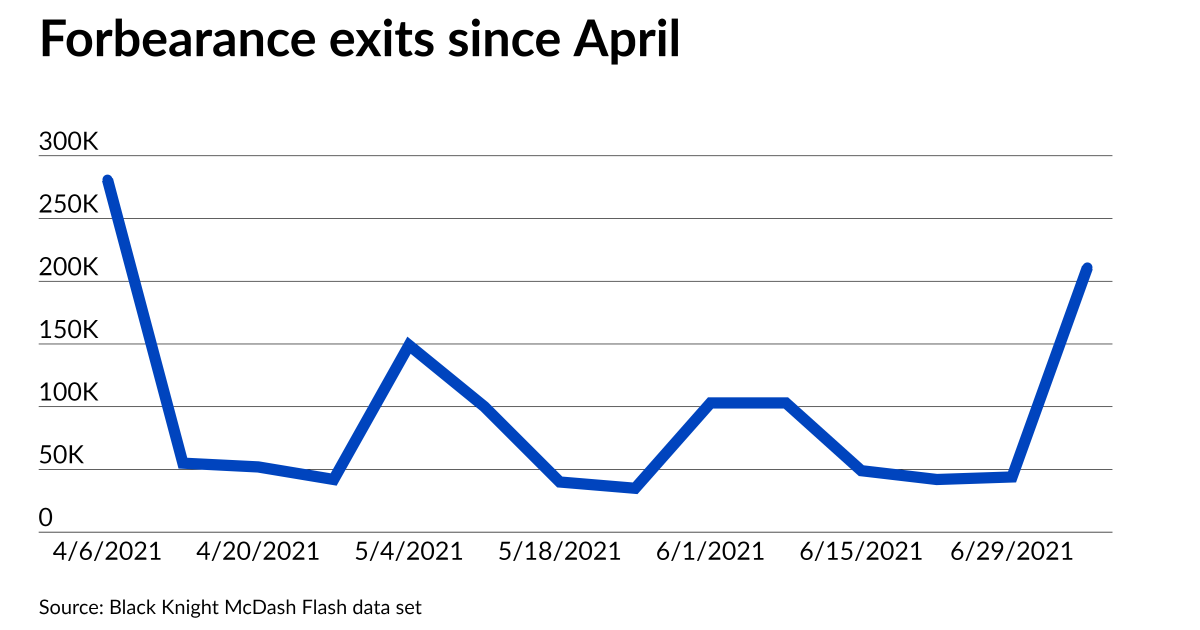

The number of borrowers who left coronavirus-related forbearance plans in the past week was the largest since early April, according to Black Knight’s latest report.

Net active plans fell by 189,000, fulfilling expectations that a drove of borrowers could cease their payment suspensions after more than 200,000 came up for quarterly reviews at the end of June. Mortgage servicers removed 211,000 borrowers from plans during the past week and added 22,000.

The sharp drop in forbearance across loan types in Black Knight’s report suggests particularly large numbers of borrowers are recovering enough from pandemic-related hardships to exit the plans even before the earliest expiration dates arrive this fall.

The surge in forbearance exits “offers more encouraging news though the key deadline is still a few months away in September,” said Brian Chappelle of Potomac Partners, in an email. Chapelle is a partner at the Washington, D.C.-based real estate consultancy.

The reductions were most pronounced for borrowers with private loans that lack government-related mortgages’ mandatory forbearance expiration dates. Borrowers with loans held in portfolio or private-label securities accounted for 78,000 of the exits.

That decline means there are less than 875,000 loans left that could expire later this year, representing an improvement from mid-June, when there were more than 1 million active plans in place in this category.

“The strong exit velocity this week certainly improves the outlook for late 2021, at least modestly,” said Andy Walden, vice president of market research at Black Knight, in an email.

Forbearance on mortgages either insured by the Federal Housing Administration or guaranteed payment suspensions fell by 44,000.

Payment suspension rates for different loan types as of July 6 were as follows, according to Black Knight: GSE (Fannie Mae and Freddie Mac), 2.2%: private loans, 4.6%; and FHA/VA, 6.8%. The average forbearance rate for all home mortgages in the past week was 3.5%.

Government-insured and guaranteed loans tend to have higher forbearance and delinquency rates because they serve many first-time home buyers with lower incomes, but experts expect higher equity levels will help cushion the impact of hardships in that market.