“Home prices have risen so sharply that lenders are on average generating twice the proceeds from foreclosure needed to pay off the mortgage note and other expenses.”

The New Year 2022 finds much of the world struggling against a new surge of COVID and the related economic challenges, most notably the highest levels of inflation seen in the U.S. in generations. Rising home prices may bring cheer to many, but thousands of Americans begin 2022 facing the prospect of foreclosure because they have lost employment and the income needed to own a home.

The Federal Open Market Committee deserves the credit for destroying affordability for millions of Americans, but progressives deserve recognition too. By keeping families in homes they cannot really afford, we are creating a new category of zombie debtors like those seen after the 2008 financial crisis. State and federal prohibitions on foreclosure will make the problem fester. Taxpayers will foot the bill.

For policy makers as well as mortgage bankers and investors, two worrisome trends demand watching: re-default of residential mortgages modified during COVID loan forbearance and growing morbidity in urban multifamily real estate. In terms of the former, several large servicers tell NMN that they think that 20 to 30% of all residential mortgages that were modified over the past 18 months will eventually re-default.

Residential mortgage servicers completed hundreds of thousands of loan modifications following the explosion of COVID in April 2020. Servicers completed 33,721 modifications during the third quarter of 2021, according to the Office of the Comptroller of the Currency (OCC), a 14.8 percent decrease from the previous quarter’s 39,599 modifications.

Of these 33,721 modifications, 33,157, or 98.3 percent, were “combination modifications” — modifications that “included multiple actions affecting the affordability and sustainability of the loan,” such as an interest rate reduction and a term extension, the OCC reports. All of these modifications were made to “help consumers,” but sadly many of these “home owners” are really tenants who must also carry the burden of paying taxes and insurance, and maintaining the property.

State and federal regulators have made clear that foreclosure of a loan will bring regulatory sanctions. Instead of resolving the loan and helping the family transition to a more stable and “sustainable” rental situation, the loan servicer will simply modify the delinquent loan, again, and sell the zombie asset into a new pool and capture another gain-on-sale.

While the FOMC has engineered a temporary inflation in residential home prices, COVID loan forbearance championed by progressives has created a new, permanent class of distressed borrower. Those zombie COVID loan modifications will become a permanent fixture of the housing economy and an unnecessary expense to servicers and the U.S. taxpayer.

Many distressed home owners ought to simply sell the house, pay off the loan and pocket the balance. Instead, progressive activists and attorneys who benefit from economic misery will keep them in financial limbo by prohibiting servicers from acting in the best interest of the consumer and the note holder (aka Uncle Sam).

