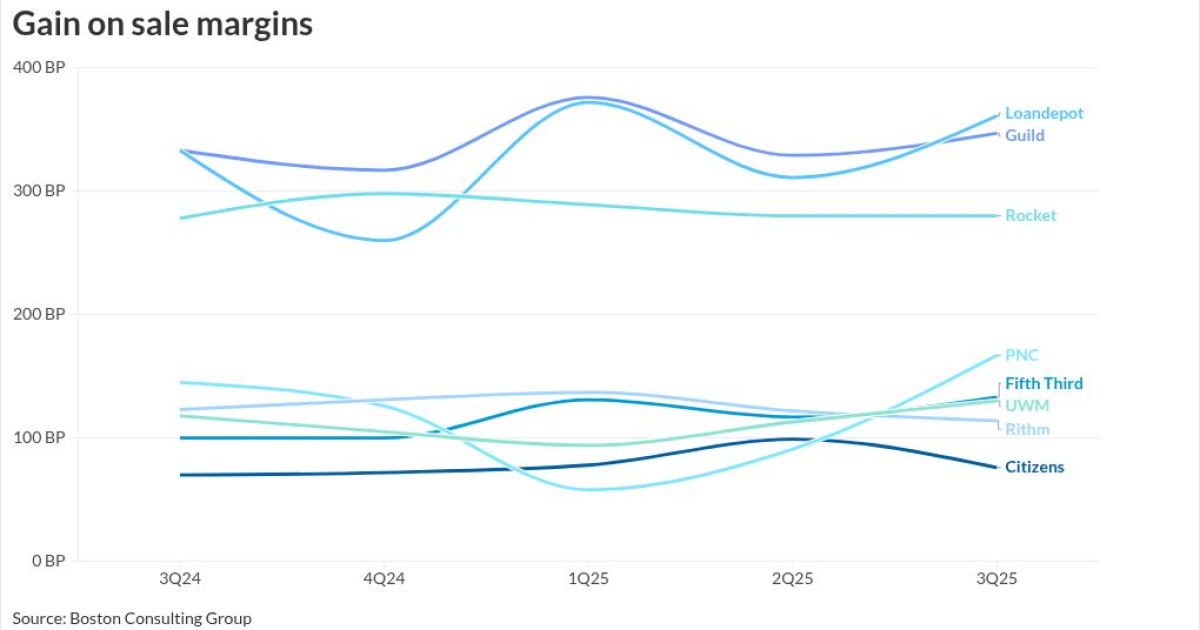

While gain on sale margins for mortgage lenders were at least stable, if not improved, in the third quarter compared to prior periods, that did not necessarily translate to improved profitability, separate reports from Morningstar DBRS and Boston Consulting Group revealed.

The Morningstar report looked only at independent mortgage bankers, and the group it pulled gain on sale data included

BCG includes depositories which provided GOS information, including Citizens Financial, Fifth Third and PNC; its non-bank group includes the

What drove IMBs third quarter results

"Companies optimized their performance by controlling pricing in the wholesale channel, capitalizing on the servicing portfolio through enhanced recapture capabilities, and optimizing channel mix by shifting volume to more profitable channels such as the direct-to-consumer channel," Morningstar DBRS analysts Shaima Ahmadi and David Laterza wrote.

Both reports noted the

Going forward, BCG is expecting

Rocket's GOS

Rithm reported lower GOS versus both comparable quarters, which the Morningstar analysts noted came from "higher Ginnie Mae streamlined refinance volumes, which are cheaper to produce, but have thinner margins."

The only depository in the BCG grouping with lower GOS on a quarter-to-quarter basis was Citizens, down 24 basis points. Among the companies it tracks, median GOS margins increased by 9 basis points versus the second quarter but declined on an annual basis by 14 basis points.

Non-bank mortgage companies tracked by Morningstar DBRS reported combined net income of $367 million for the third quarter, down from $807 million three months prior but up from $191 million of net losses for the third quarter of 2024.

Why improved margins did not correlate with better results

"Stabilization of mortgage servicing rights, fair values with effective hedging and higher servicing fee income were common drivers of improving profitability for certain participants," the analysts said. "However, higher gain on sale margin as reported by some of the peers did not have a corresponding effect on overall firm profitability as those gains were offset by an increase in operating costs, and the nonrecurrence of derivative gains, and one-time benefits reported in the same quarter a year ago."

When it came to operating expenses across the peer group, these rose by an average of 30% over the third quarter of 2024, with higher variable costs related to higher production volumes being a common driver. For Rocket in particular, expenses were also driven by transaction-related costs from the Redfin and Mr. Cooper deals.

In its client conversations, BCG found they are working towards creating lasting low-cost structures and remarkable growth, primarily via margin expansion and increased market share, the report from Micah Jindal said.

"Many are prioritizing investments in artificial intelligence, end-to-end digital customer journeys and home ecosystems to achieve these goals," BCG said. "These observations highlight a common urgency: continually adapting to fuel sustainable growth and lead in a persistently changing mortgage sector industry."

What lenders are doing to grow their business

As part of efforts to grow market share, lenders are adding to their product menu "to meet changing customer needs," such as adding or expanding their home equity line of credit and

Among the forward looking guidance the BCG clients provided was a "strong belief across peers that continued AI investment will reduce cost to originate and service while enabling personalization at scale to help grow revenues.

"Peers are continuing to shape their mortgage platforms as some look to diversify their business lines (Rithm), invest in servicing capabilities (Rocket, UWM), pursue asset lite strategies (Pennymac, Onity) and focus on customer relationships (banks)," BCG said.

Besides the six IMBs and three banks previously mentioned, the other depositories in the BCG report are Wells Fargo, J.P. Morgan Chase, U.S. Bank, Bank of America, Truist, Huntington Bank and Citi.