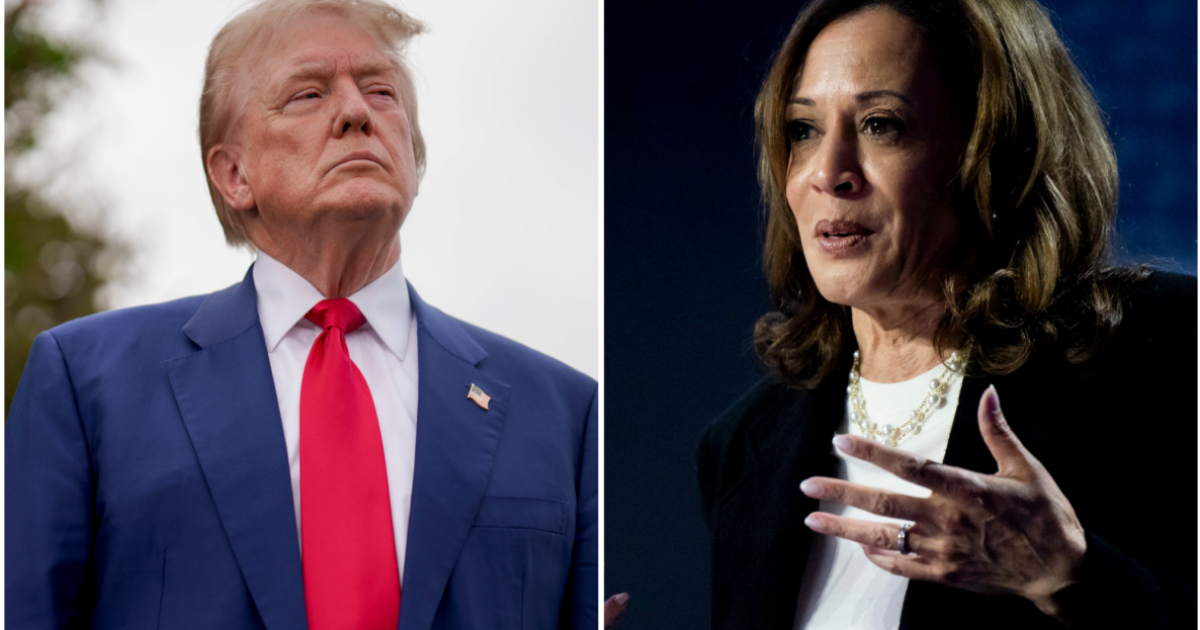

The presidential election is drawing ever closer, and bankers are still split on which candidate is most likely to sit in the White House come next year.

Fall election survey data gathered by Arizent, the publisher of American Banker, found that 59% of a total 191 respondents said Democratic frontrunner Kamala Harris is the most likely winner of the election. Roughly 41% of bankers polled selected former President Donald Trump as November's winner.

Interestingly, 58% of bankers surveyed felt that a Trump administration would be better for their industry and individual companies, against 35% who said Harris would be best for the banking industry. That same perspective was found in similar questions about which election outcome would yield the best outcome for regulatory and policy matters, as well as the country overall.

"This election is lighter on policy details than any in recent memory, so all of us are forced to do a bit more extrapolating than we are used to," Isaac Boltansky, managing director and director of policy research at BTIG, said in an interview with American Banker's

Read more:

While on the campaign trail, Trump has been

"Instead of attacking industries of the future, we will embrace them, including making America the world capital for crypto and bitcoin," Trump said during a speech at the Economic Club of New York in September.

Other key components of the Republican platform include lowering the corporate tax rate from 21% to 15% and expanding research tax credits. Harris seeks to do the opposite, proposing to raise the corporate rate to 28% in addition to a

Outside of taxes, Harris' focus lies on addressing

"In terms of where the vice president's coming from and where we're coming from, we know that there's not going to be a single solution to the housing affordability and supply crisis — it's never either/or, it needs to be yes/and, and we want to be part of it," Ryan Donovan, president and CEO of the Council of Federal Home Loan Banks, said in an interview with American Banker's

Read more:

Read on for the latest American Banker insights into recent election developments and what the banking industry should be aware of.