Chancellor Rishi Sunak is weighing up extending the stamp duty holiday by six weeks to prevent up to 100,000 homebuyers from being caught in a “completion trap”, according to The Telegraph.

The 10-month tax relief is due to end on 31 March, but the Treasury is understood to recognise that a jump in transactions in the second half of last year and extended completion times due to pandemic restrictions has led to a backlog of half-completed purchases.

Stamp duty transactions in the last quarter of last year were 43 per cent higher than in the third quarter of 2020, according to HMRC data released this month.

Mortgage approvals jumped more than two-and-a-half times in the second half of last year, with a rise in demand that has continued into 2021 seeing house purchases taking over three months to conclude.

It currently takes 134 days to complete a property purchase in the UK, said online mortgage broker Trussle last month.

Repeated lockdowns have led to lengthy delays for conveyancing solicitors, mortgage lenders and search departments.

“It is certainly the case that a lot of people would be caught in the completion trap if the holiday were to end when it is due to,” an unnamed source told the newspaper.

But the chancellor is understood to be against a six-month delay that some groups the mortgage industry have called for, as this would have a “gratuitous” impact on tax receipts.

The stamp duty holiday has so far cost the Treasury £3.8bn, says the newspaper.

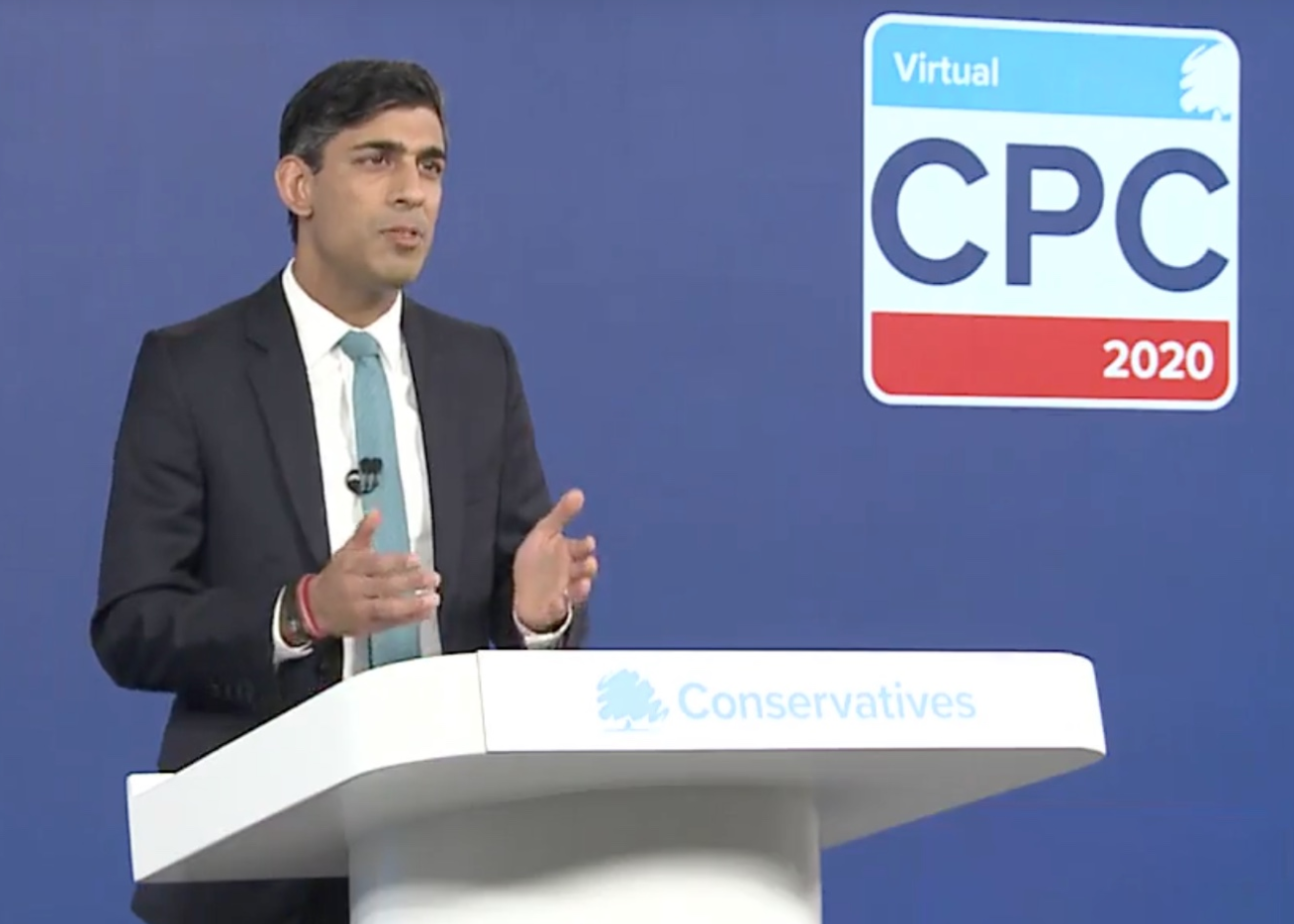

The chancellor will unveil his Budget on 3 March, and has pledged to “set out the next phase of the plan to tackle the virus and protect jobs”.

Earlier this month, Bank of England governor Andrew Bailey forecast that the UK economy is expected to shrink 4.2 per cent in the first three months of the year, amid tighter lockdown restrictions to slow the spread of the virus.

But the governor expects a rebound this spring as consumer confidence returns, as a result of the country’s rapid Covid-19 vaccination programme.

Trussle head of mortgages Miles Robinson says the chancellor mulling plans to extend the stamp duty holiday “offers a glimmer of hope to buyers racing to beat the current deadline”. But calls for a longer delay.

Robinson adds: “The surge in demand has triggered long delays in the processing of transactions. It currently takes 134 days to complete on a property in the UK and it’s been reported that one in five buyers are facing more than a six-month wait for completion. Therefore, a potential six-week extension could prove invaluable to the estimated 100,000 property purchases currently underway.”

Robinson says: However, there will be many who are yet to begin their home ownership journey but still hoping to benefit from the tax relief. For these people, the proposed extension won’t be long enough. Whilst their mortgages might be approved before the deadline, the current wait time for other necessary processes, such as surveys, valuations and local searches are likely to take longer.”

He adds: “As the wider economy continues to recover from the coronavirus pandemic, we’d urge the government to consider granting a longer extension or adopting a tapered approach to ending the stamp duty holiday.”

Almost 70 per cent of homebuyers want to see the stamp duty holiday extended while just under half worry they will miss the current deadline, according to a survey by high-net-worth mortgage broker Enness Global last month.