- Key Insight: The Supreme Court's focus on procedural and due process concerns suggests that Fed Governor Lisa Cook is likely to remain in her post while her case against the Trump administration proceeds.

- Expert quote: "While it's always perilous to try to predict where the Court will come out, it seems to me that the Court leaned in the direction of Lisa Cook and is poised to find she can stay on the Fed Board while the courts sort out the merits of the case." — Former Fed General Counsel Scott Alvarez.

- Forward look: Some observers predict that the Supreme Court's apparent skepticism in Fed Gov. Lisa Cook's case could provide relief for Fed Chair Jerome Powell, who is under investigation by the Justice Department over renovations at the central bank's headquarters.

An almost two-hour Supreme Court hearing Wednesday on whether Federal Reserve Gov. Lisa Cook can remain on the board of governors left observers with the impression the court is unlikely to rule in the Trump administration's favor.

But while the court's skepticism of the real-world implications of the Justice Department's arguments suggest that Cook will likely remain in office pending the outcome of her lawsuit challenging her purported removal by President Donald Trump last year, observers say such a ruling would only delay Trump's appointment of a four-member majority on the Fed board of governors.

Although the outcome remains uncertain, observers said the Supreme Court justices'

Richard Horn, co-founder of Garris Horn LLP and former counsel at the Consumer Financial Protection Bureau, said that means the court is likely to rule for Cook on the narrow question of whether she should remain at her post while the litigation proceeds.

"The justices seemed to focus on the fact that there were no developed facts and that there was no opportunity for Cook to respond to the administration's claim about her mortgage loans," said Horn. "The justices also had questions about the administration's argument that there is no authority for the court to reinstate Cook because she was fired by the President. So it appears that the Court will likely let Cook remain on the job while the merits of her case plays out."

Jaret Seiberg, managing director at TD Cowen, offered similar analysis, noting that having Cook remain on the board in the short term means one less seat that the White House will be able to fill. Cook's term on the board expires in 2038.

"This matters because Cook is one of three Democrats on the board," Seiberg said in a note. "If she were removed, Trump would have a majority even if Powell remained."

The Trump administration filed an emergency petition in September 2025 after a lower court allowed Cook to remain at the Fed while

Scott Alvarez, an adjunct professor at Georgetown University Law and former general counsel of the Federal Reserve, said the justices also indicated that the case's scope and impact were too significant to be decided hastily. Alvarez noted that, in his opinion, it seemed that the justices indicated "that the issue in this case was complex and important and perhaps shouldn't have to be decided on an emergency basis without decisions and briefings to the lower courts.

"Several members on both sides also seemed frustrated with the Government's argument that there was no real remedy here other than allowing the President to remove Cook," Alvarez said.

The former general counsel at the Fed added that while it's "perilous" to predict the outcome, it seemed to him that "the Court leaned in the direction of Lisa Cook and is poised to find she can stay on the Fed Board while the courts sort out the merits of the case."

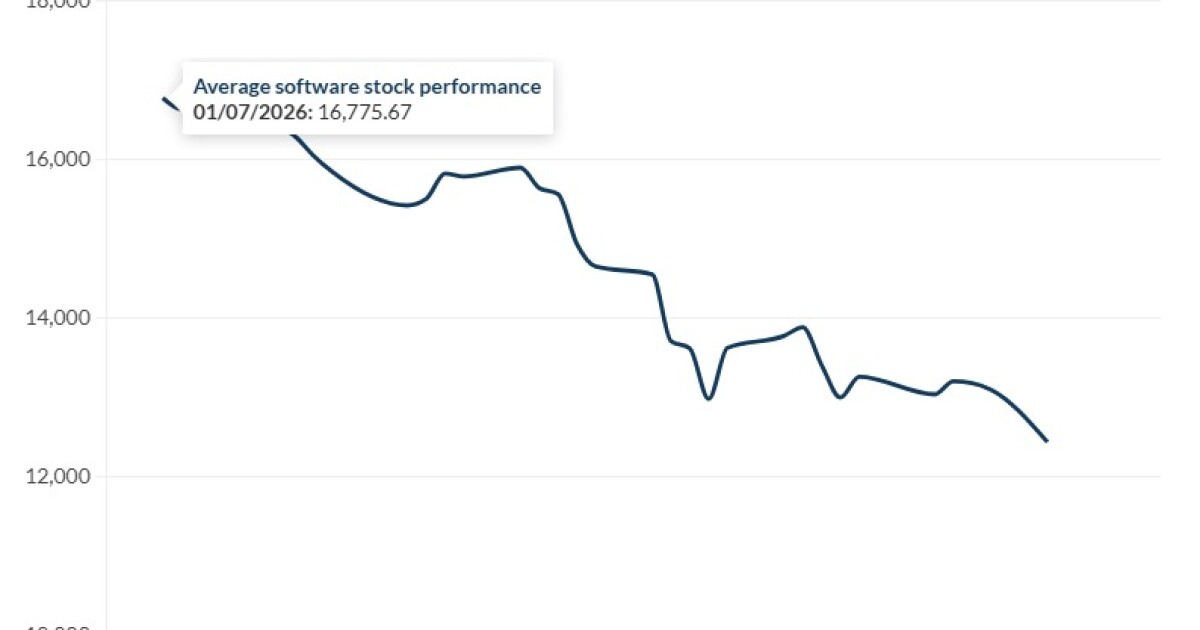

Several Supreme Court justices, including Justice Brett Kavanaugh, a Trump appointee from his first term, expressed apprehension that a ruling could politicize the composition of the Fed board for years and affect markets.

"Once these tools are unleashed, they're used by both sides, usually more the second time around," Kavanaugh told U.S. Solicitor General John Sauer. "We have to be aware of the consequences of your position for the structure of the government."

Throughout most of 2025, the Trump administration waged a

Seiberg said the Supreme Court's skepticism of the president's attempt to remove Cook "firmly closes the door" on efforts to fire Powell before his term ends in May.

"It seems to us that they would be equally skeptical if the President tried to remove Powell over the cost of the renovation of two Federal Reserve buildings," Seiberg added.

Mark Spindel, senior advisor at F/m investments and chief investment officer at Potomac River Capital, said both the Cook and Powell developments reflect Trump's broader effort to gain a majority on the Fed board.

"I think over time, the President is going to get a majority of the board," said Spindel. "He wants power … and it frustrates him that the most powerful economic agent in government — in the country, in the world — is not exactly under his control."