Bill Pulte, the director of the oversight agency setting policy for the government-sponsored enterprises, has pressed Federal Reserve Chair Jerome Powell to do more to lower mortgage rates but the GSEs themselves also have a hand in loan pricing that reform could impact.

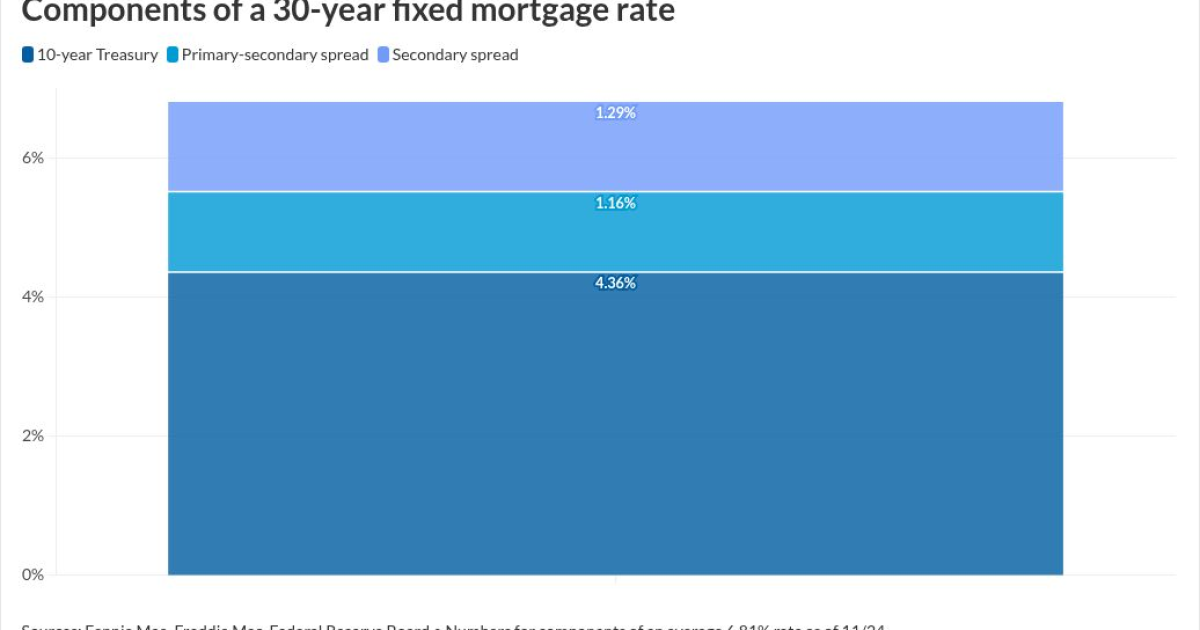

From various primary market requirements that affect loan costs to maintaining an implicit guarantee that affects the spread between treasuries and mortgage-backed securities, the GSEs' operations can have a lot to do with rates.

With that in mind, here are some of the possible scenarios that could influence mortgage rates if the enterprises move forward with staging

Holding more MBS on balance sheet

One way the government-sponsored enterprise policymakers could try to keep long-term rates stable or lower is to buy and hold more MBS on their balance sheets. The Fed also has bought MBS at times. Right now they're allowing runoff with reinvestment of proceeds in treasuries.

"They're clearly not going to be able to get the Fed to do what they want while Chairman Powell is still there, so the GSE balance sheets are going to look awfully attractive," said Isaac Boltansky, managing director and head of public policy at Pennymac. "I think that's a mighty powerful tool, and I would be surprised if they don't use it at some point over the next year or so."

While

The CHLA suggests only buying MBS if the primary-secondary spread is "elevated 170 basis points" and capping the buying at $300 billion per GSE.

It won't be easy to avoid raising rates in transitioning the GSEs to more of a profit-driven model but this is one of a limited number of ways to do it, according to

Why there are mixed opinions on how reform may affect rates

The Stanford researchers found rates could go up more than 20 basis points as a result of an equity offering, or more than 30 with conservatorship exit added to that, or above 80 in total with the loss of an implicit guarantee on top of it. They added the caveat that their numbers were estimates based on what were unspecified GSE reform plans at the time.

However, Trump administration officials have said they want to avoid home affordability strains and have pledged to retain the implicit government guarantee that protects the large agency MBS market, in order to avoid disrupting secondary market bond pricing and rates.

Some groups like the Mortgage Bankers Association have called for an explicit government guarantee that would give the MBS market more confidence there'd be a public backstop for the enterprises in ways likely to lower rates.

Boltansky said Congressional action needed for one has been discussed for years but not materialized, so the market may want to consider preserving the current conservatorship model in some fashion as they go through reform.

"If we're going to operate in the world that we live in, I think that we should have clarity that the existing backstop, which is $254 billion of the aggregate, needs to continue, no matter what scenario plays out in the future," he said.

Eventually, reform that allows the GSEs to compete more with the private sector could lower rates, said Larry Goldstone, president of capital markets and lending at BSI Financial Services.

"I suspect that with Fannie and Freddie competing in a free market economy, guarantee fees might come down, which might bring mortgage rates down a little bit," he said.

Potential for various adjustments in LLPAs

"I think the other thing that they can do, and that is sort of in that affordability bucket, is they will lower loan-level pricing adjustments," Boltansky said. "The director has already suggested that

Negative adjustments to what the GSEs pay to guarantee the loans they buy based typically on characteristics like a low credit score are structured as an upfront fee for the lender but can get passed on to borrowers and affect their rate. Legislatively-mandated

"They are looking at ideas around the LLPAs. It's unclear what they are. We're trying to set up a meeting with Director Pulte ourselves at NAMB, to sit down and talk with them about that," said Kimber White, president at the National Association of Mortgage Brokers.

The GSEs' status could make a difference when it comes to the willingness to cut LLPAs and White said that while he thought full removal of the risk-based adjustments was unlikely, a partial one might be.

"We would love to have all the LLPAs go away, yeah, but being realistic, what about half? Would a 50% reduction help? Yes, it would drop at least, I think, a quarter to three eighths of percent in interest rate across the board," White said.

Extreme rate cuts might not even be desirable given how those during the pandemic have left the market with many borrowers reluctant to give up their low financing costs to move. It also could create a challenge for servicers related to managing prepayment risk.

"I think lowering rates for a short period of time, maybe two or three quarters, and then stopping, would make sense into 2026," said Phil Crescenzo, branch manager at Nation One Mortgage Corp. "That could restart some activity."

While Trump administration officials have said home affordability is a priority for them, they also have several other considerations that could play into decisions about what direction to move g-fees and LLPAs, said Reetu Mittal, a senior mortgage specialist at Vema.

"This is not the only factor they will be taking into account. There will be other factors as well. They

That could mean LLPA adjustments won't necessarily move in one direction or the other but vary in new ways across the grid based on different combinations of loan characteristics with an outcome that addresses the need for profitability and affordability in an even-handed way.

"They would have to think about all the perspectives if they did that, right? Like, which LLPAs they want to introduce or change for which category. They have to maintain a balance," Mittal said.