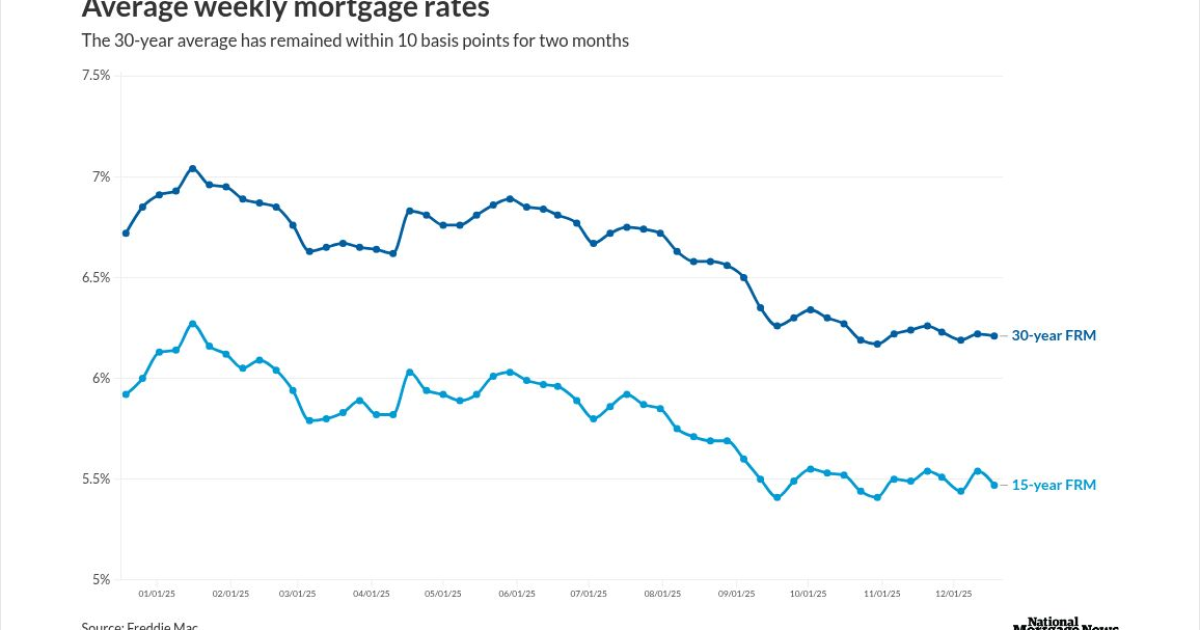

Mortgage rates largely held steady over the past seven days despite the latest Federal Reserve decision to cut, exhibiting many of the same trends they've shown over the past several weeks.

The 30-year fixed-rate average came in at 6.21% on Dec. 18, according to Freddie Mac's Primary Mortgage Market Survey. The number inched down by a single basis point from 6.22%

"The average 30-year fixed-rate mortgage has remained within a narrow 10-basis point range over the last two months," noted Freddie Mac Chief Economist Sam Khater.

The 15-year fixed average took a larger step back to 5.47% compared to 5.54% in the prior Freddie Mac survey. One year ago, the average rate clocked in at 5.92%.

Freddie Mac's rate data largely followed movements in corresponding 10-year Treasury yields over the past several days. After closing at 4.14% on Dec. 11, the 10-year climbed to as high as 4.19% before finishing at 4.15% on Wednesday.

Even with the Fed reducing its funds rate by a quarter rate last week, mortgage averages stayed the course, as

The latest survey, though, likely would not have factored this Thursday morning's dip to 4.11%, as investors turned away from bonds following the release of a

While the latest rate movements haven't led to dramatic easing of affordability strains, stability may hold a silver lining by opening up possibilities for consumers, said One Real Mortgage CEO Samir Dedhia in a statement on Wednesday afternoon.

"This kind of consistency in rates can be a good thing," he said. "It helps create more confidence in the housing market and gives people time to plan. With inventory improving and home price growth cooling, today's mortgage rate environment is more balanced than it was at the start of the year."

Are signs of improved housing affordability ahead?

Some signals affordability may be easing turned up in applications data, which showed the median new monthly payment on November purchases

While the latest number was down only $5 from October, according to

"MBA expects that affordability conditions will continue to improve in 2026, with house prices forecast to fall nationally by 0.3%," said Edward Seiler, the trade group's associate vice president of housing economics and executive director of the Research Institute for Housing America.

By its calculations, MBA also forecasted mortgage rates to hover near 6.4% throughout 2026.

On a similar note, economists at Zillow also said they see rising potential for housing activity next year.

"Affordability is still a hurdle for home buyers, but 2025 brought real progress," said Zillow senior economist Kara Ng. "Mortgage payments dropped by more than $100 a month, while incomes continued to rise. For many households, that small shift can be the difference between sitting out the market and finally being able to buy or sell a home."

Aspiring buyers may need to wait until the end of winter, though, just as sellers appear to be, Zillow said. New for-sale listings in November dropped almost 30% from one month earlier, the biggest dip in the equivalent time frame since at least 2018.

Year over year, new listings in November were down 4.4%, reversing October's 5.1% growth, according to the real estate platform.

The new year should also come with more home price softening, which would further ease affordability pressure, according to First American Chief Economist Mark Fleming.

"The new housing market normal is characterized by minimal price appreciation and, in some regions, outright decline," he said. "Slower price growth offers buyers a bit of affordability breathing room in near term, and with wage growth exceeding house price growth, affordability is poised to continue slowly improving."

Where rates stood elsewhere

The minimal movement in Freddie Mac's data echoes what other mortgage researchers observed over the past seven days.

Optimal Blue's tracker had the conforming 30-year rate falling more steeply to 6.208% on Thursday compared to 6.25% one week earlier.

Meanwhile, Lender Price mortgage rate data on the National Mortgage News homepage showed the 30-year fixed average at 6.34% on Thursday afternoon, 2 basis points higher from 6.32% one week earlier.