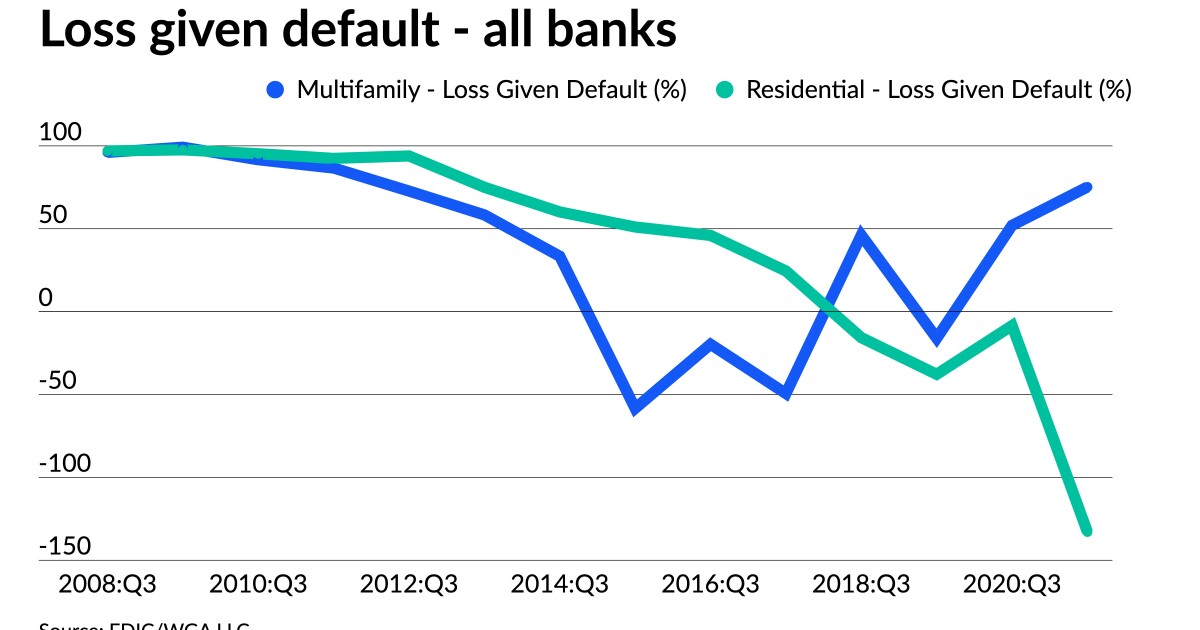

Keep in mind that at year-end, loss given default on prime residential 1-4s was negative by more than 100% of the loan balance. Home prices have risen so sharply that lenders are on average generating twice the proceeds from foreclosure needed to pay off the mortgage note and other expenses.

The windfall of increased home equity ought to go to distressed families as they exit the yoke of home ownership. But you’ll never hear a progressive policy types suggest such a strategy. Keeping struggling families captive to endless mortgage loan forbearance, and permanently impaired credit, is seen by progressives as a better outcome.

The home equity windfall provided by the FOMC will not last forever. To give you some idea of the huge pool of money that is available to help distressed “home owners,” the chart below shows loss-given default for $2.4 trillion in bank owned 1-4s and $500 billion in multifamily loans.

Notice that while Loss Given Default for bank-owned 1-4s was -132% in Q3 2021, the LGD for multifamily properties was positive at 75% loss at default, 10 points above the long-term average for this asset class. In 2008, LGD on 1-4s was 100% or more.

The fact of a federal guarantee on most conventional and government-insured residential mortgage loans means that progressive policy advocates can play games with delinquency, at least until home prices start to correct in 2024 or later. In the case of mortgage loans on multifamily and commercial properties, however, there is no safety net.

Even as affluent home owners search for condo bargains in cities like New York, Chicago and Loss Angeles, the cancer of commercial delinquency is silently consuming the economic vitality of these communities. Landlords are assumed to be wealthy, with endless pools of capital set aside to finance progressive loan forbearance schemes.

As 2022 begins and state foreclosure moratoria end, many owners of commercial properties are facing foreclosure due to falling occupancy and lease rates. Consider one notable talisman. As 2021 ended, several mortgage loans on 245 Park Avenue in New York City, across the street from the new headquarters for JPMorgan, went into special servicing.

Like many commercial buildings in Manhattan, 245 Park is largely vacant and has too much debt, especially at post-COVID property values. As 2022 progresses, look for a lot more pain for bond holders and banks coming from impaired urban commercial and multifamily assets.

Commercial landlords that missed much of a years’ worth of rental income on urban apartments or office space face a no win scenario. They must somehow keep the building operating at lower lease rates, finance maintenance and capital improvements, and convince a bank or bond investors to continue to provide financing.

The fact that lease concessions to tenants have reduced the building’s net operating income means that the value of the building has also fallen and the loan-to-value ratio is higher. If you are a community bank in a major city, you hold hundreds of mortgages on small and medium sized multifamily rental properties impaired by COVID forbearance. Do you foreclose on the property? Or simply roll the mortgage?

Multifamily assets have been rock solid in credit terms for half a century prior to 2020, with the equity only ever rising each year. Now with COVID and progressive generosity in terms of rent forbearance, however, banks must write-down these loans and demand more equity from distressed owners.

Urban landlords will reduce expenses and maintenance on zombie buildings in an effort to survive, reducing the quality and quantity of affordable housing. As was seen in New York City in the 1970s, some distressed building owners will simply hand the bank the keys and walk away from a loss-making asset. Landlords will seek tax abatement from financially pressed cities.

The damage done by COVID forbearance on loan and rental payments to cities, and urban commercial and residential properties, is far larger than the national statistics suggest. There is, after all, no free lunch in real estate or life.

Aggregate national statistics on commercial delinquency have actually improved in recent months, but beneath the surface particular distressed situations in major cities will grow in number and severity.

In many ways, 2022 will look a lot like 2009-2012, only this time around the less visible delinquency of urban commercial and multifamily properties will be the focus of restructuring efforts. The open question is whether progressive zealots within the Biden Administration will seek to force commercial banks and bond investors to forbear on delinquency of urban commercial and residential properties. Stay tuned.