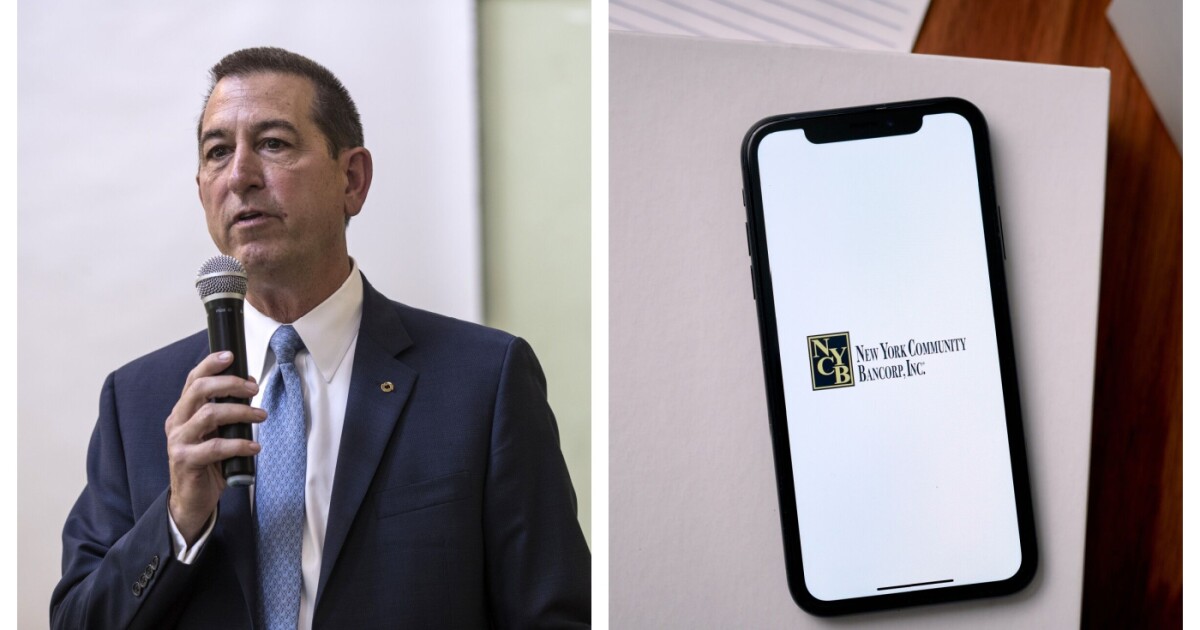

New York Community Bancorp's new executive management team had to answer this week to shareholders whose investments in the beleaguered company have lost substantial value.

Shareholders approved all but one of the company proposals presented Wednesday at the bank's annual meeting, including a resolution okaying the

But questions from shareholders, none of whom were identified during the meeting, suggested at least some discontent in the wake of the capital influx, which significantly diluted their existing position in the Long Island-based company.

One shareholder wanted to know why investors should sign off on the additional capital, which came from an investment group led by former Trump administration Treasury Secretary Steven Mnuchin. Although the capital infusion was announced March 6 and closed six days later, New York Community was

"If the capital raise was not ready to go specifically that afternoon, the chances of the company surviving would have been at a peril," CEO Joseph Otting told shareholders during the meeting. "As we look back today, it was the right decision for the company, it was the right decision for the investors, and collectively we will work very hard to reestablish the value of this company going forward."

New York Community's annual meeting, which took place virtually, was open only to shareholders, though a recording was later made public. It was the firm's first annual meeting with its new management team.

The new corporate leaders include Otting, who served alongside Mnuchin in the Trump administration and took over as the company's president and CEO on April 1. Earlier this week,

New York Community is the parent company of Flagstar Bank. It acquired Troy, Michigan-based Flagstar Bancorp in late 2022 as part of a strategy to diversify its loan portfolio.

Wednesday's meeting offered a chance for investors to hear more about

Shareholders approved the proposal related to the capital infusion, as well as seven other company proposals included in its latest proxy statement. They rejected one company proposal and one shareholder proposal, both of which aimed to eliminate supermajority voting requirements.

The vote counts have not yet been released.

A proposal that would allow the bank's board to enact a reverse stock split of issued and outstanding common stock by a ratio of 1-for-3 was among those that received majority shareholder support. A reverse stock split is a strategy that banks can put in play when their shares are trading at low figures, and they want the prices to look higher.

According to New York Community's proxy statement, the company expects its tangible book value per share this year to be $6.05 to $6.10, reflecting shareholder dilution of nearly 40%. The company has said that tangible book value per share could rise to somewhere between $7 and $7.25 by 2026.

The dilution is painful, but it's another reminder that "capital is exorbitantly expensive" when a bank needs to raise it,

He also noted that the company's shares are trading at about half of their book value, an indication that investors are skeptical that $1.05 billion will be enough to cover potential loan losses or New York Community's weaker earnings going forward.

On Wednesday, one New York Community shareholder wanted to know if the bank could enact a policy that would protect existing shareholders' investments in the event of a reverse stock split. In the company's proxy statement, the board said that doing so "should increase the per share price of the common stock and make the bid price of the common stock more attractive to a broader group of institutional and retail investors."

Otting did not commit to any such policy Wednesday, but he did say that it was "unfortunate, the situation that we found the company in when we arrived" and that the management team "appreciates the impact" that the company's challenges have had on longtime shareholders.

"Myself and the new executive management team and the board really are here to enhance the value to all shareholders, and that is our mission ahead," Otting said. "We really want to build a strong regional bank that serves the needs of commercial real estate customers, commercial and corporate banking customers, specialized industries and consumers."

Another shareholder wanted to know more about the steps New York Community is taking to make sure it has adequate reserves to handle future loan losses. About 45% of the firm's loan portfolio is made up of multifamily loans, which are under pressure due to a combination of higher interest rates and a 2019 law in New York that's hampered landlords' ability to raise rents.

About 4% of the book is made up of office loans, which are also facing challenges as companies reduce their office spaces in the post-pandemic shift to hybrid- and remote-work environments.

Meanwhile, the company is planning to add more new faces to its executive ranks. It is hiring a new chief credit officer and someone to run its commercial and private banking unit, Otting said.

New York Community does not plan to hire a new chief operating officer, following

The company's head of human resources and its head of technology will now report to Otting, while Gifford will oversee operations and facilities as well as procurement duties, Otting said.

Polo Rocha and Catherine Leffert contributed to this story.