A mostly flat December jobs report points to more of the same for housing and mortgage markets.

The U.S. added 50,000 non-farm payroll jobs last month, while the unemployment rate came in at 4.4%, according to the Bureau of Labor Statistics. The numbers edged down

The total number of unemployed individuals in the U.S. totaled a seasonally adjusted 7.5 million compared to 7.8 million in November. Current numbers are up from 6.9 million in December 2024 and could signal further potential weakening.

"The share of workers who had been unemployed for more than six months increased to 26% in December, another sign that it is getting tougher for job seekers to find a new position," noted Mike Fratantoni, Mortgage Bankers Association senior vice president and chief economist, in a statement.

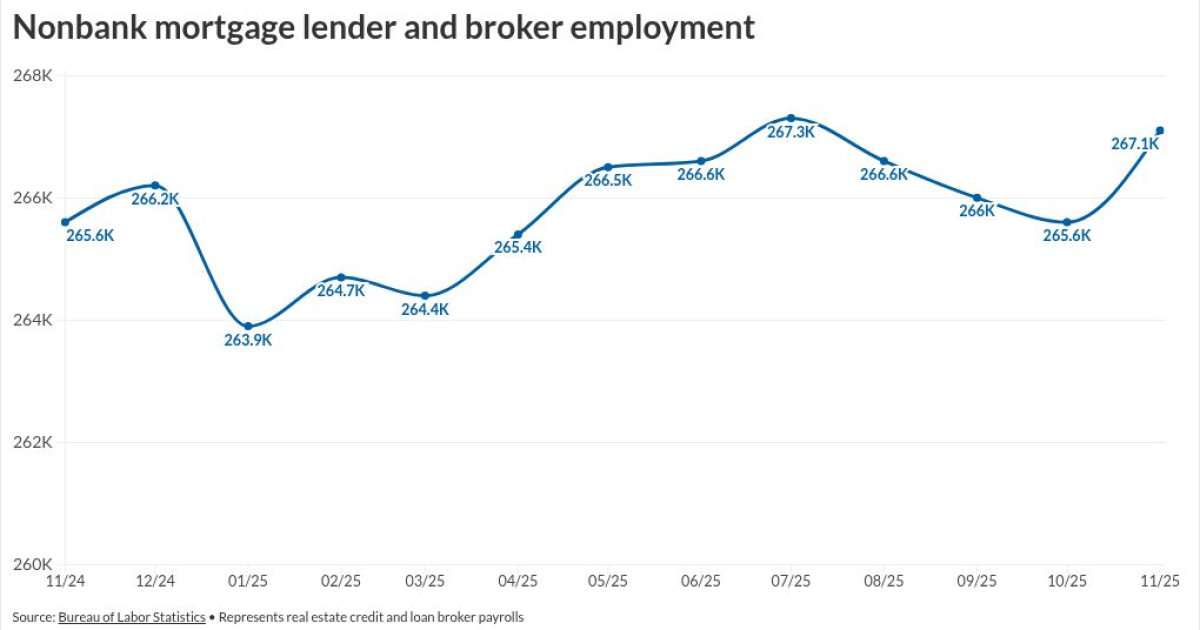

Mortgage-specific similarly largely tracked overall job data trends. Nonbank mortgage employment, which is reported with a one-month lag from the full jobs report, finished with a preliminary estimate of 267,100 for November.

The total climbed up from a total of 265,600 both in October and one year earlier, which represented an increase of 0.6%.

What jobs numbers mean for the mortgage market

The mostly sideways movement means expectations for a January rate cut at the

"For the Federal Reserve, this mix supports a cautious pause at the January FOMC meeting, especially with officials split between inflation-focused hawks and more growth- and jobs-focused doves," said First American senior economist Sam Williamson.

"The Fed is still watching inflation closely and isn't in a hurry to cut again unless inflation cools more or the job market weakens further," he added.

While most analysts were already factoring in another hold in the banking rate, the probability of a 25 basis point cut this month fell to 5% upon release of the jobs data Friday, according to Fedwatch tracking data from CME Group Inc. The probability further narrowed from 11.1% on Thursday and 16.6% as recently as a week ago.

With few changes on the horizon, the December jobs numbers give little reason for the mortgage industry to change

Calling the report "neutral" for the housing market, the Mortgage Bankers Association said the data largely underscored the idea that the economy is slowly growing but did not increase urgency for a shift in monetary policy strategy.

"As we look ahead to the spring housing market, these trends are likely to support only modest improvement in the pace of activity," Fratantoni said.

"For home buyers, that means mortgage rates are likely to stay close to where they are in the near term, Williamson similarly noted.

While possibly influenced by President Trump's announcement on Thursday of