection, and that service has yet to be connected."

The letter also references a statement from the White House provided to American Banker indicating that "no final decisions have been made" and suggesting Treasury could still "consolidate aspects of the program," despite Treasury informing the Office of Management and Budget that CDFI Fund programs are legally required.

Established with bipartisan support and maintained across administrations of both parties, the CDFI Fund

"During the pandemic and the Trump Administration's first term, Democrats and Republicans worked with your predecessor, former Secretary Mnuchin, to provide historic support to CDFIs because they serve as lifelines for underserved communities and play a pivotal role in helping small businesses keep the lights on and to pay the workers they employ," the lawmakers said.

The letter calls for immediate action, asking Bessent to "promptly update the Executive Order to exempt the CDFI Fund from its application, ensure that the staff has access to the Internet to do their jobs, and work with Congress to strengthen and expand the work of the CDFI Fund."

"It would be a shame if this becomes the first Administration to forsake the long bipartisan tradition of collaborating with Congress to support our CDFIs and the communities they serve," the lawmakers concluded.

The challenge to the administration's CDFI policy comes as Rep. Waters has simultaneously escalated criticism of the

"The Trump Administration's approval of the Capital One-Discover merger will create yet another ultra-wealthy megabank in America that our nation's consumers, small businesses, and working-class families cannot afford," Waters said in a separate statement. "This merger will create a $637 billion bank, making it the sixth-largest bank overall and the nation's largest issuer of credit cards."

Waters emphasized concerns about the regulatory history of both institutions.

"Last year, the Consumer Financial Protection Bureau sued Capital One for cheating millions of their customers out of $2 billion in interest payments," she said. "Unfortunately, the Trump Administration dropped this suit and let the bank off the hook. Similarly, regulators took an enforcement action against Discover after the bank 'recklessly engaged in unsafe or unsound banking practices' by overcharging small businesses excessive interchange fees for 16 straight years."

Waters said that regulators have disregarded public input on the merger.

"A staggering 91% of the 6,132 comments regulators received from the public raised concerns about the merger leading to less competition and causing financial instability," she said. "Despite the fact that commenters overwhelmingly urged regulators to oppose the merger, their voices in the process went unheeded and this merger was rubber stamped like so many bank mergers before it."

She said that Democratic lawmakers will "use every tool at our disposal" to oversee the large banks that this merger will create, as well as others.

"Megabanks, including the new one created with this merger approval, should know that I and my Democratic colleagues will use every tool at our disposal to oversee them, and will not tolerate any abuse of hard-working American consumers," she said.