The Government Accountability Office has issued new warnings about the public sector's exposure to nonbank mortgage risks and said the Federal Housing Finance Agency and Ginnie Mae have agreed to do more to manage them.

The GAO indicated the nonbank share of the secondary mortgage markets that the FHFA oversees as conservator and which Ginnie, a government corporation, guarantees has gotten even larger than it was when the office

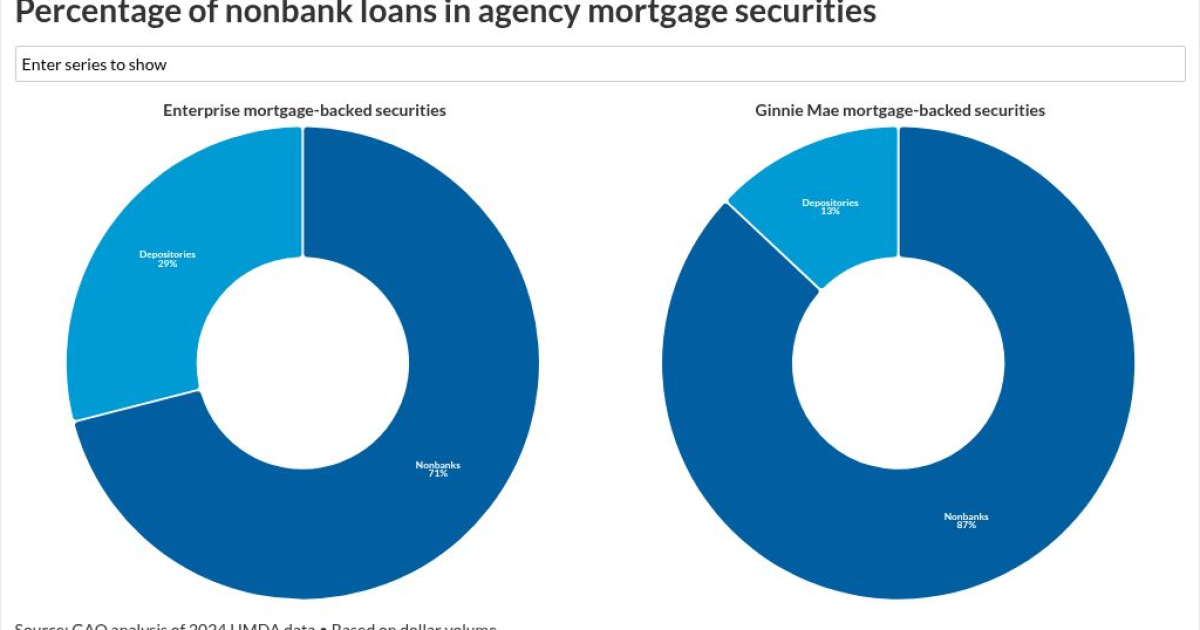

In 2024, nondepositories originated 71% of securitized loans in the government-sponsored enterprise market FHFA oversees and 87% of those in Ginnie-backed mortgage bonds based on dollar volume, according to the GAO's analysis of Home Mortgage Disclosure Act data.

"Nonbanks now originate and service most loans in the over $9 trillion in securities guaranteed by Ginnie Mae, a government-owned corporation, and by Fannie Mae and Freddie Mac," Jill Naamane, a director at GAO, wrote in the report she authored.

A closer look at warehouse lines

The GAO's recommendations included additional steps for Ginnie and FHFA related to short-term credit lines nonbank mortgage companies rely on to fund their loan originations.

Ginnie has agreed to draw up guidance requiring its analysts "to consistently review key components of warehouse lending risk, including the committed funding amount, as part of the manual credit review process," according to the GAO

The Federal Housing Finance Agency has promised to assess "the feasibility and utility of incorporating all key components of warehouse lending risk in its risk scoring process," according to Naamane's report.

The GAO said it also got Ginnie to agree to look into expanding stress testing and FHFA to draw up procedures for assessing the integrity of the data on the mortgage banker financial reporting form.

Banks have been heavily involved in nonbanks funding in the past year and there have been

How Ginnie Mae and FHFA responded to GAO

"Ginnie Mae agrees to the audit team's recommendations to enhance an already robust counterparty risk management framework," President Joe Gormley wrote in a Dec. 5 letter the GAO included in its report. Gormley was acting president at the time.

FHFA also agreed with its recommendations and set Sept. 30 as a deadline for action on them, according to a letter included in the report from Christopher Boland, deputy director, division of enterprise regulation.

He also echoed past calls for

"Congress should consider granting FHFA explicit authority to examine third parties that do business with FHFA's regulated entities," Boland wrote.