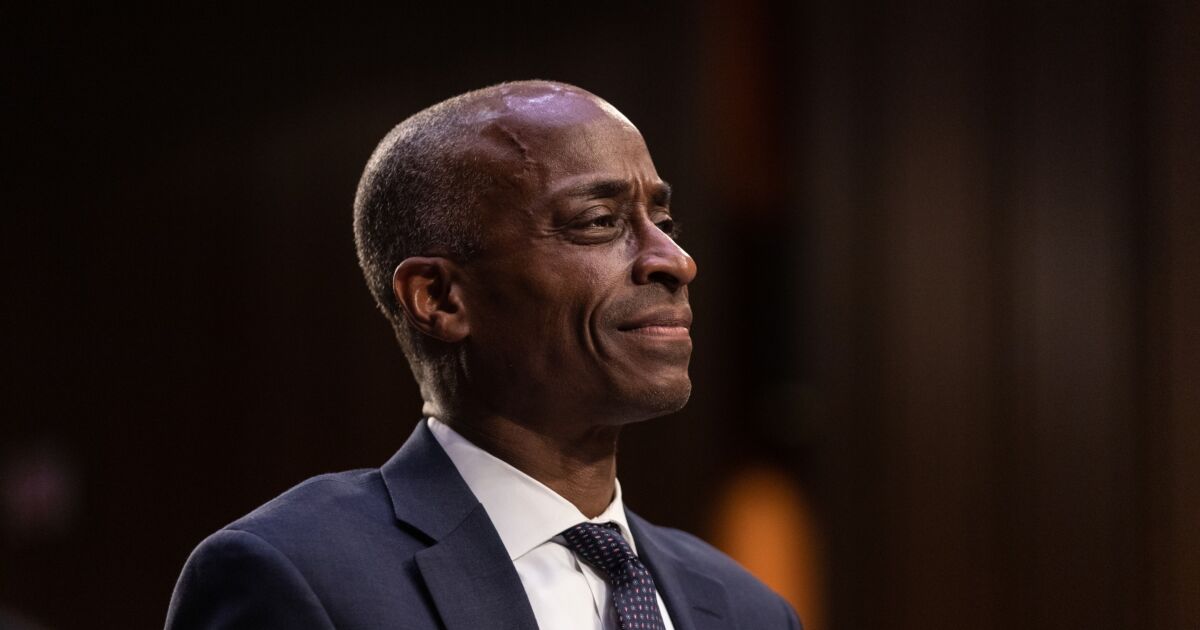

Philip Jefferson has been confirmed the Federal Reserve Board's second ranking position by a Senate vote of 88-10 on Wednesday.

The full Senate vote on Jefferson's nomination was the first of three such votes expected to take place this week. Fed. Gov. Lisa Cook is up for a full 14-year term on the board and labor economist Adriana Kugler has been nominated to fill a vacant seat that expires in 2026.

President Joe Biden nominated Jefferson, an economist by training and a former college administrator, to be the Fed's vice chair in May, less than three months after the previous vice chair, Lael Brainard, departed the board to become the White House's top economist.

Sen. Sherrod Brown, D-Ohio, who chairs the Senate Banking Committee, lauded Jefferson as a "respected economist" with "outstanding academic credentials and strong leadership experience," in remarks on the Senate floor Tuesday afternoon.

"Dr. Jefferson possesses a strong understanding of how higher prices hurt the most economically insecure Americans and that access to good paying jobs is the best antidote to poverty," Brown said, noting that Jefferson garnered unanimous support from the Banking Committee earlier this year.

Sens. Mike Braun, R-Ind., Josh Hawley, R-Mo., James Lankford, R-Okla., Mike Lee, R-Utah, Cynthia Lummis, R-Wyo., Rand Paul, R-Ky., Eric Schmitt, R-Mo., Rick Scott, R-Fla., Dan Sullivan, R-Ak., and Tommy Tuberville, R-Ala., voted against invoking cloture.

Jefferson joined the board in May 2022. Since then, he has delivered several speeches on the economy, monetary policy and financial stability. He's also taken the reins of the Fed's internal Committee on Board Affairs as chair and oversight governor for the office of the Fed's chief operating officer.

In recent months, Jefferson has been non-committal about his support for potential changes to risk-capital rules. While he has not gone so far as to oppose changes called for under the Fed's Basel III endgame proposal — as fellow Board members Govs. Michelle Bowman and Christopher Waller have — he has noted concerns about the economic impact of the proposal.

"I will evaluate any future proposed final rules on their merits. My views on any proposed final Basel III endgame requirements for U.S. banking organizations will be informed by the potential impact on banking sector resiliency, financial stability and the broader economy stemming from the implementation," Jefferson said during an open meeting about the proposal in July. "I look forward to reading and digesting the comments we received from the public, which will inform my future decision on any eventual proposed final approvals."

Jefferson enjoyed broad bipartisan support in his initial confirmation, which was approved by a vote of 91-7. This broad-based support was unique among Biden's Fed nominees. His first pick for vice chair for supervision, Sarah Bloom Raskin, had to withdraw from consideration among staunch Republican opposition.

Meanwhile Cook, a former economic professor at Michigan State University, was confirmed by the thinnest of margins, with Vice President Kamala Harris casting the tie-breaking vote to secure her position on the board.

Brown called the Republican criticism of Cook during last year's confirmation process an "underhanded and unfair attack on an eminently qualified woman of color," but noted she had "proved her naysayers wrong" during the past 17 months. He noted that, if confirmed, Cook would be the first Black woman to be granted a full term on the Fed Board.

Brown urged Senators to vote in favor of Cook and Kugler this week. If confirmed, Kugler — who worked at the World Bank Group and served as the Labor Department's chief economist under the Obama Administration — would become the first Fed governor of Latin American descent. Brown said confirming her would not only give the Fed a full complement of seven governors, but also a jolt of needed diversity.

"Her confirmation will be a critical step forward in bringing more diverse perspectives to our nation's central bank, not just diversity in the way these nominees look, but diversity in the way they think, something we simply have not seen much of in these kind of elitist institutions like the Board of Governors of the Federal Reserve," he said.

Consumer advocates also encourage the Senate to confirm all three Biden nominees this week.

In a statement, Dennis Kelleher, head of the advocacy group Better Markets, heralded the experience of all three economists, arguing that their expertise will be needed to address various challenges faced by the Fed and the country as a whole in the years ahead.

"Beyond technical and professional qualifications, the nominees bring diverse perspectives to the Board, which will be critical to successfully navigating the many looming challenges on topics ranging from inflation and bank capital rules to resolution planning and ethics," Kelleher said. "The American people will surely benefit from Drs. Jefferson, Cook, and Kugler's diversity of upbringings, educations, experiences and views."