Reverse mortgage company Finance of America's continuing operations took a net loss on a one-time adjustment in the third quarter, but it was profitable on that basis for the year-to-date, unaudited interim results show.

The company reported a $29 million in net loss from continuing operations during the third quarter due to home price model adjustments, and earnings of $131 million for the first nine months of this year. On an adjusted basis, FOA reported $60 million in earnings for the quarter.

In comparison, FOA reported $80 million in income on a continuing operations basis in

The company's nine-month results reflect "the benefit of lower interest rates and tighter spreads, partially offset by softer home price appreciation projections in the third quarter," CEO Graham Fleming said during a company earnings call.

Shifts in how the company models home price appreciation were the main driver of the company's third quarter loss, according to its press release.

Rising funded volumes and a record-breaking securitization

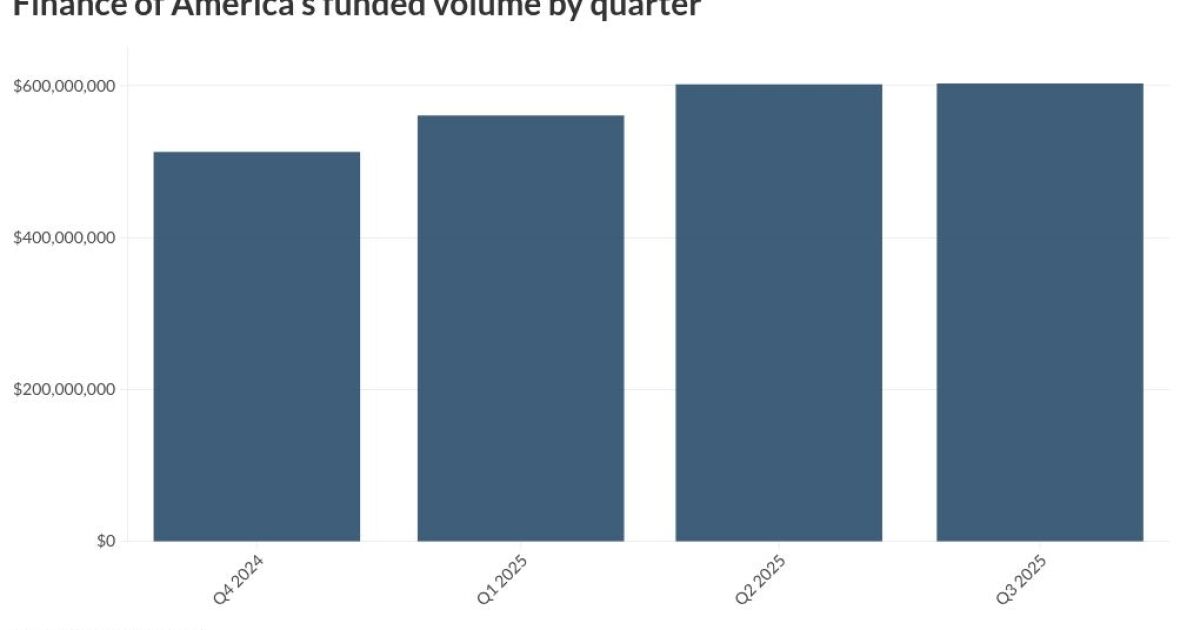

Finance of America also reported that its funded volume edged up higher to the quarter to $603 million from $602 million the previous fiscal period and $513 million a year earlier.

"By the end of October for the year 2025, we funded $1.97 billion in reverse mortgages, surpassing our entire 2024 production of $1.92 billion," President Kristen Sieffert said during the earnings call.

Submissions for October totaled $336 million, marking "the highest month in three years," Sieffert said.

Chief Financial Officer Matt Engel said during the call that the Finance of America also closed its "largest proprietary securitization in company history in September."

Other highlights and challenges during the quarter

Several developments in both the private and home equity conversion mortgage markets contributed to revenue during the quarter, including "increased margins for HomeSafe and HECM products, stronger origination fee income and higher capital markets revenue," he said.

Executives also touted

"These traditional home equity products enable us to serve approximately 30% more of the potential borrowers already engaging with our brand who need higher loan-to-value solutions than our current reverse suite provides at FOA," Sieffert said.

Engel said he is anticipating benefits from the adoption of artificial intelligence automation.

"While still very early in the adoption of AI technology, we fully expect these investments to improve the customer experience," he said, noting that the company also anticipates it will enhance return on investment in markets, and increase productivity.